Apollo Global Management Investor Presentation Deck

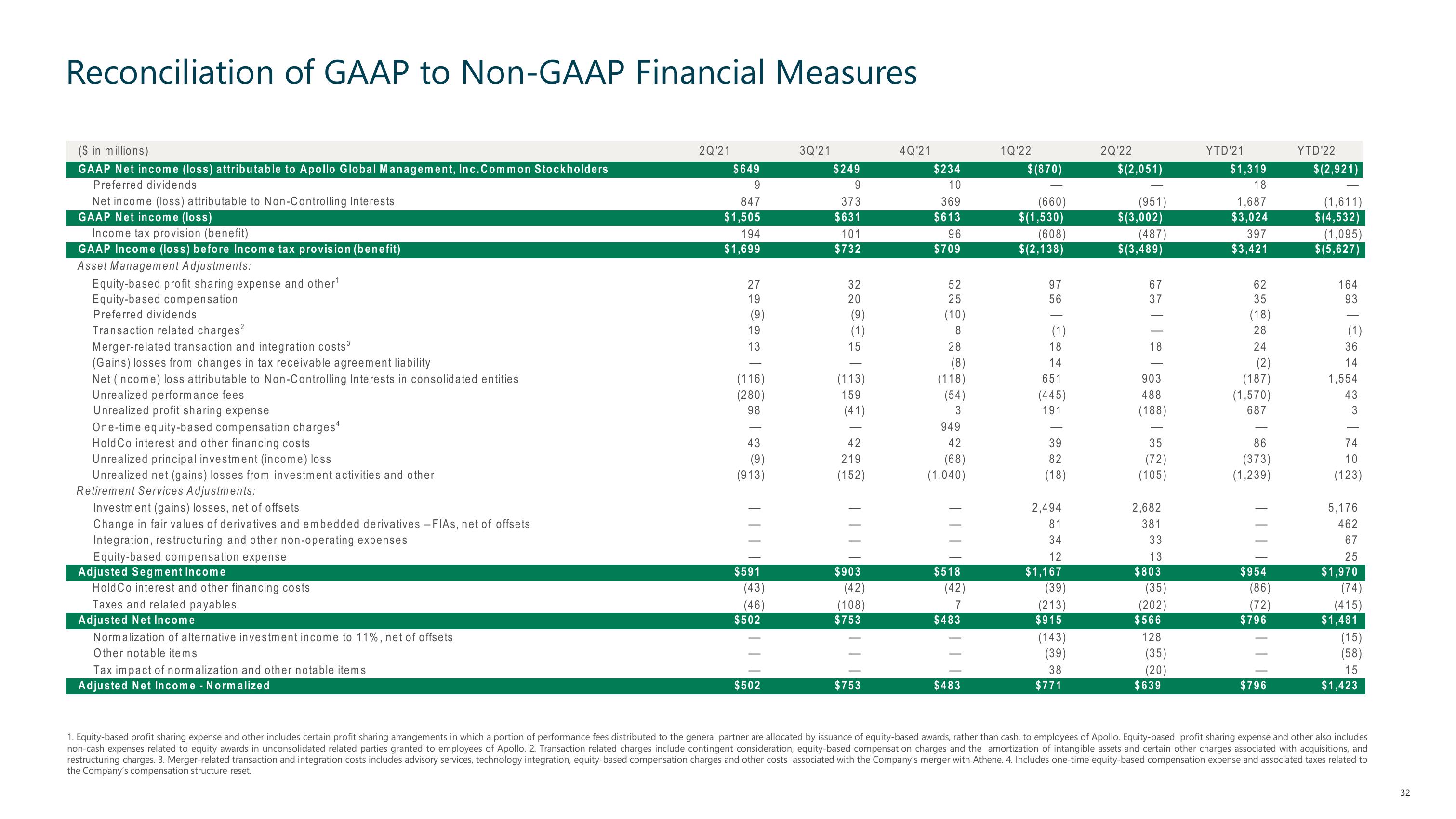

Reconciliation of GAAP to Non-GAAP Financial Measures

($ in millions)

GAAP Net income (loss) attributable to Apollo Global Management, Inc. Common Stockholders

Preferred dividends

Net income (loss) attributable to Non-Controlling Interests

GAAP Net income (loss)

Income tax provision (benefit)

GAAP Income (loss) before Income tax provision (benefit)

Asset Management Adjustments:

Equity-based profit sharing expense and other¹

Equity-based compensation

Preferred dividends

Transaction related charges²

Merger-related transaction and integration costs³

3

(Gains) losses from changes in tax receivable agreement liability

Net (income) loss attributable to Non-Controlling Interests in consolidated entities

Unrealized performance fees

Unrealized profit sharing expense

One-time equity-based compensation charges4

Hold Co interest and other financing costs

Unrealized principal investment (income) loss

Unrealized net (gains) losses from investment activities and other

Retirement Services Adjustments:

Investment (gains) losses, net of offsets

Change in fair values of derivatives and embedded derivatives - FIAS, net of offsets

Integration, restructuring and other non-operating expenses

Equity-based compensation expense

Adjusted Segment Income

Hold Co interest and other financing costs

Taxes and related payables

Adjusted Net Income

Normalization of alternative investment income to 11%, net of offsets

Other notable items

Tax impact of normalization and other notable items

Adjusted Net Income - Normalized

2Q¹21

$649

9

847

$1,505

194

$1,699

27

19

(9)

19

13

(116)

(280)

98

43

(9)

(913)

$591

(43)

(46)

$50

||

$502

3Q'21

$249

9

373

$631

101

$732

32

20

(9)

(1)

15

(113)

159

(41)

42

219

(152)

$903

(42)

(108)

$75

$753

4Q'21

$234

10

369

$613

96

$709

52

25

(10)

8

28

(8)

(118)

(54)

3

949

42

(68)

(1,040)

$518

(42)

7

$483

$483

1Q'22

$(870)

(660)

$(1,530)

(608)

$(2,138)

97

56

(1)

18

14

651

(445)

191

39

82

(18)

2,494

81

34

12

$1,167

(39)

(213)

$915

(143)

(39)

38

$771

2Q'22

$(2,051)

(951)

$ (3,002)

(487)

$ (3,489)

67

37

18

903

488

(188)

35

(72)

(105)

2,682

381

33

13

$803

(35)

(202)

566

128

(35)

(20)

$639

YTD'21

$1,319

18

1,687

$3,024

397

$3,421

62

35

(18)

28

24

(2)

(187)

(1,570)

687

86

(373)

(1,239)

$954

(86)

(72)

$796

$796

YTD¹22

$(2,921)

(1,611)

$(4,532)

(1,095)

$(5,627)

164

93

(1)

36

14

1,554

43

3

74

10

(123)

5,176

462

67

25

$1,970

(74)

(415)

$1,481

(15)

(58)

15

$1,423

1. Equity-based profit sharing expense and other includes certain profit sharing arrangements in which a portion of performance fees distributed to the general partner are allocated by issuance of equity-based awards, rather than cash, to employees of Apollo. Equity-based profit sharing expense and other also includes

non-cash expenses related to equity awards in unconsolidated related parties granted to employees of Apollo. 2. Transaction related charges include contingent consideration, equity-based compensation charges and the amortization of intangible assets and certain other charges associated with acquisitions, and

restructuring charges. 3. Merger-related transaction and integration costs includes advisory services, technology integration, equity-based compensation charges and other costs associated with the Company's merger with Athene. 4. Includes one-time equity-based compensation expense and associated taxes related to

the Company's compensation structure reset.

32View entire presentation