Origo Results Presentation Deck

✓

✓

✓

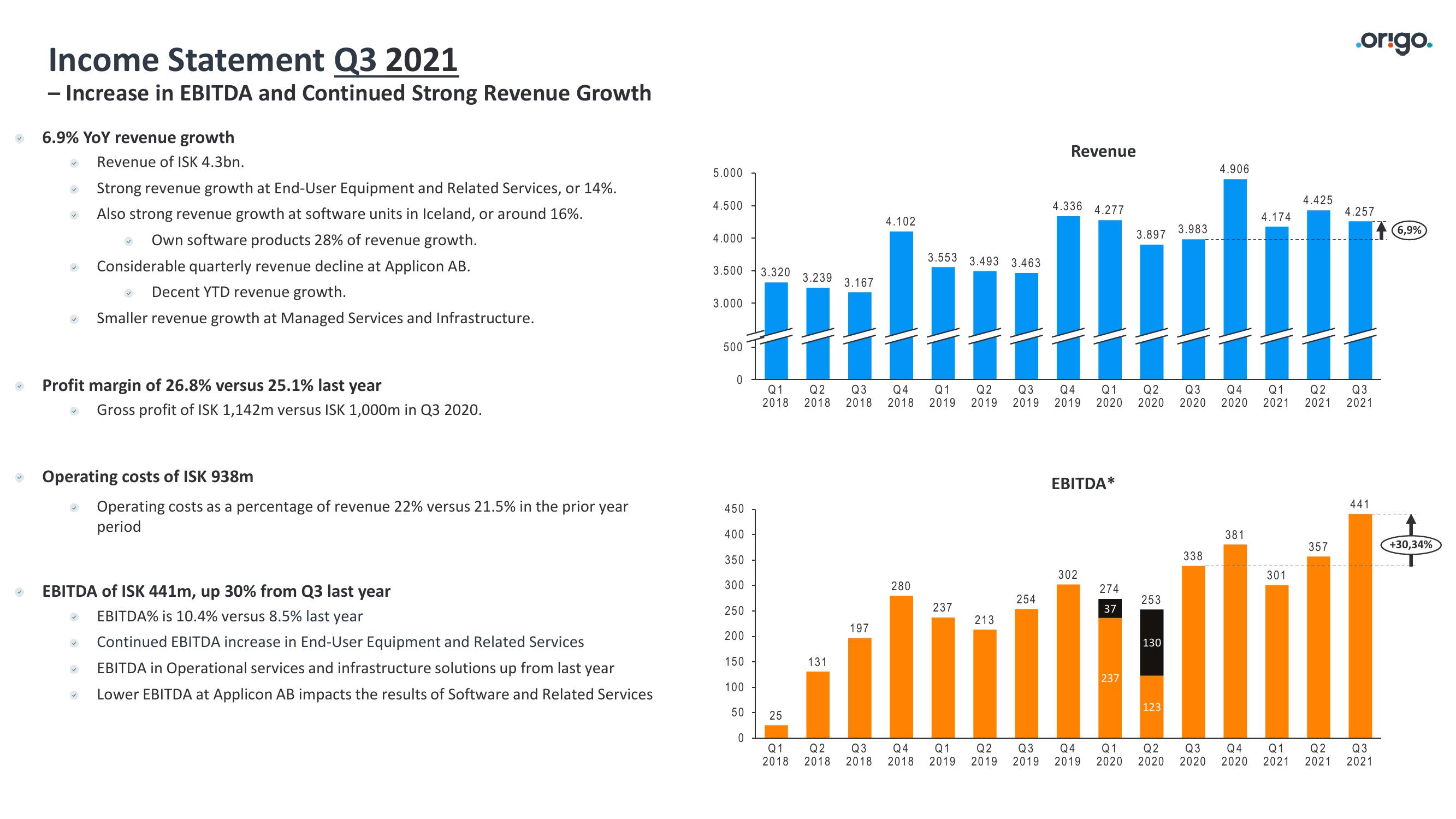

Income Statement Q3 2021

- Increase in EBITDA and Continued Strong Revenue Growth

6.9% YoY revenue growth

Revenue of ISK 4.3bn.

Strong revenue growth at End-User Equipment and Related Services, or 14%.

Also strong revenue growth at software units in Iceland, or around 16%.

Own software products 28% of revenue growth.

Considerable quarterly revenue decline at Applicon AB.

Decent YTD revenue growth.

Smaller revenue growth at Managed Services and Infrastructure.

✓

Profit margin of 26.8% versus 25.1% last year

Gross profit of ISK 1,142m versus ISK 1,000m in Q3 2020.

Operating costs of ISK 938m

✔

Operating costs as a percentage of revenue 22% versus 21.5% in the prior year

period

EBITDA of ISK 441m, up 30% from Q3 last year

EBITDA% is 10.4% versus 8.5% last year

Continued EBITDA increase in End-User Equipment and Related Services

EBITDA in Operational services and infrastructure solutions up from last year

Lower EBITDA at Applicon AB impacts the results of Software and Related Services

5.000

4.500

4.000

3.500 3.320

3.000

500

0

450

400

350

300

250

200

150

100

50

0

25

131

3.167

197

4.102

Q1 Q2 Q3

2018 2018

2018

3.553 3.493 3.463

280

237

213

Revenue

3.239

1

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2018 2018 2018 2018 2019 2019 2019 2019 2020 2020 2020 2020 2021 2021 2021

254

4.336 4.277

EBITDA*

302

274

37

3.897

237

253

130

3.983

123

4.906

338

4.174

381

4.425

301

.origo.

357

4.257

441

Q2 Q3

Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2018 2019 2019 2019 2019 2020 2020 2020 2020 2021 2021 2021

6,9%

+30,34%View entire presentation