Engine No. 1 Activist Presentation Deck

While ExxonMobil is focusing investors on its best assets,

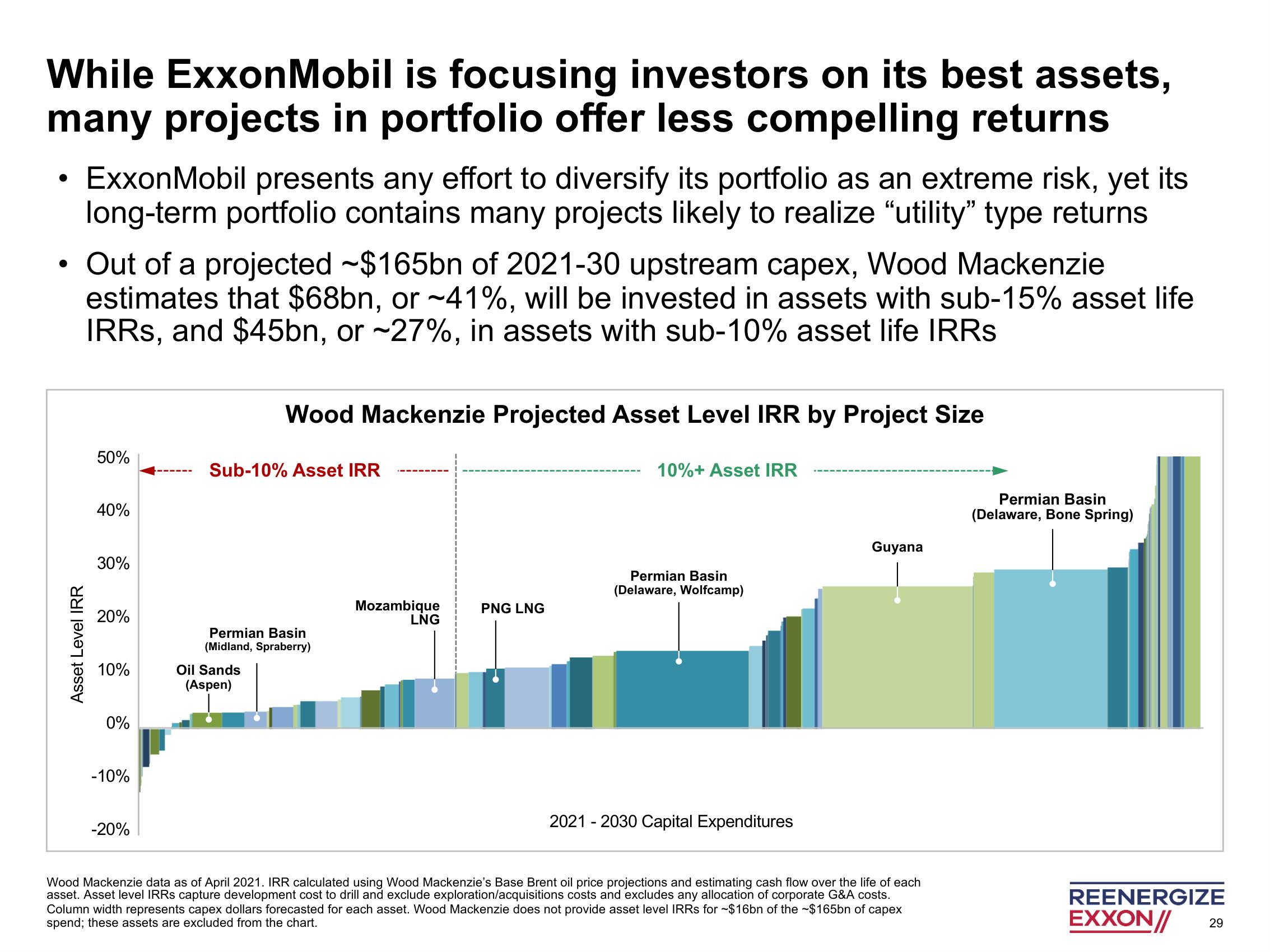

many projects in portfolio offer less compelling returns

●

ExxonMobil presents any effort to diversify its portfolio as an extreme risk, yet its

long-term portfolio contains many projects likely to realize "utility" type returns

• Out of a projected $165bn of 2021-30 upstream capex, Wood Mackenzie

estimates that $68bn, or ~41%, will be invested in assets with sub-15% asset life

IRRs, and $45bn, or ~27%, in assets with sub-10% asset life IRRs

Asset Level IRR

50%

40%

30%

20%

10%

0%

-10%

-20%

—

Wood Mackenzie Projected Asset Level IRR by Project Size

Sub-10% Asset IRR

Permian Basin

(Midland, Spraberry)

Oil Sands

(Aspen)

Mozambique

LNG

PNG LNG

10%+ Asset IRR

Permian Basin

(Delaware, Wolfcamp)

2021-2030 Capital Expenditures

Guyana

Wood Mackenzie data as of April 2021. IRR calculated using Wood Mackenzie's Base Brent oil price projections and estimating cash flow over the life of each

asset. Asset level IRRs capture development cost to drill and exclude exploration/acquisitions costs and excludes any allocation of corporate G&A costs.

Column width represents capex dollars forecasted for each asset. Wood Mackenzie does not provide asset level IRRs for ~$16bn of the $165bn of capex

spend; these assets are excluded from the chart.

Permian Basin

(Delaware, Bone Spring)

REENERGIZE

EXXON//

29View entire presentation