Bakkt SPAC Presentation Deck

Overview of ICE

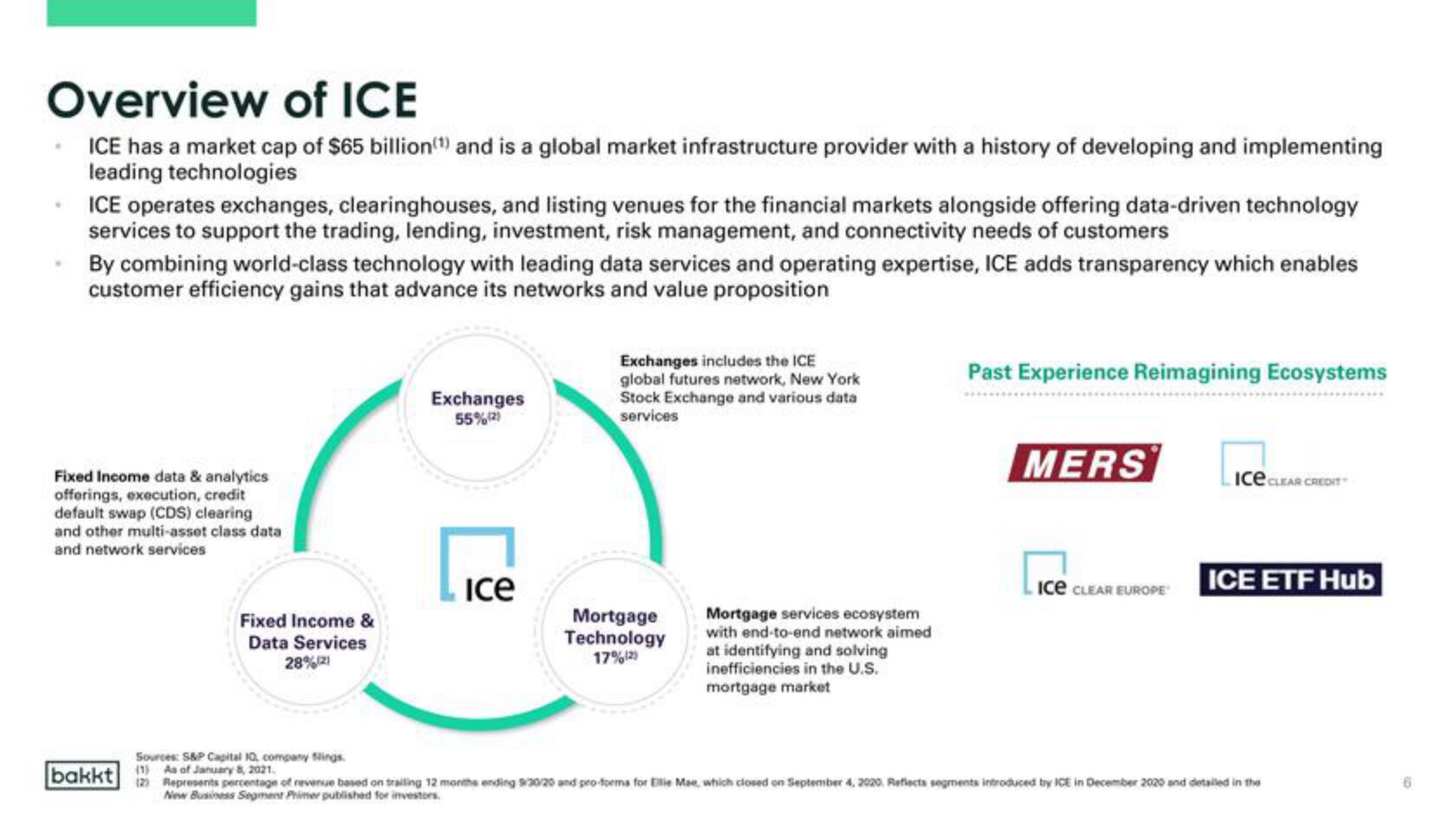

ICE has a market cap of $65 billion(¹) and is a global market infrastructure provider with a history of developing and implementing

leading technologies

• ICE operates exchanges, clearinghouses, and listing venues for the financial markets alongside offering data-driven technology

services to support the trading, lending, investment, risk management, and connectivity needs of customers

By combining world-class technology with leading data services and operating expertise, ICE adds transparency which enables

customer efficiency gains that advance its networks and value proposition

Fixed Income data & analytics

offerings, execution, credit

default swap (CDS) clearing

and other multi-asset class data

and network services

bakkt

Fixed Income &

Data Services

28%(21

Sources: S&P Capital 10, company Slings.

(1) As of January 8, 2021.

(2)

Exchanges

55%(2)

Ice

Exchanges includes the ICE

global futures network, New York

Stock Exchange and various data

services

Mortgage

Technology

17%(2)

Mortgage services ecosystem

with end-to-end network aimed

at identifying and solving

inefficiencies in the U.S.

mortgage market

Past Experience Reimagining Ecosystems

MERS

Ice CLEAR EUROPE

Ice CLEAR CREDIT

ICE ETF Hub

Represents percentage of revenue based on trailing 12 months ending 9/30/20 and pro-forms for Ellie Mae, which closed on September 4, 2020 Reflects segments introduced by ICE in December 2020 and detailed in the

New Business Segment Primer published for investors.View entire presentation