Apollo Global Management Investor Day Presentation Deck

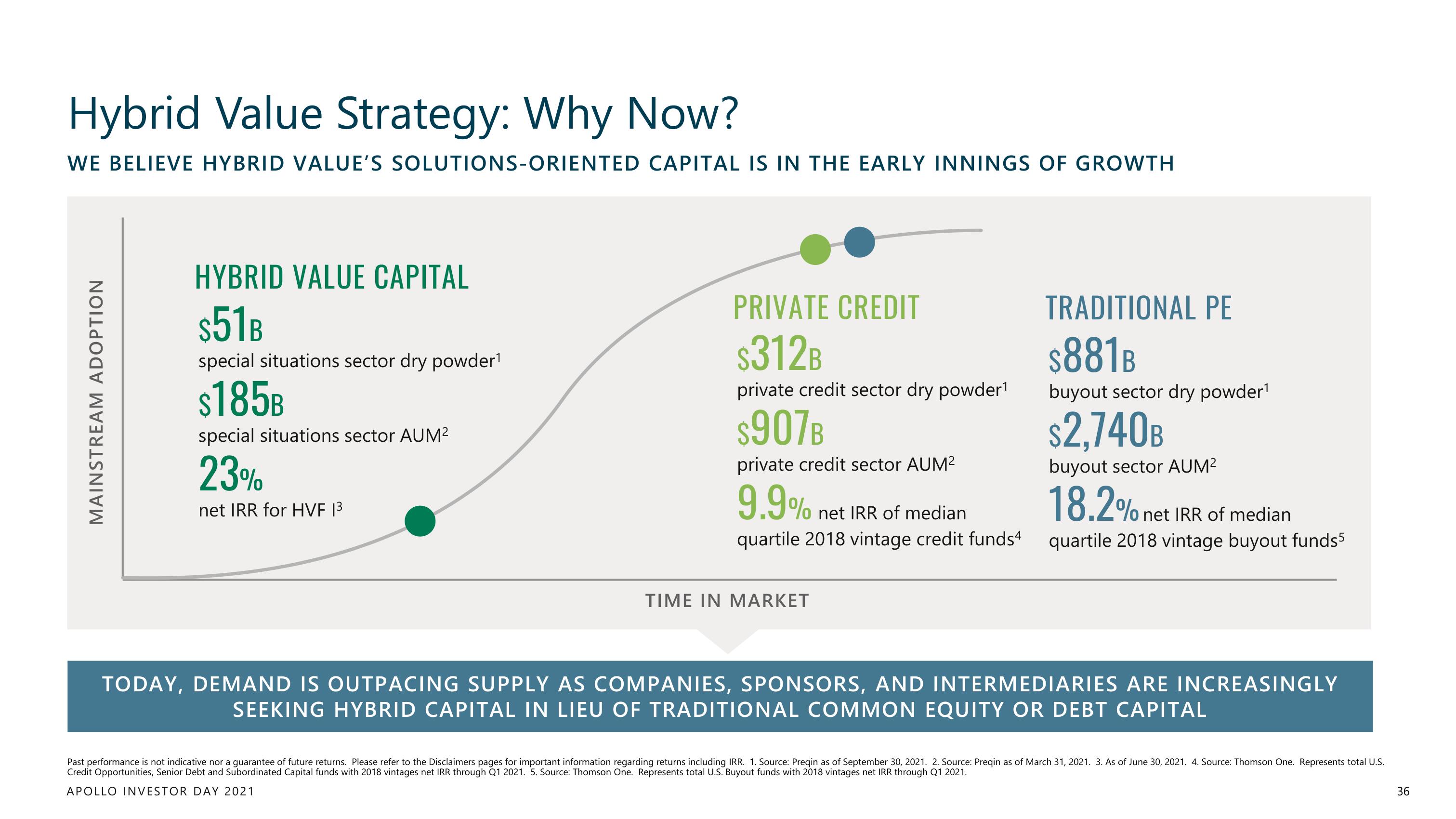

Hybrid Value Strategy: Why Now?

WE BELIEVE HYBRID VALUE'S SOLUTIONS-ORIENTED CAPITAL IS IN THE EARLY INNINGS OF GROWTH

MAINSTREAM ADOPTION

HYBRID VALUE CAPITAL

$51B

special situations sector dry powder¹

$185B

special situations sector AUM²

23%

net IRR for HVF 1³

PRIVATE CREDIT

$312B

private credit sector dry powder¹

$907B

private credit sector AUM²

9.9%

net IRR of median

quartile 2018 vintage credit funds4

TIME IN MARKET

TRADITIONAL PE

$881B

buyout sector dry powder¹

$2,740B

buyout sector AUM²

18.2% net IRR of median

quartile 2018 vintage buyout funds5

TODAY, DEMAND IS OUTPACING SUPPLY AS COMPANIES, SPONSORS, AND INTERMEDIARIES ARE INCREASINGLY

SEEKING HYBRID CAPITAL IN LIEU OF TRADITIONAL COMMON EQUITY OR DEBT CAPITAL

Past performance is not indicative nor a guarantee of future returns. Please refer to the Disclaimers pages for important information regarding returns including IRR. 1. Source: Preqin as of September 30, 2021. 2. Source: Preqin as of March 31, 2021. 3. As of June 30, 2021. 4. Source: Thomson One. Represents total U.S.

Credit Opportunities, Senior Debt and Subordinated Capital funds with 2018 vintages net IRR through Q1 2021. 5. Source: Thomson One. Represents total U.S. Buyout funds with 2018 vintages net IRR through Q1 2021.

APOLLO INVESTOR DAY 2021

36View entire presentation