J.P.Morgan 2Q23 Investor Results

JPMORGAN CHASE & CO.

CORPORATE

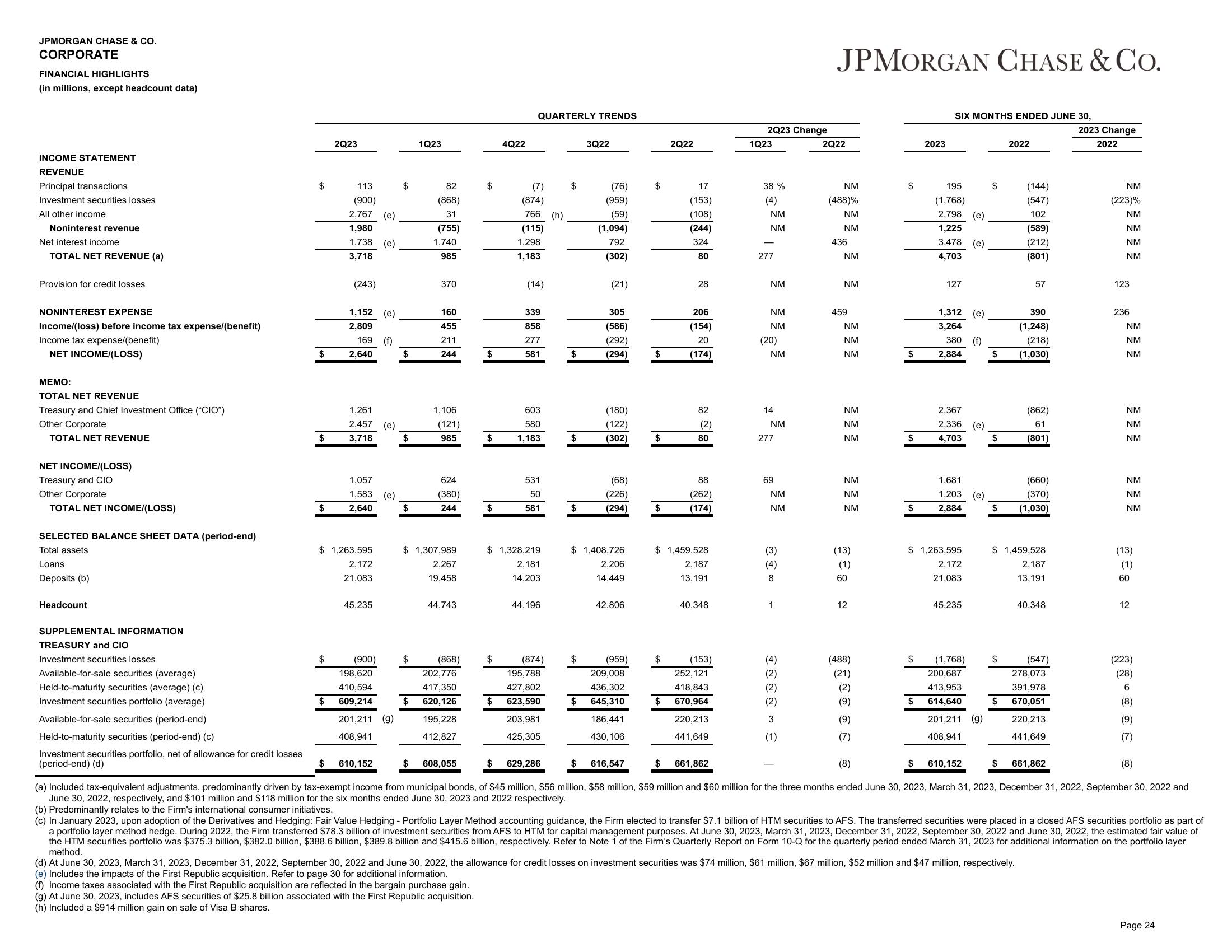

FINANCIAL HIGHLIGHTS

(in millions, except headcount data)

INCOME STATEMENT

REVENUE

Principal transactions

Investment securities losses

All other income

Noninterest revenue

Net interest income

TOTAL NET REVENUE (a)

Provision for credit losses

NONINTEREST EXPENSE

Income/(loss) before income tax expense/(benefit)

Income tax expense/(benefit)

NET INCOME/(LOSS)

MEMO:

TOTAL NET REVENUE

Treasury and Chief Investment Office ("CIO")

Other Corporate

TOTAL NET REVENUE

NET INCOME/(LOSS)

Treasury and CIO

Other Corporate

TOTAL NET INCOME/(LOSS)

SELECTED BALANCE SHEET DATA (period-end)

Total assets

Loans

Deposits (b)

Headcount

SUPPLEMENTAL INFORMATION

TREASURY and CIO

Investment securities losses

Available-for-sale securities (average)

Held-to-maturity securities (average) (c)

Investment securities portfolio (average)

