Evotec Investor Day Presentation Deck

1

2

3

PAGE 18

evotec

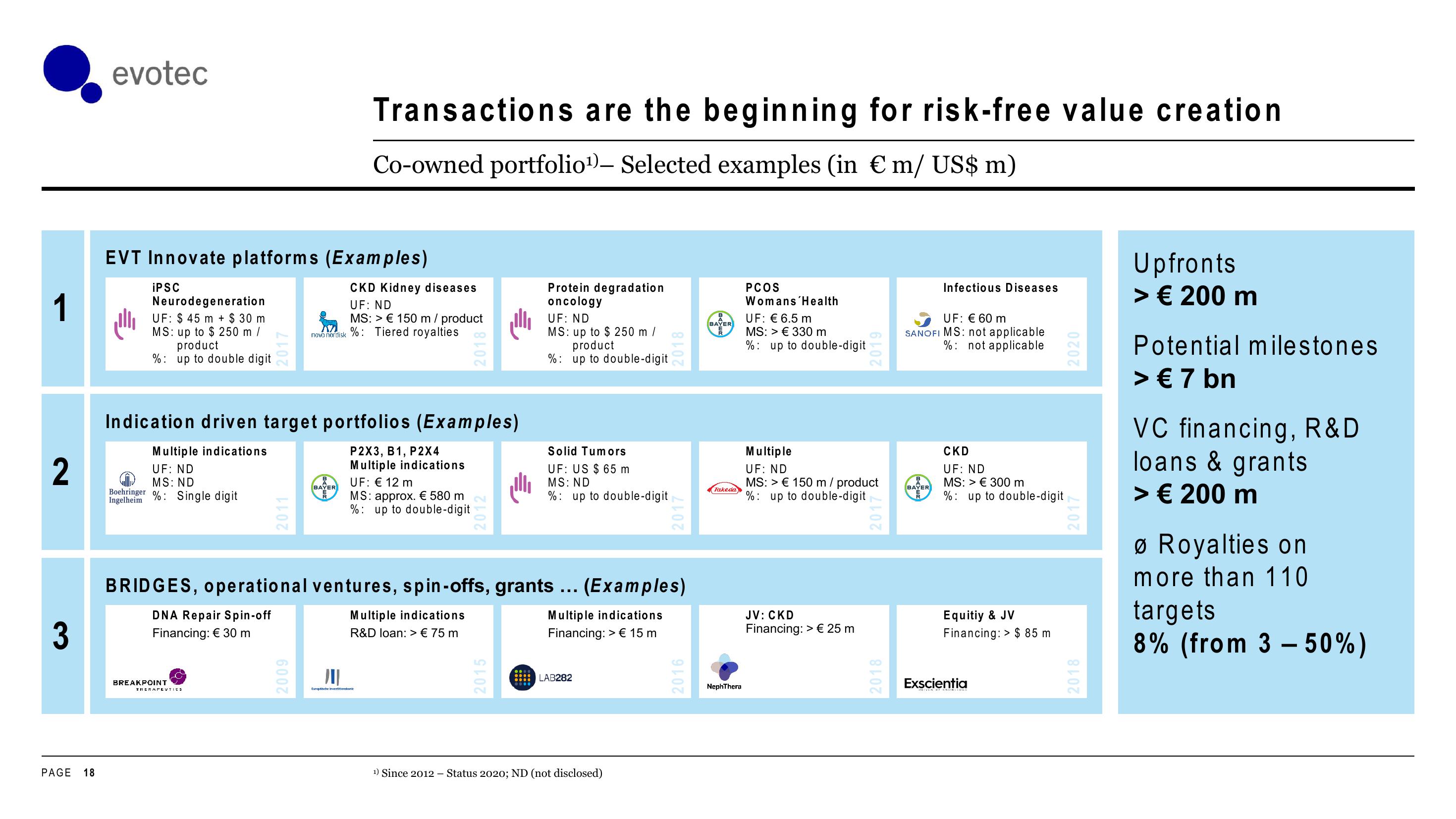

EVT Innovate platforms (Examples)

iPSC

Boehringer

Ingelheim

Neurodegeneration

UF: $45 m + $ 30 m

MS: up to $ 250 m /

product

% up to double digit

2017

BREAKPOINT

THERAPEUTICS

Indication driven target portfolios (Examples)

Multiple indications

P2X3, B1, P2X4

UF: ND

Multiple indications

MS: ND

%: Single digit

2011

novo nordisk

2009

Transactions are the beginning for risk-free value creation

Co-owned portfolio¹)- Selected examples (in € m/ US$ m)

B

BAYER

5

CKD Kidney diseases

UF: ND

MS: > € 150 m / product

% Tiered royalties

UF: € 12 m

MS: approx. € 580 m

% up to double-digit

2018

Multiple indications

R&D loan: > € 75 m

Europische investitionshank

2012

BRIDGES, operational ventures, spin-offs, grants... (Examples)

DNA Repair Spin-off

Multiple indications

Financing: > € 15 m

Financing: € 30 m

Protein degradation

oncology

2015

UF: ND

MS: up to $250 m /

product

% up to double-digit

Solid Tumors

UF: US $ 65 m

MS: ND

% up to double-digit

LAB282

2018

¹) Since 2012 - Status 2020; ND (not disclosed)

2017

2016

BAYER

2

Takeda

NephThera

PCOS

Womans 'Health

UF: € 6.5 m

MS: > € 330 m

% up to double-digit

2019

Multiple

UF: ND

MS: > € 150 m/product

%: up to double-digit

JV: CKD

Financing: > € 25 m

2017

2018

Infectious Diseases

UF: € 60 m

SANOFI MS: not applicable

%: not applicable

BAYER

長

CKD

UF: ND

MS: > € 300 m

% up to double-digit

Equitiy & JV

Financing: > $ 85 m

Exscientia

RIVEN HY KNOWLEDGE

2020

2017

2018

Upfronts

> € 200 m

Potential milestones

> € 7 bn

VC financing, R&D

loans & grants

> € 200 m

Ø Royalties on

more than 110

targets

8% (from 3 -50%)View entire presentation