Markforged Results Presentation Deck

Financial Summary

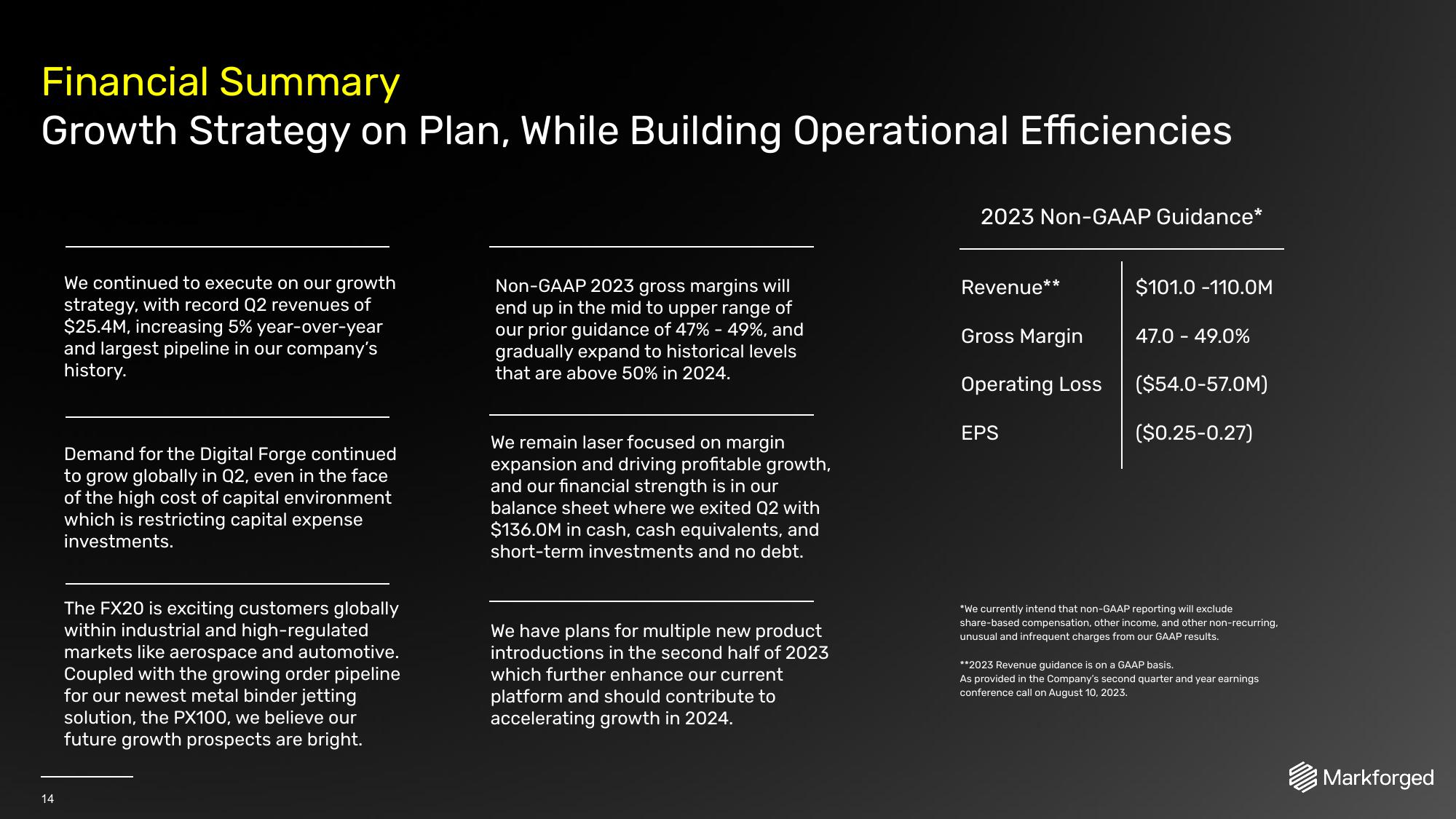

Growth Strategy on Plan, While Building Operational Efficiencies

14

We continued to execute on our growth

strategy, with record Q2 revenues of

$25.4M, increasing 5% year-over-year

and largest pipeline in our company's

history.

Demand for the Digital Forge continued

to grow globally in Q2, even in the face

of the high cost of capital environment

which is restricting capital expense

investments.

The FX20 is exciting customers globally

within industrial and high-regulated

markets like aerospace and automotive.

Coupled with the growing order pipeline

for our newest metal binder jetting

solution, the PX100, we believe our

future growth prospects are bright.

Non-GAAP 2023 gross margins will

end up in the mid to upper range of

our prior guidance of 47% -49%, and

gradually expand to historical levels

that are above 50% in 2024.

We remain laser focused on margin

expansion and driving profitable growth,

and our financial strength is in our

balance sheet where we exited Q2 with

$136.0M in cash, cash equivalents, and

short-term investments and no debt.

We have plans for multiple new product

introductions in the second half of 2023

which further enhance our current

platform and should contribute to

accelerating growth in 2024.

2023 Non-GAAP Guidance*

Revenue**

Gross Margin

Operating Loss

EPS

$101.0 -110.0M

47.0 - 49.0%

($54.0-57.0M)

($0.25-0.27)

*We currently intend that non-GAAP reporting will exclude

share-based compensation, other income, and other non-recurring.

unusual and infrequent charges from our GAAP results.

**2023 Revenue guidance is on a GAAP basis.

As provided in the Company's second quarter and year earnings

conference call on August 10, 2023.

MarkforgedView entire presentation