Mondee Investor Presentation Deck

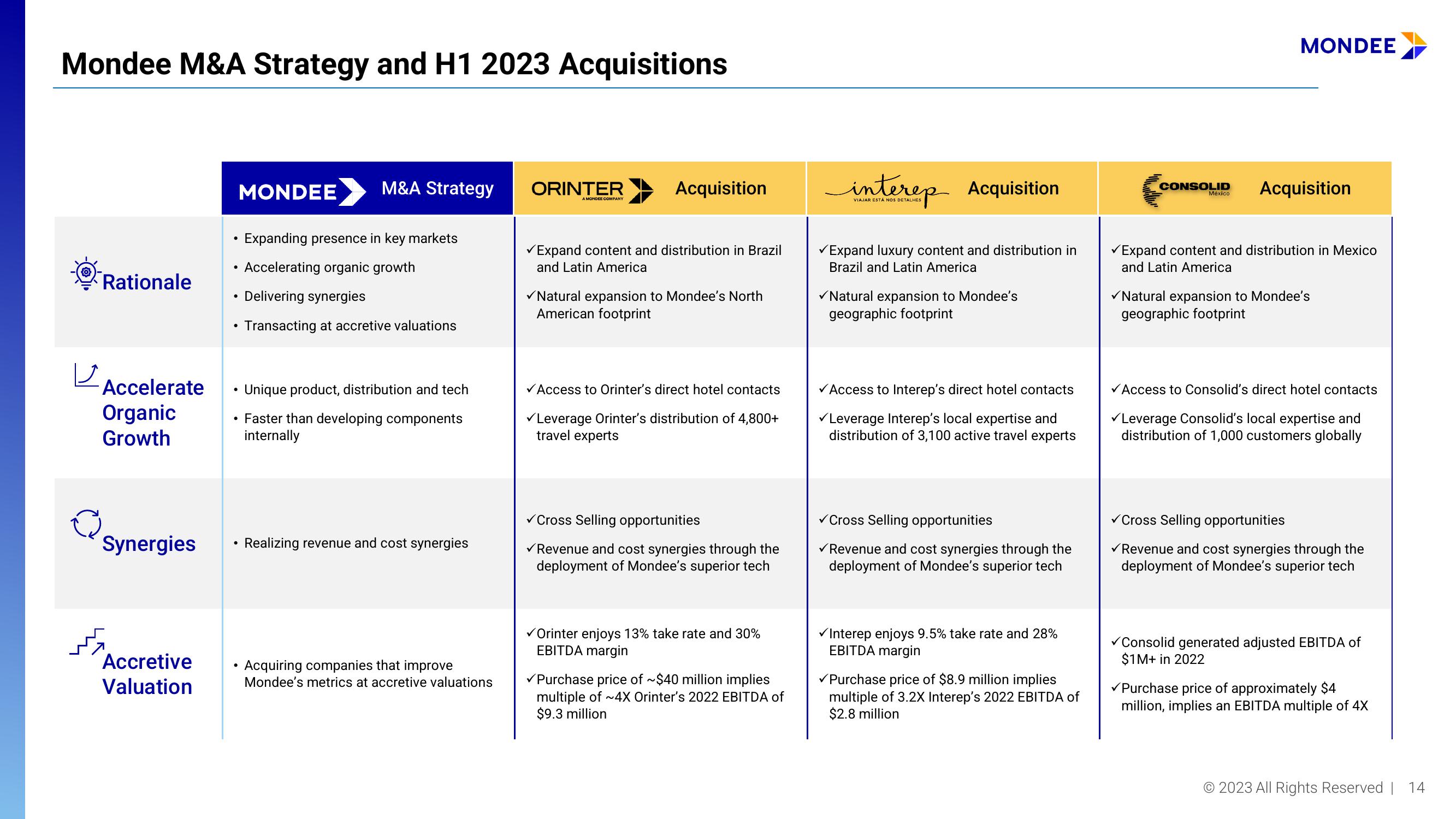

Mondee M&A Strategy and H1 2023 Acquisitions

Rationale

Accelerate

Organic

Growth

Synergies

Accretive

Valuation

MONDEE

M&A Strategy

Expanding presence in key markets

Accelerating organic growth

Delivering synergies

Transacting at accretive valuations

• Unique product, distribution and tech

• Faster than developing components

internally

Realizing revenue and cost synergies

Acquiring companies that improve

Mondee's metrics at accretive valuations

ORINTER

A MONDEE COMPANY

Acquisition

✓ Expand content and distribution in Brazil

and Latin America

✓Natural expansion to Mondee's North

American footprint

✓ Access to Orinter's direct hotel contacts

✓Leverage Orinter's distribution of 4,800+

travel experts

✓Cross Selling opportunities

✓ Revenue and cost synergies through the

deployment of Mondee's superior tech

✓Orinter enjoys 13% take rate and 30%

EBITDA margin

✓Purchase price of ~$40 million implies

multiple of ~4X Orinter's 2022 EBITDA of

$9.3 million

interep Acquisition

VIAJAR ESTÁ NOS DETALHES

✓ Expand luxury content and distribution in

Brazil and Latin America

✓Natural expansion to Mondee's

geographic footprint

✓ Access to Interep's direct hotel contacts

✓Leverage Interep's local expertise and

distribution of 3,100 active travel experts

✓Cross Selling opportunities

✓ Revenue and cost synergies through the

deployment of Mondee's superior tech

✓ Interep enjoys 9.5% take rate and 28%

EBITDA margin

✓Purchase price of $8.9 million implies

multiple of 3.2X Interep's 2022 EBITDA of

$2.8 million

CONSOLID

México

MONDEE

Acquisition

✓ Expand content and distribution in Mexico

and Latin America

✓Natural expansion to Mondee's

geographic footprint

✓ Access to Consolid's direct hotel contacts

✓Leverage Consolid's local expertise and

distribution of 1,000 customers globally

✓Cross Selling opportunities

✓ Revenue and cost synergies through the

deployment of Mondee's superior tech

✓Consolid generated adjusted EBITDA of

$1M+ in 2022

✓Purchase price of approximately $4

million, implies an EBITDA multiple of 4X

© 2023 All Rights Reserved | 14View entire presentation