Lumen Investor Day Presentation Deck

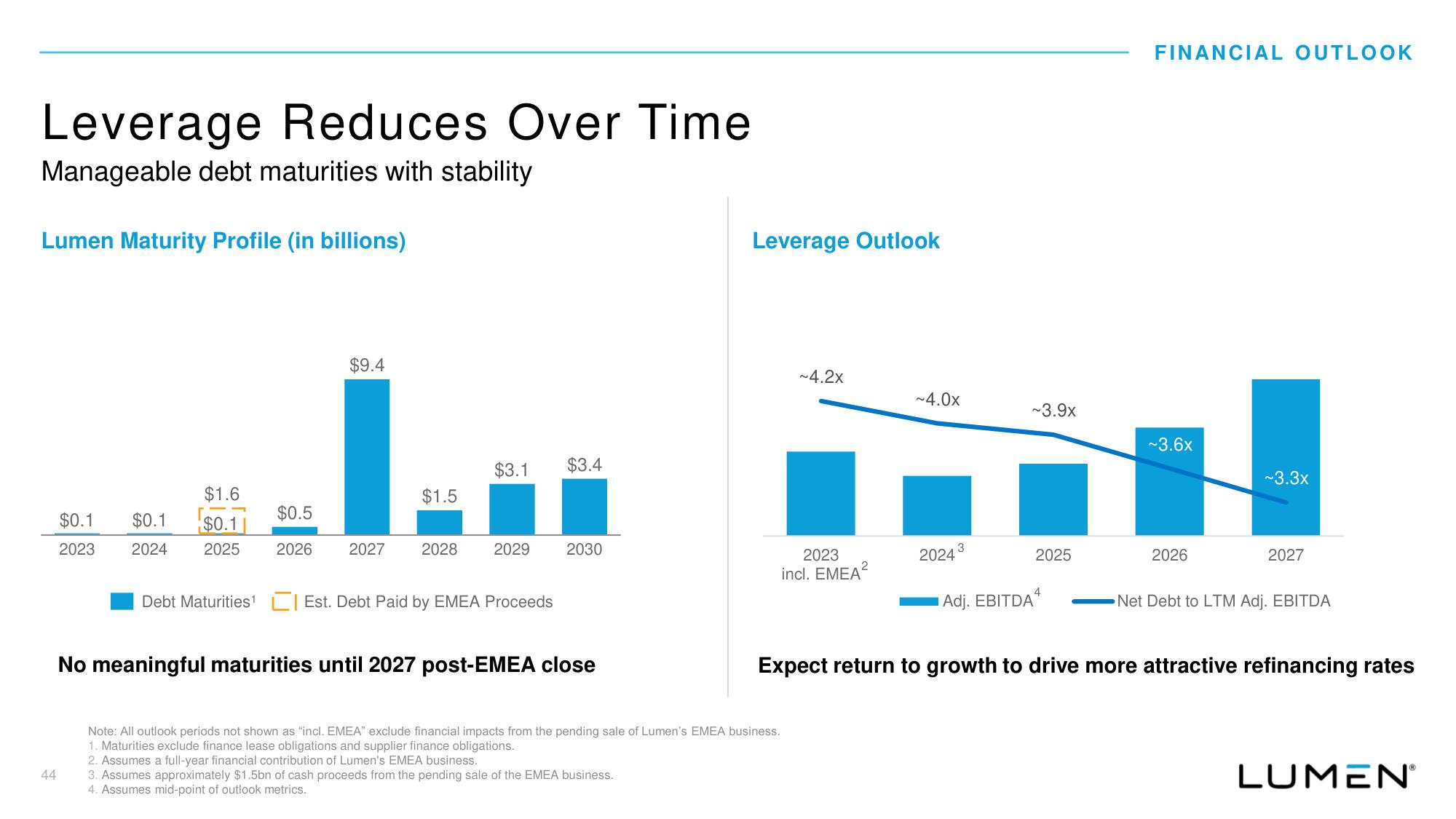

Leverage Reduces Over Time

Manageable debt maturities with stability

Lumen Maturity Profile (in billions)

44

$1.6

$0.1 $0.1 $0.1

2023

2024

$9.4

$0.5

2025 2026 2027

Debt Maturities¹

$1.5

2028

$3.1

2029

Est. Debt Paid by EMEA Proceeds

$3.4

2030

No meaningful maturities until 2027 post-EMEA close

Leverage Outlook

~4.2x

2023

incl. EMEA²

Note: All outlook periods not shown as "incl. EMEA" exclude financial impacts from the pending sale of Lumen's EMEA business.

1. Maturities exclude finance lease obligations and supplier finance obligations.

2. Assumes a full-year financial contribution of Lumen's EMEA business.

3. Assumes approximately $1.5bn of cash proceeds from the pending sale of the EMEA business.

4. Assumes mid-point of outlook metrics.

~4.0x

2024

3

~3.9x

Adj. EBITDA

2025

4

FINANCIAL OUTLOOK

~3.6x

2026

~3.3x

2027

Net Debt to LTM Adj. EBITDA

Expect return to growth to drive more attractive refinancing rates

LUMENⓇView entire presentation