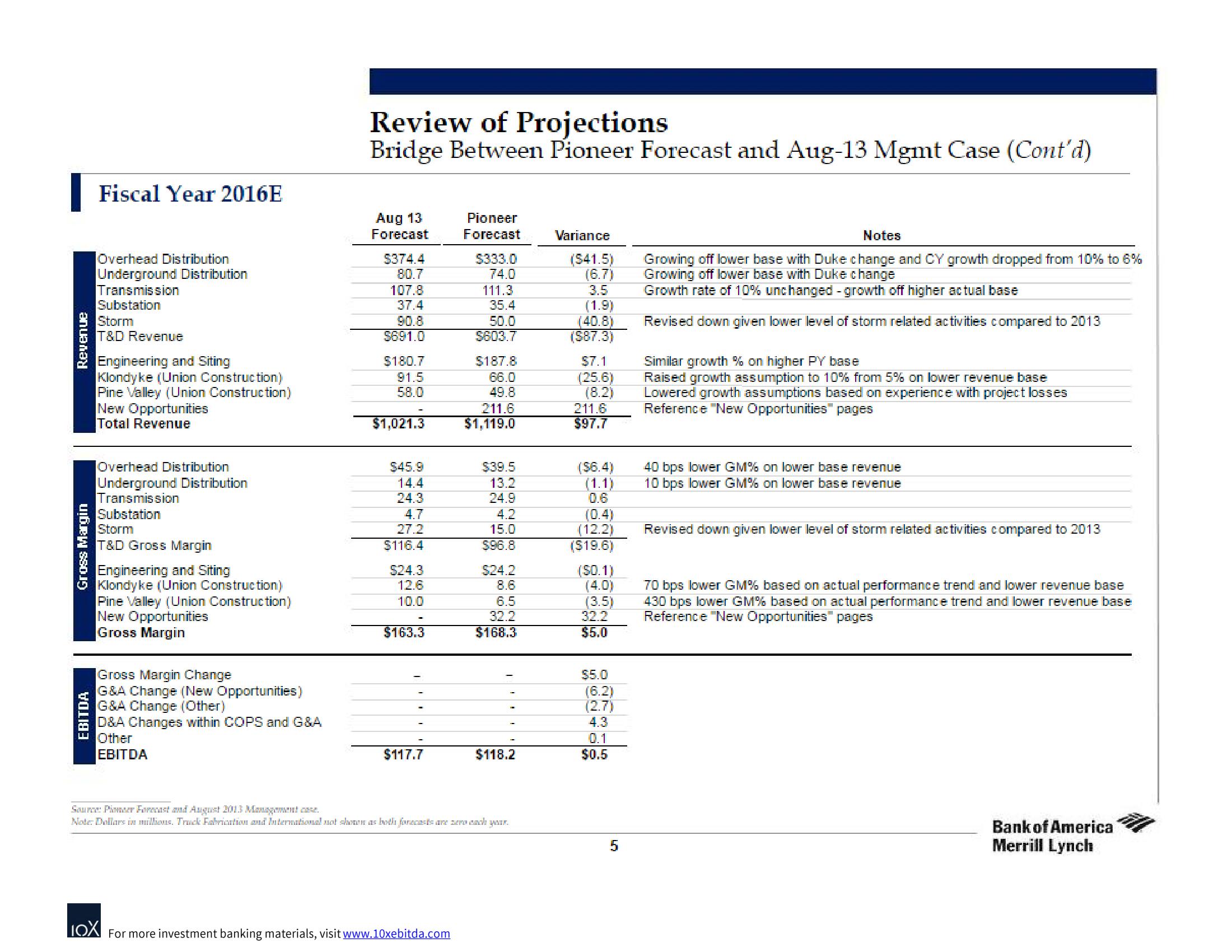

Bank of America Investment Banking Pitch Book

Revenue

Gross Margin

EBITDA

Fiscal Year 2016E

Overhead Distribution

Underground Distribution

Transmission

Substation

Storm

T&D Revenue

Engineering and Siting

Klondyke (Union Construction)

Pine Valley (Union Construction)

New Opportunities

Total Revenue

Overhead Distribution

Underground Distribution

Transmission

Substation

Storm

T&D Gross Margin

Engineering and Siting

Klondyke (Union Construction)

Pine Valley (Union Construction)

New Opportunities

Gross Margin

Gross Margin Change

G&A Change (New Opportunities)

G&A Change (Other)

D&A Changes within COPS and G&A

Other

EBITDA

Review of Projections

Bridge Between Pioneer Forecast and Aug-13 Mgmt Case (Cont'd)

Aug 13

Forecast

$374.4

80.7

107.8

37.4

90.8

$691.0

$180.7

91.5

58.0

$1,021.3

$45.9

14.4

24.3

4.7

27.2

$116.4

$24.3

12.6

10.0

$163.3

$117.7

Pioneer

Forecast

LOX For more investment banking materials, visit www.10xebitda.com

$333.0

74.0

111.3

35.4

50.0

$603.7

$187.8

66.0

49.8

211.6

$1,119.0

$39.5

13.2

24.9

4.2

15.0

$96.8

$24.2

8.6

6.5

32.2

$168.3

$118.2

Source: Pioneer Forecast and August 2013 Management case.

Note: Dollars in millions. Track Fabrication and International not shown as both forecasts are zero cach your.

Variance

($41.5)

(6.7)

3.5

(1.9)

(40.8)

($87.3)

$7.1

(25.6)

(8.2)

211.6

$97.7

($6.4)

(1.1)

0.6

(0.4)

(12.2)

($19.6)

(S0.1)

(4.0)

(3.5)

32.2

$5.0

$5.0

(6.2)

(2.7)

4.3

0.1

$0.5

5

Notes

Growing off lower base with Duke change and CY growth dropped from 10% to 6%

Growing off lower base with Duke change

Growth rate of 10% unchanged - growth off higher actual base

Revised down given lower level of storm related activities compared to 2013

Similar growth % on higher PY base

Raised growth assumption to 10% from 5% on lower revenue base

Lowered growth assumptions based on experience with project losses

Reference "New Opportunities" pages

40 bps lower GM% on lower base revenue

10 bps lower GM% on lower base revenue

Revised down given lower level of storm related activities compared to 2013

70 bps lower GM% based on actual performance trend and lower revenue base

430 bps lower GM% based on actual performance trend and lower revenue base

Reference "New Opportunities" pages

Bank of America

Merrill LynchView entire presentation