First Quarter 2023 Earnings Conference Call

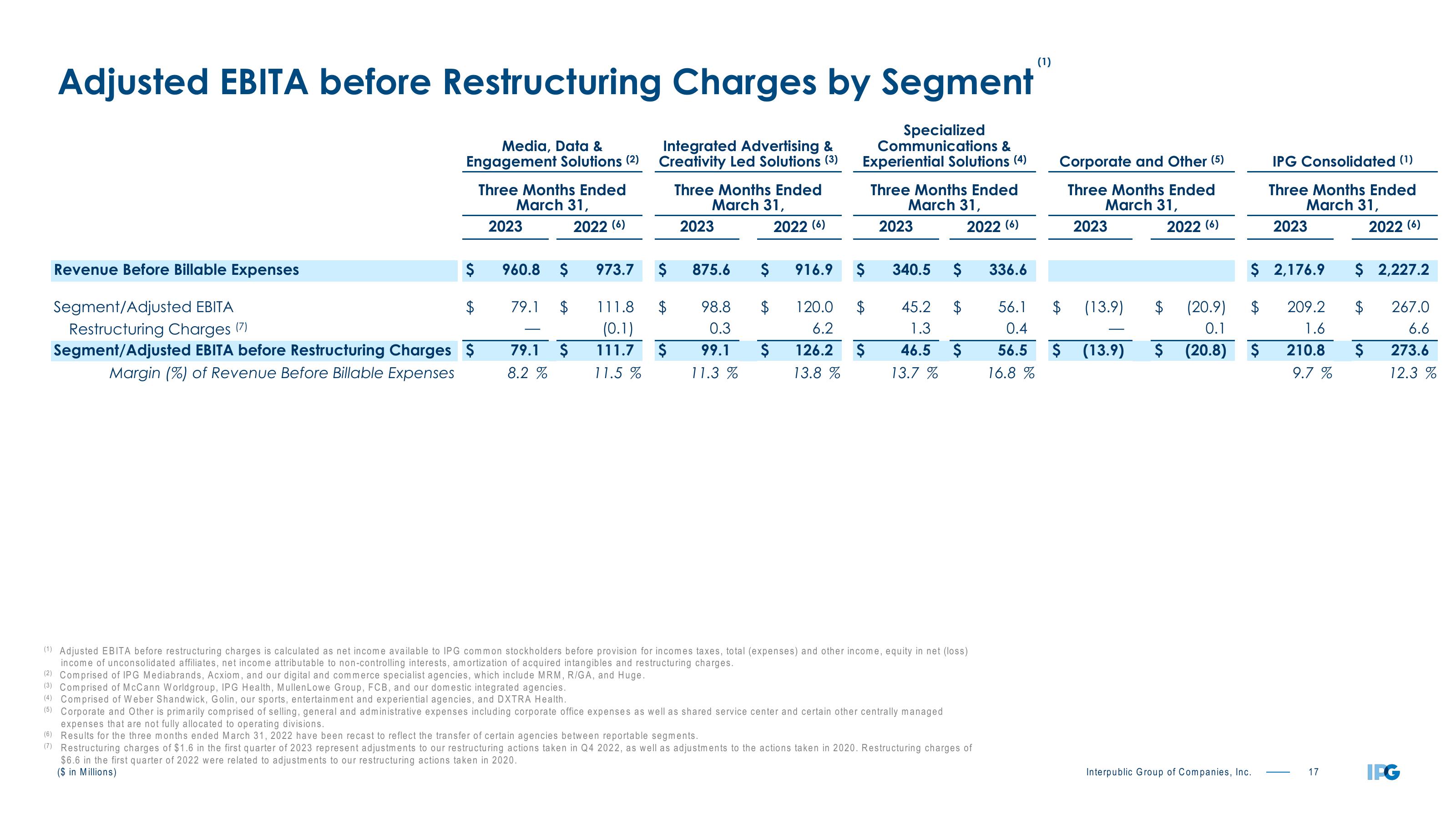

Adjusted EBITA before Restructuring Charges by Segment

Specialized

Communications &

Experiential Solutions (4)

Three Months Ended

March 31,

2022 (6)

Media, Data &

Engagement Solutions (2)

Three Months Ended

March 31,

2022 (6)

Revenue Before Billable Expenses

Segment/Adjusted EBITA

Restructuring Charges (7)

Segment/Adjusted EBITA before Restructuring Charges $

Margin (%) of Revenue Before Billable Expenses

$

2023

960.8

$ 973.7

79.1 $

79.1 $

8.2 %

Integrated Advertising &

Creativity Led Solutions (3)

$

$

111.8

(0.1)

111.7 $

11.5 %

Three Months Ended

March 31,

2022 (6)

2023

875.6 $ 916.9

$ 120.0

6.2

98.8

0.3

99.1

11.3%

$ 126.2 $

13.8 %

$

$

2023

340.5 $ 336.6

45.2

1.3

46.5 $

13.7 %

(1) Adjusted EBITA before restructuring charges is calculated as net income available to IPG common stockholders before provision for incomes taxes, total (expenses) and other income, equity in net (loss)

income of unconsolidated affiliates, net income attributable to non-controlling interests, amortization of acquired intangibles and restructuring charges.

(2) Comprised of IPG Mediabrands, Acxiom, and our digital and commerce specialist agencies, which include MRM, R/GA, and Huge.

(3) Comprised of McCann Worldgroup, IPG Health, MullenLowe Group, FCB, and our domestic integrated agencies.

(4) Comprised of Weber Shandwick, Golin, our sports, entertainment and experiential agencies, and DXTRA Health.

(5) Corporate and Other is primarily comprised of selling, general and administrative expenses including corporate office expenses as well as shared service center and certain other centrally managed

expenses that are not fully allocated to operating divisions.

(6) Results for the three months ended March 31, 2022 have been recast to reflect the transfer of certain agencies between reportable segments.

(7) Restructuring charges of $1.6 in the first quarter of 2023 represent adjustments to our restructuring actions taken in Q4 2022, as well as adjustments to the actions taken in 2020. Restructuring charges of

$6.6 in the first quarter of 2022 were related to adjustments to our restructuring actions taken in 2020.

in Millions)

(1)

Corporate and Other (5)

Three Months Ended

March 31,

2022 (6)

2023

56.1

0.4

56.5 $

16.8 %

$ (13.9) $

(13.9)

(20.9)

0.1

$ (20.8) $

IPG Consolidated (1)

Three Months Ended

March 31,

2022 (6)

$ 2,176.9 $ 2,227.2

$

267.0

6.6

273.6

12.3 %

Interpublic Group of Companies, Inc.

2023

209.2 $

1.6

210.8 $

9.7 %

|

17

IPGView entire presentation