Informatica Investor Presentation Deck

33

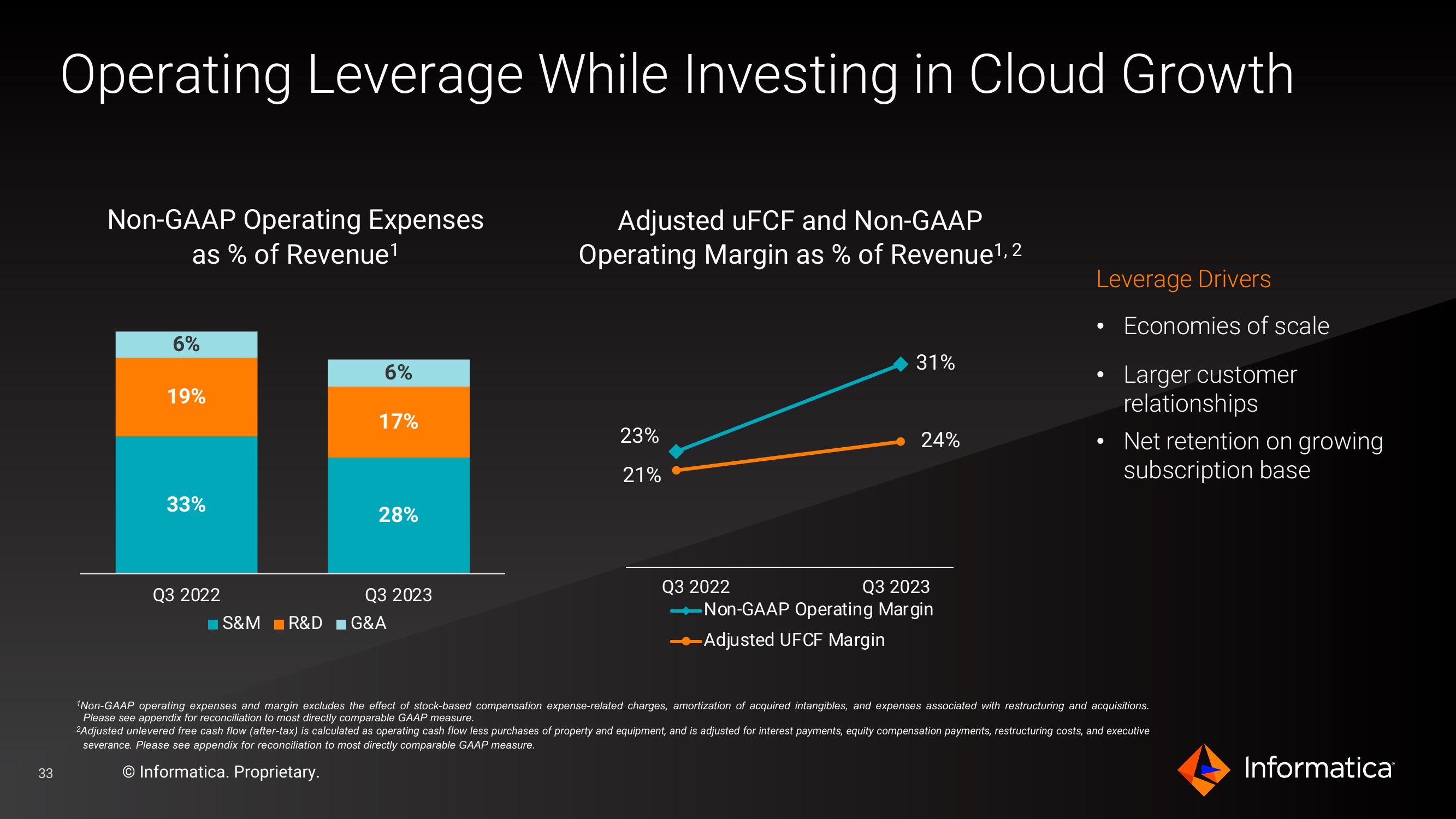

Operating Leverage While Investing in Cloud Growth

Non-GAAP Operating Expenses

as % of Revenue¹

Adjusted uFCF and Non-GAAP

Operating Margin as % of Revenue¹, 2

6%

19%

33%

Q3 2022

6%

17%

28%

Q3 2023

S&M R&D = G&A

23%

21%

31%

Q3 2022

24%

Q3 2023

-Non-GAAP Operating Margin

-Adjusted UFCF Margin

Leverage Drivers

Economies of scale

Larger customer

relationships

• Net retention on growing

subscription base

●

¹Non-GAAP operating expenses and margin excludes the effect of stock-based compensation expense-related charges, amortization of acquired intangibles, and expenses associated with restructuring and acquisitions.

Please see appendix for reconciliation to most directly comparable GAAP measure.

2Adjusted unlevered free cash flow (after-tax) is calculated as operating cash flow less purchases of property and equipment, and is adjusted for interest payments, equity compensation payments, restructuring costs, and executive

severance. Please see appendix for reconciliation to most directly comparable GAAP measure.

Informatica. Proprietary.

InformaticaView entire presentation