Baird Investment Banking Pitch Book

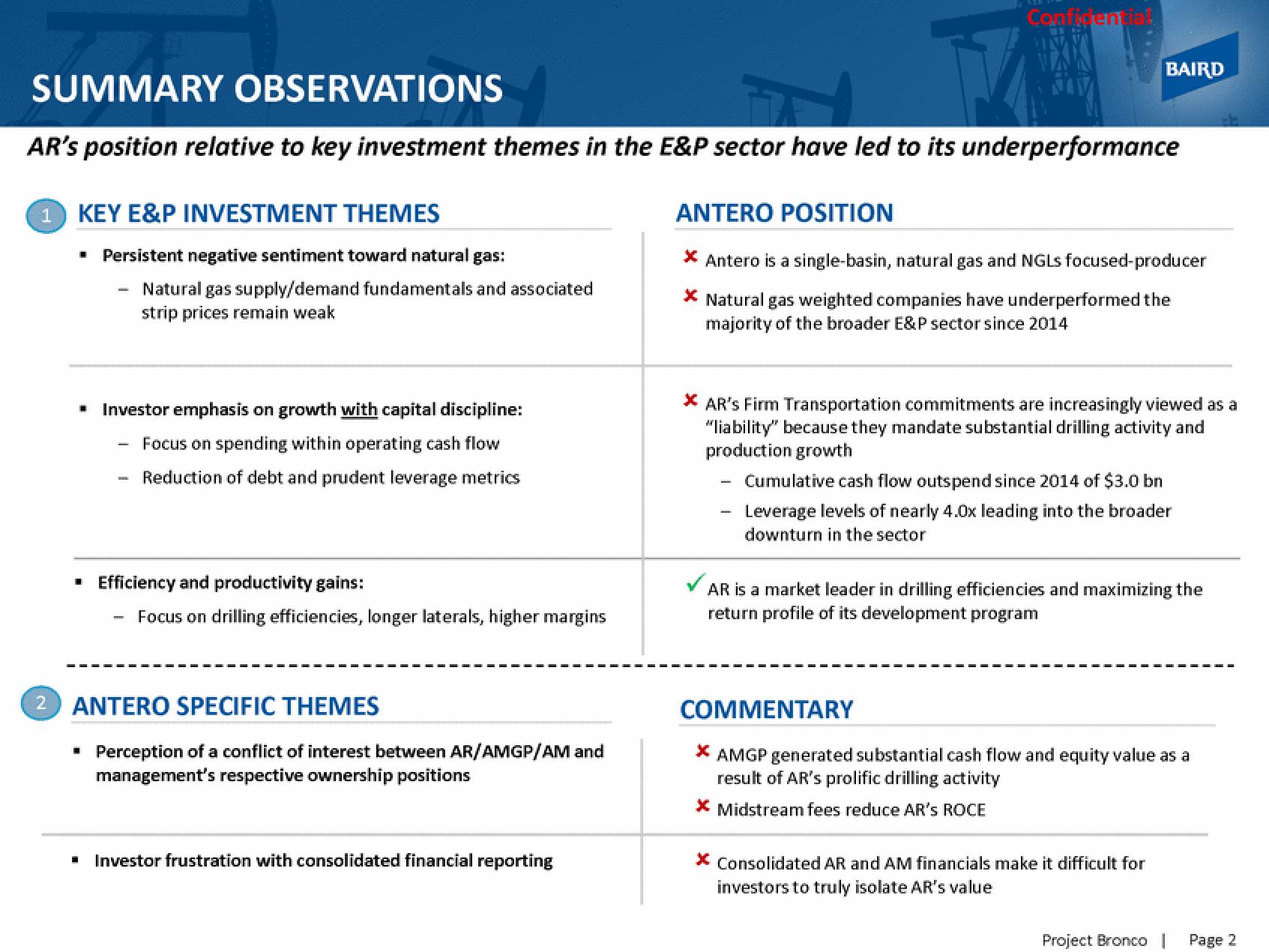

1 KEY E&P INVESTMENT THEMES

▪ Persistent negative sentiment toward natural gas:

SUMMARY OBSERVATIONS

AR's position relative to key investment themes in the E&P sector have led to its underperformance

■

L

I

Investor emphasis on growth with capital discipline:

Focus on spending within operating cash flow

Reduction of debt and prudent leverage metrics

-

Natural gas supply/demand fundamentals and associated

strip prices remain weak

■ Efficiency and productivity gains:

-

Focus on drilling efficiencies, longer laterals, higher margins

2 ANTERO SPECIFIC THEMES

Perception of a conflict of interest between AR/AMGP/AM and

management's respective ownership positions

Confidential

Investor frustration with consolidated financial reporting

BAIRD

ANTERO POSITION

* Antero is a single-basin, natural gas and NGLS focused-producer

* Natural gas weighted companies have underperformed the

majority of the broader E&P sector since 2014

* AR's Firm Transportation commitments are increasingly viewed as a

"liability" because they mandate substantial drilling activity and

production growth

Cumulative cash flow outspend since 2014 of $3.0 bn

Leverage levels of nearly 4.0x leading into the broader

downturn in the sector

AR is a market leader in drilling efficiencies and maximizing the

return profile of its development program

COMMENTARY

* AMGP generated substantial cash flow and equity value as a

result of AR's prolific drilling activity

* Midstream fees reduce AR'S ROCE

* Consolidated AR and AM financials make it difficult for

investors to truly isolate AR's value

Project Bronco

Page 2View entire presentation