Dave Results Presentation Deck

Q-O-Q improvement

in variable margin

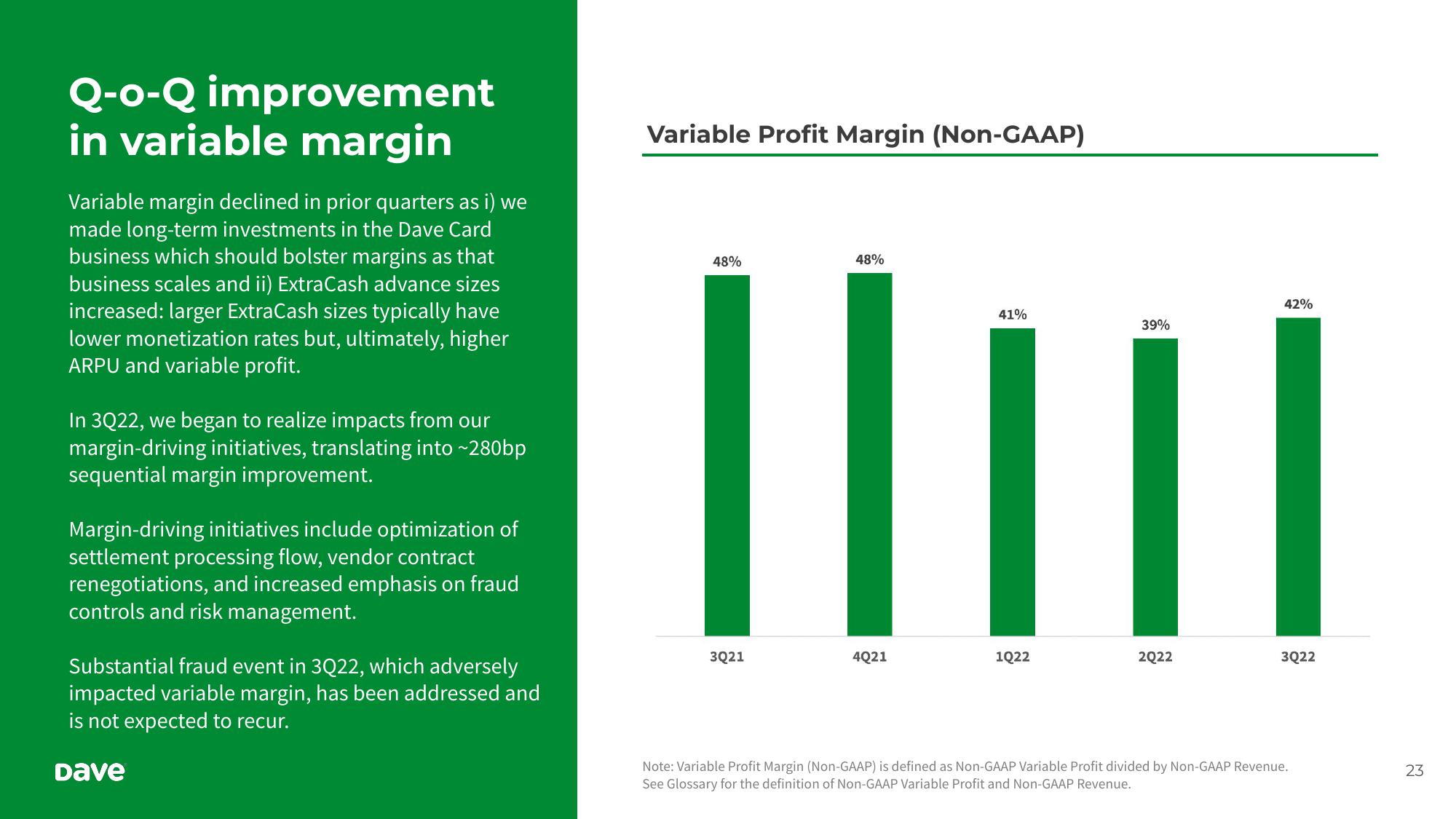

Variable margin declined in prior quarters as i) we

made long-term investments in the Dave Card

business which should bolster margins as that

business scales and ii) ExtraCash advance sizes

increased: larger ExtraCash sizes typically have

lower monetization rates but, ultimately, higher

ARPU and variable profit.

In 3Q22, we began to realize impacts from our

margin-driving initiatives, translating into ~280bp

sequential margin improvement.

Margin-driving initiatives include optimization of

settlement processing flow, vendor contract

renegotiations, and increased emphasis on fraud

controls and risk management.

Substantial fraud event in 3Q22, which adversely

impacted variable margin, has been addressed and

is not expected to recur.

Dave

Variable Profit Margin (Non-GAAP)

48%

3Q21

48%

4Q21

41%

1Q22

42%

39%

||

2Q22

3Q22

Note: Variable Profit Margin (Non-GAAP) is defined as Non-GAAP Variable Profit divided by Non-GAAP Revenue.

See Glossary for the definition of Non-GAAP Variable Profit and Non-GAAP Revenue.

23View entire presentation