Avantor Results Presentation Deck

6

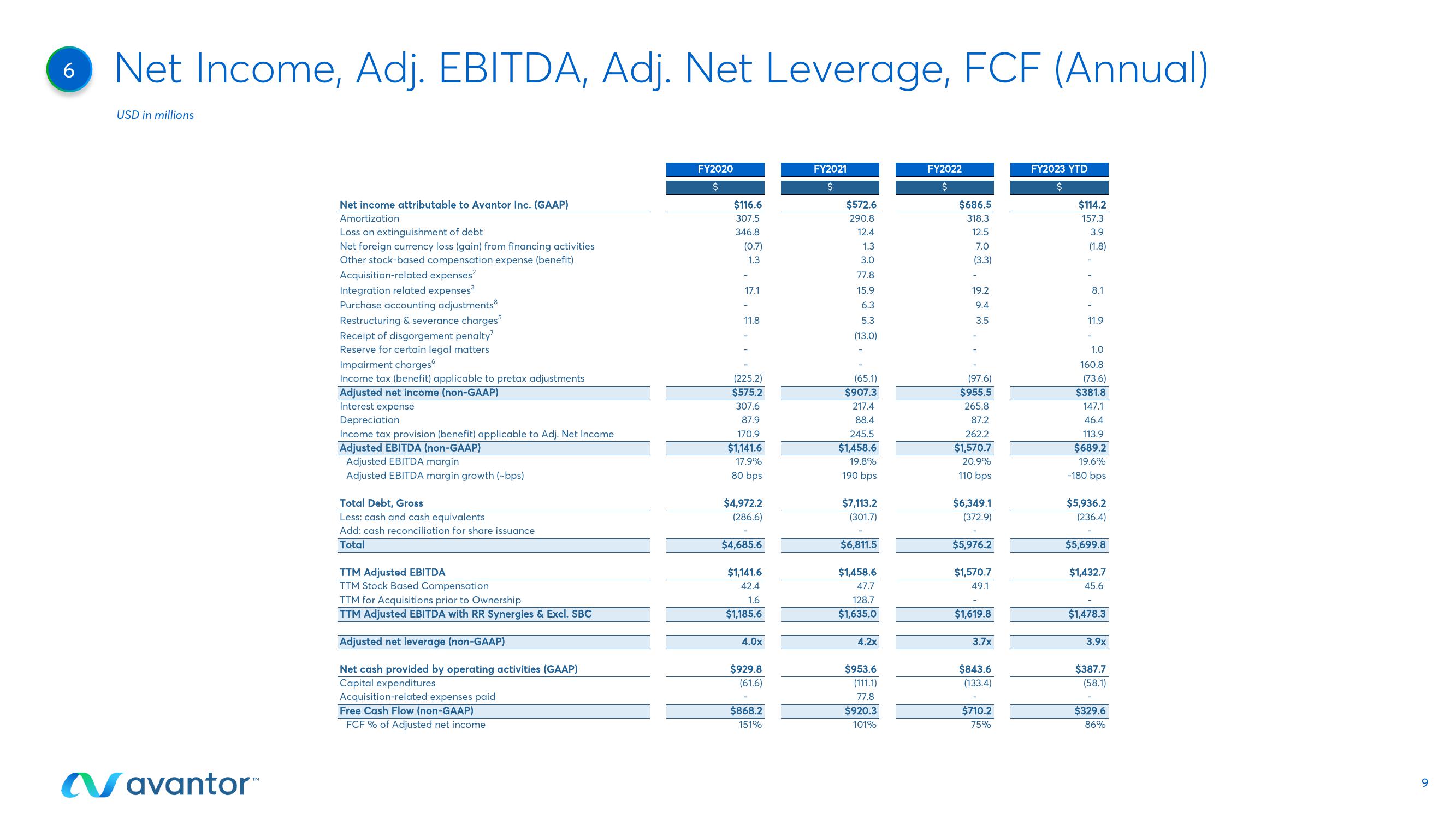

Net Income, Adj. EBITDA, Adj. Net Leverage, FCF (Annual)

USD in millions

Navantor™

Net income attributable to Avantor Inc. (GAAP)

Amortization

Loss on extinguishment of debt

Net foreign currency loss (gain) from financing activities

Other stock-based compensation expense (benefit)

Acquisition-related expenses²

Integration related expenses³

Purchase accounting adjustments

Restructuring & severance charges5

Receipt of disgorgement penalty7

Reserve for certain legal matters

Impairment charges

Income tax (benefit) applicable to pretax adjustments

Adjusted net income (non-GAAP)

Interest expense

Depreciation

Income tax provision (benefit) applicable to Adj. Net Income

Adjusted EBITDA (non-GAAP)

Adjusted EBITDA margin

Adjusted EBITDA margin growth (~bps)

Total Debt, Gross

Less: cash and cash equivalents

Add: cash reconciliation for share issuance

Total

TTM Adjusted EBITDA

TTM Stock Based Compensation

TTM for Acquisitions prior to Ownership

TTM Adjusted EBITDA with RR Synergies & Excl. SBC

Adjusted net leverage (non-GAAP)

Net cash provided by operating activities (GAAP)

Capital expenditures

Acquisition-related expenses paid

Free Cash Flow (non-GAAP)

FCF % of Adjusted net income

FY2020

$

$116.6

307.5

346.8

(0.7)

1.3

17.1

-

11.8

(225.2)

$575.2

307.6

87.9

170.9

$1,141.6

17.9%

80 bps

$4,972.2

(286.6)

$4,685.6

$1,141.6

42.4

1.6

$1,185.6

4.0x

$929.8

(61.6)

$868.2

151%

FY2021

$

$572.6

290.8

12.4

1.3

3.0

77.8

15.9

6.3

5.3

(13.0)

(65.1)

$907.3

217.4

88.4

245.5

$1,458.6

19.8%

190 bps

$7,113.2

(301.7)

$6,811.5

$1,458.6

47.7

128.7

$1,635.0

4.2x

$953.6

(111.1)

77.8

$920.3

101%

FY2022

$

$686.5

318.3

12.5

7.0

(3.3)

19.2

9.4

3.5

(97.6)

$955.5

265.8

87.2

262.2

$1,570.7

20.9%

110 bps

$6,349.1

(372.9)

$5,976.2

$1,570.7

49.1

$1,619.8

3.7x

$843.6

(133.4)

$710.2

75%

FY2023 YTD

$

$114.2

157.3

3.9

(1.8)

-

8.1

-

11.9

1.0

160.8

(73.6)

$381.8

147.1

46.4

113.9

$689.2

19.6%

-180 bps

$5,936.2

(236.4)

$5,699.8

$1,432.7

45.6

$1,478.3

3.9x

$387.7

(58.1)

$329.6

86%

9View entire presentation