flyExclusive SPAC

V. FINANCIAL OVERVIEW

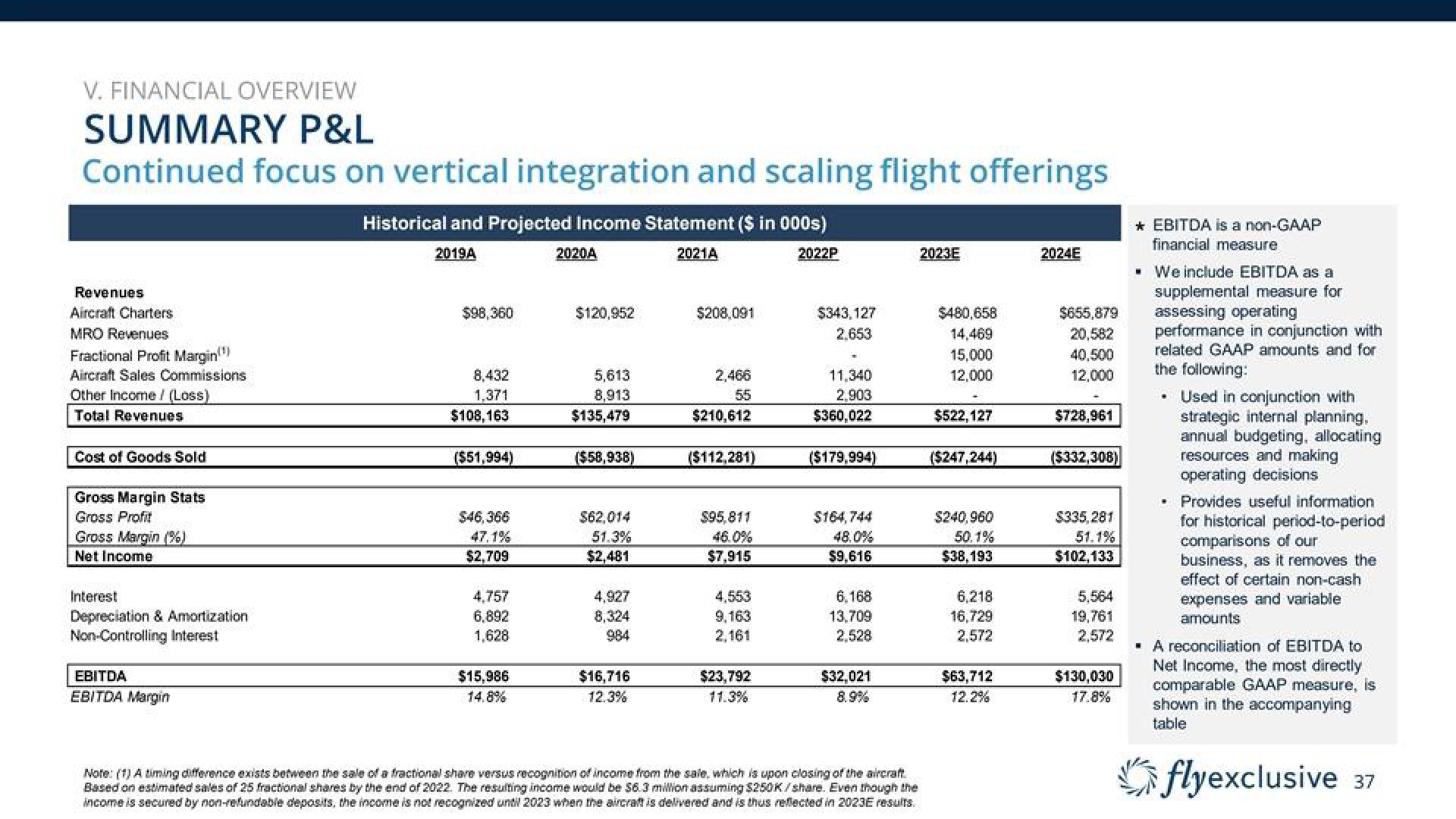

SUMMARY P&L

Continued focus on vertical integration and scaling flight offerings

Revenues

Aircraft Charters

MRO Revenues

Fractional Profit Margin(¹)

Aircraft Sales Commissions

Other Income / (Loss)

Total Revenues

Cost of Goods Sold

Gross Margin Stats

Gross Profit

Gross Margin (%)

Net Income

Interest

Depreciation & Amortization

Non-Controlling Interest

EBITDA

EBITDA Margin

Historical and Projected Income Statement ($ in 000s)

2019A

2021A

2022P

$98,360

8,432

1,371

$108,163

($51,994)

$46,366

47.1%

$2,709

4,757

6,892

1,628

$15,986

14.8%

2020A

$120,952

5,613

8,913

$135,479

($58,938)

$62,014

51.3%

$2,481

4,927

8,324

984

$16,716

12.3%

$208.091

2,466

55

$210,612

($112,281)

$95.811

46.0%

$7,915

4,553

9,163

2,161

$23,792

11.3%

$343,127

2.653

11,340

2,903

$360,022

($179,994)

$164,744

48.0%

$9,616

6.168

13.709

2,528

$32,021

8.9%

Note: (1) A timing difference exists between the sale of a fractional share versus recognition of income from the sale, which is upon closing of the aircraft.

Based on estimated sales of 25 fractional shares by the end of 2022. The resulting income would be $6.3 million assuming $250K/share. Even though the

income is secured by non-refundable deposits, the income is not recognized until 2023 when the aircraft is delivered and is thus reflected in 2023E results.

2023E

$480,658

14,469

15,000

12,000

$522,127

($247,244)

$240,960

50.1%

$38,193

6,218

16,729

2,572

$63,712

12.2%

2024E

$655,879

20,582

40,500

12,000

$728,961

($332,308)

$335,281

51.1%

$102,133

5,564

19,761

2,572

$130,030

17.8%

* EBITDA is a non-GAAP

financial measure

. We include EBITDA as a

supplemental measure for

assessing operating

performance in conjunction with

related GAAP amounts and for

the following:

#

Used in conjunction with

strategic internal planning,

annual budgeting, allocating

resources and making

operating decisions

• Provides useful information

for historical period-to-period

comparisons of our

business, as it removes the

effect of certain non-cash

expenses and variable

amounts

A reconciliation of EBITDA to

Net Income, the most directly

comparable GAAP measure, is

shown in the accompanying

table

flyexclusive 37View entire presentation