J.P.Morgan 2Q23 Investor Results

JPMORGAN CHASE & CO.

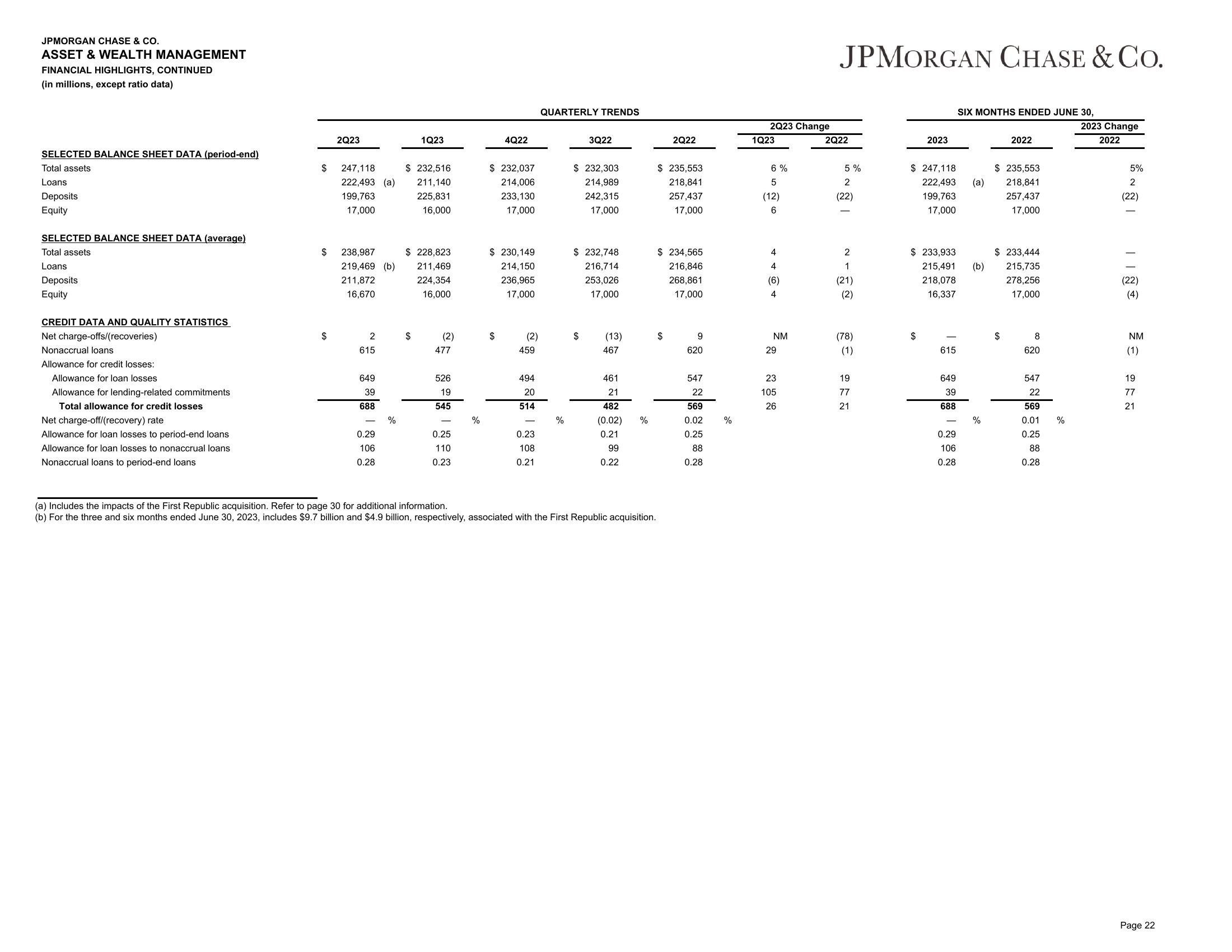

ASSET & WEALTH MANAGEMENT

FINANCIAL HIGHLIGHTS, CONTINUED

(in millions, except ratio data)

SELECTED BALANCE SHEET DATA (period-end)

Total assets

Loans

Deposits

Equity

SELECTED BALANCE SHEET DATA (average)

Total assets

Loans

Deposits

Equity

CREDIT DATA AND QUALITY STATISTICS

Net charge-offs/(recoveries)

Nonaccrual loans

Allowance for credit losses:

Allowance for loan losses

Allowance for lending-related commitments

Total allowance for credit losses

Net charge-off/(recovery) rate

Allowance for loan losses to period-end loans

Allowance for loan losses to nonaccrual loans

Nonaccrual loans to period-end loans

$ 247,118

$

2Q23

$

222,493 (a)

199,763

17,000

238,987

219,469 (b)

211,872

16,670

2

615

649

39

688

0.29

106

0.28

%

1Q23

$ 232,516

211,140

225,831

16,000

$ 228,823

211,469

224,354

16,000

$

(2)

477

526

19

545

0.25

110

0.23

%

4Q22

$ 232,037

214,006

233,130

17,000

$ 230,149

214,150

236,965

17,000

$

(2)

459

494

20

514

0.23

108

0.21

QUARTERLY TRENDS

%

3Q22

$ 232,303

214,989

242,315

17,000

$ 232,748

216,714

253,026

17,000

$

(13)

467

461

21

482

(0.02)

0.21

99

0.22

%

(a) Includes the impacts of the First Republic acquisition. Refer to page 30 for additional information.

(b) For the three and six months ended June 30, 2023, includes $9.7 billion and $4.9 billion, respectively, associated with the First Republic acquisition.

2Q22

$ 235,553

218,841

257,437

17,000

$ 234,565

216,846

268,861

17,000

$

9

620

547

22

569

0.02

0.25

88

0.28

%

2Q23 Change

1Q23

6%

5

(12)

6

4

4

(6)

4

NM

29

23

105

26

JPMORGAN CHASE & CO.

2Q22

5%

2

(22)

2

1

(21)

(2)

(78)

(1)

19

77

21

2023

$ 247,118

222,493

199,763

17,000

$ 233,933

215,491

218,078

16,337

$

615

649

39

688

0.29

106

0.28

SIX MONTHS ENDED JUNE 30,

(a)

(b)

%

2022

$ 235,553

218,841

257,437

17,000

$ 233,444

215,735

278,256

17,000

$

8

620

547

22

569

0.01

0.25

88

0.28

%

2023 Change

2022

5%

2

(22)

(22)

(4)

NM

(1)

19

77

21

Page 22View entire presentation