Tudor, Pickering, Holt & Co Investment Banking

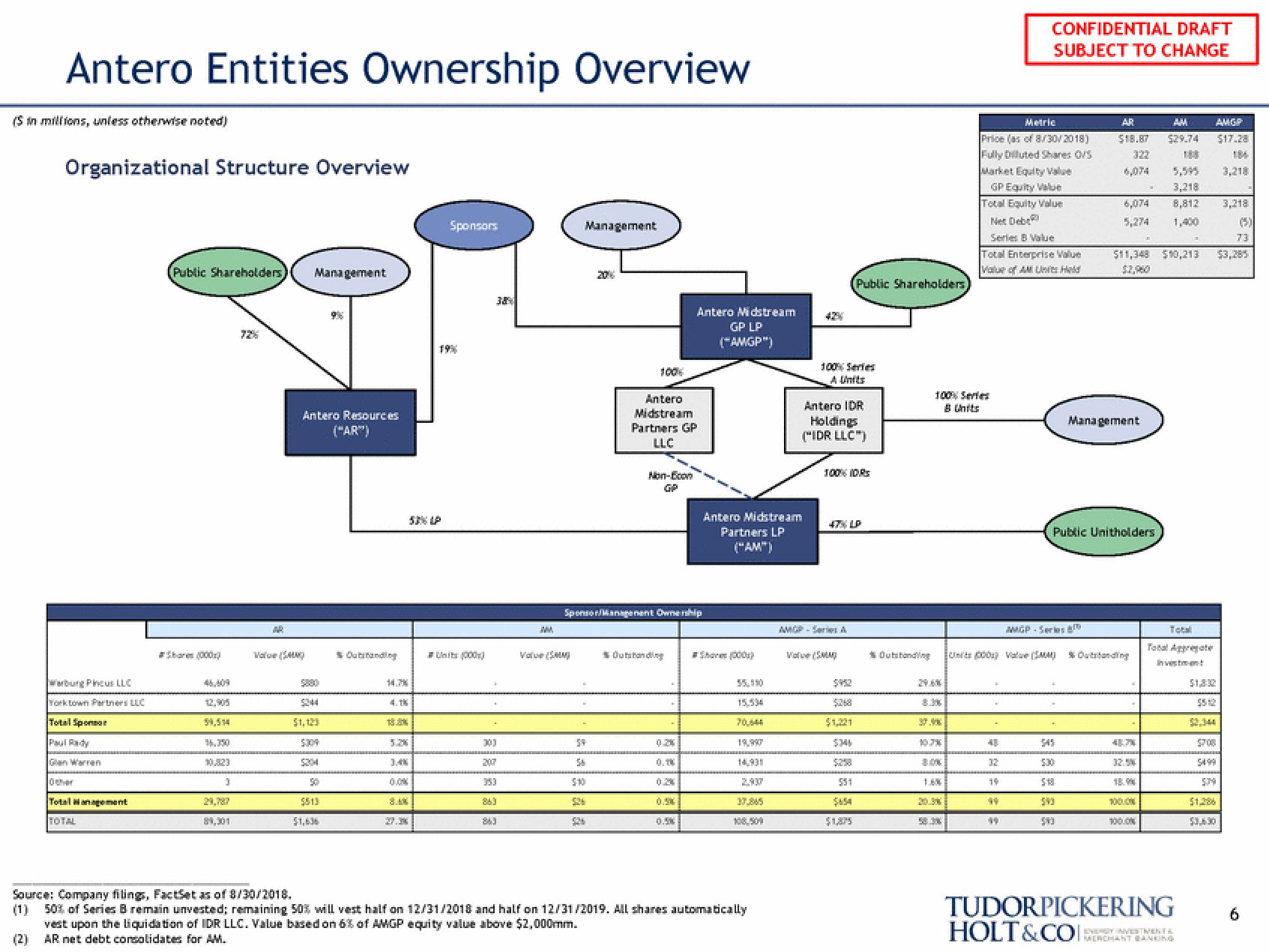

Antero Entities Ownership Overview

(Sin millions, unless otherwise noted)

(2)

Organizational Structure Overview

Werburg Pincus LLC

Yorktown Partners LLC

Total Sponsor

Paul Rady

Gan Warren

Total Management

TOTAL

Public Shareholders) Management

46,409

12,905

59,514

16.350

10,823

3

81,301

AR

Antero Resources

("AR")

Value (SMA)

$309

$304

50

$513

* Outbanding

14.7%

5.2%

3.40€

27.2%

Sponsors

19%

303

207

353

863

863

V

MM

Management

59

56

5:10

Antero

Midstream

Partners GP

LLC

Non-Econ

SponsorManagement Ownership

* Outstanding

0.2%

Antero Midstream

GP LP

{"AMGP")

0.7%

0.20

0.5%

Antero Midstream

Partners LP

("AM")

#Shane (0001)

15,534

70,644

19,997

108,509

Source: Company filings, FactSet as of 8/30/2018.

(1) 50% of Series B remain unvested; remaining 50% will vest half on 12/31/2018 and half on 12/31/2019. All shares automatically

vest upon the liquidation of IDR LLC. Value based on 6% of AMGP equity value above $2,000mm.

AR net debt consolidates for AM.

V

(Public Shareholders

100% Series

A Units

Antero IDR

Holdings

("IDR LLC")

100% IDRS

AMGP-SA

47% LP

$1,221

$1,875

* Outstanding

10.7%

100% Series

8 Units

20.30

58.3%

Metric

Price (as of 8/30/2018)

Fully Dilluted Shares OVS

Market Equity Value

GP Equity Value

Total Equity Value

Net Debe

Series B Value

Total Enterprise Value

Value of AM Unis Held

.

48

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

32

19

49

MGP-Series

545

AR

AM

AMGP

$18.87 $29.74 $17.28

322

6,074

5:18

543

543

3,218

6,074 8,812 3,218

1,400

Public Unitholders

$11,348 $10,213

Management

48.7%

100%

Total

Total Appregate

Investment

5499

579

$3,630

(5)

73

$3,285

TUDORPICKERING 6

HOLT&COCHANT BANKINGView entire presentation