WPP Results Presentation Deck

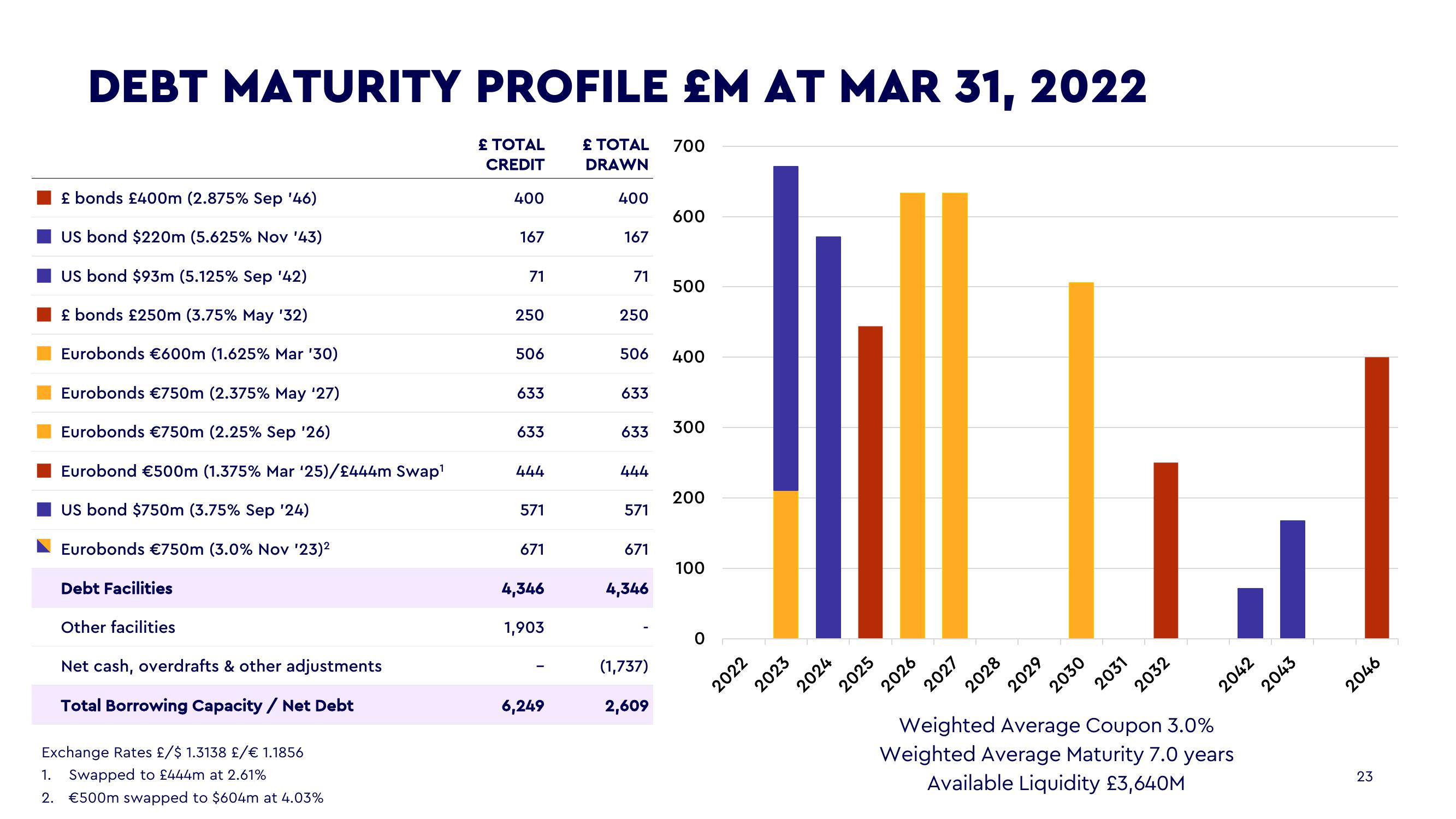

DEBT MATURITY PROFILE £M AT MAR 31, 2022

£ bonds £400m (2.875% Sep '46)

US bond $220m (5.625% Nov '43)

US bond $93m (5.125% Sep '42)

£ bonds £250m (3.75% May '32)

Eurobonds €600m (1.625% Mar '30)

Eurobonds €750m (2.375% May ¹27)

Eurobonds €750m (2.25% Sep '26)

Eurobond €500m (1.375% Mar '25)/£444m Swap¹

US bond $750m (3.75% Sep '24)

Eurobonds €750m (3.0% Nov '23)²

Debt Facilities

Other facilities

Net cash, overdrafts & other adjustments

Total Borrowing Capacity / Net Debt

Exchange Rates £/$ 1.3138 £ / € 1.1856

1.

Swapped to £444m at 2.61%

2. €500m swapped to $604m at 4.03%

£ TOTAL

CREDIT

400

167

71

250

506

633

633

444

571

671

4,346

1,903

6,249

£ TOTAL 700

DRAWN

400

167

71

250

506

633

633

444

571

671

4,346

(1,737)

2,609

600

500

400

300

200

100

2022

2023

2024

2025

2026

2027

2028

2029

H

2030

2031

2032

Weighted Average Coupon 3.0%

Weighted Average Maturity 7.0 years

Available Liquidity £3,640M

2042

2043

2046

23

7View entire presentation