Available-for-sale securities (period-end)

Held-to-maturity securities (period-end) (c)

Investment securities portfolio, net of allowance for credit losses

(period-end) (d)

$

$

$

$

$

$

2Q23

113

(900)

2,767 (e)

1,980

1,738 (e)

3,718

$

(243)

1,152 (e)

2,809

169 (f)

2,640

$ 1,263,595

2,172

21,083

1,261

2,457 (e)

3,718

1,057

1,583 (e)

2,640

45,235

(900)

198,620

410,594

609,214

201,211 (g)

408,941

$

610,152

$

$

$

1Q23

82

(868)

31

(755)

1,740

985

370

160

455

211

244

1,106

(121)

985

624

(380)

244

$1,307,989

2,267

19,458

44,743

(868)

202,776

417,350

$ 620,126

195,228

412,827

608,055

(**

$

$

$

$

QUARTERLY TRENDS

4Q22

$

(7)

(874)

766 (h)

(115)

1,298

1,183

(14)

339

858

277

581

603

580

1,183

$ 1,328,219

2,181

14,203

531

50

581

44,196

(874)

195,788

427,802

623,590

203,981

425,305

$

$

$

3Q22

(76)

(959)

(59)

(1,094)

792

(302)

(21)

305

(586)

(292)

(294)

(180)

(122)

(302)

(68)

(226)

(294)

$1,408,726

2,206

14,449

42,806

(959)

209,008

436,302

$ 645,310

186,441

430,106

616,547

$

$

2Q22

17

(153)

(108)

$

****

(244)

324

111

80

28

206

(154)

20

(174)

82

(2)

80

88

(262)

(174)

$ 1,459,528

2,187

13,191

40,348

(153)

252,121

418,843

$ 670,964

220,213

441,649

2Q23 Change

1Q23

38 %

(4)

NM

NM

277

NM

NM

NM

(20)

NM

14

NM

277

69

NM

NM

(3)

(4)

8

1

(4)

(2)

(2)

(2)

3

€

JPMORGAN CHASE & CO.

2Q22

NM

(488)%

NM

NM

436

NM

NM

459

NM

NM

NM

NM

NM

NM

NM

NM

NM

(13)

(1)

60

12

(488)

(21)

(2)

(9)

(9)

(7)

$

$

$

$

$

2023

$

SIX MONTHS ENDED JUNE 30,

195

(1,768)

2,798 (e)

1,225

3,478

4,703

127

1,312 (e)

3,264

380

2,884

$1,263,595

2,172

21,083

1,681

1,203

2,884

(e)

2,367

2,336 (e)

4,703

45,235

(f)

(e)

(1,768)

200,687

413,953

614,640

201,211 (9)

408,941

$

$

$

$

2022

$

(144)

(547)

102

(589)

(212)

(801)

57

2523

390

(1,248)

(218)

(1,030)

$ 1,459,528

2,187

13,191

(d) At June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022 and June 30, 2022, the allowance for credit losses on investment securities was $74 million, $61 million, $67 million, $52 million and $47 million, respectively.

(e) Includes the impacts of the First Republic acquisition. Refer to page 30 for additional information.

(f) Income taxes associated with the First Republic acquisition are reflected in the bargain purchase gain.

(g) At June 30, 2023, includes AFS securities of $25.8 billion associated with the First Republic acquisition.

(h) Included a $914 million gain on sale of Visa B shares.

(862)

61

(801)

(660)

(370)

(1,030)

40,348

(547)

278,073

391,978

670,051

220,213

441,649

2023 Change

2022

NM

(223)%

NM

NM

NM

NM

123

236

NM

NM

NM

NM

NM

NM

NM

NM

NM

$ 629,286

$ 661,862

(8)

$

610,152

661,862

(a) Included tax-equivalent adjustments, predominantly driven by tax-exempt income from municipal bonds, of $45 million, $56 million, $58 million, $59 million and $60 million for the three months ended June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022 and

June 30, 2022, respectively, and $101 million and $118 million for the six months ended June 30, 2023 and 2022 respectively.

(b) Predominantly relates to the Firm's international consumer initiatives.

(c) In January 2023, upon adoption of the Derivatives and Hedging: Fair Value Hedging - Portfolio Layer Method accounting guidance, the Firm elected to transfer $7.1 billion of HTM securities to AFS. The transferred securities were placed in a closed AFS securities portfolio as part of

a portfolio layer method hedge. During 2022, the Firm transferred $78.3 billion of investment securities from AFS to HTM for capital management purposes. At June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022 and June 30, 2022, the estimated fair value of

the HTM securities portfolio was $375.3 billion, $382.0 billion, $388.6 billion, $389.8 billion and $415.6 billion, respectively. Refer to Note 1 of the Firm's Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2023 for additional information on the portfolio layer

method.

(13)

(1)

60

12

(223)

(28)

6

(8)

(9)

(7)

(8)

Page 24View entire presentation