DraftKings Investor Day Presentation Deck

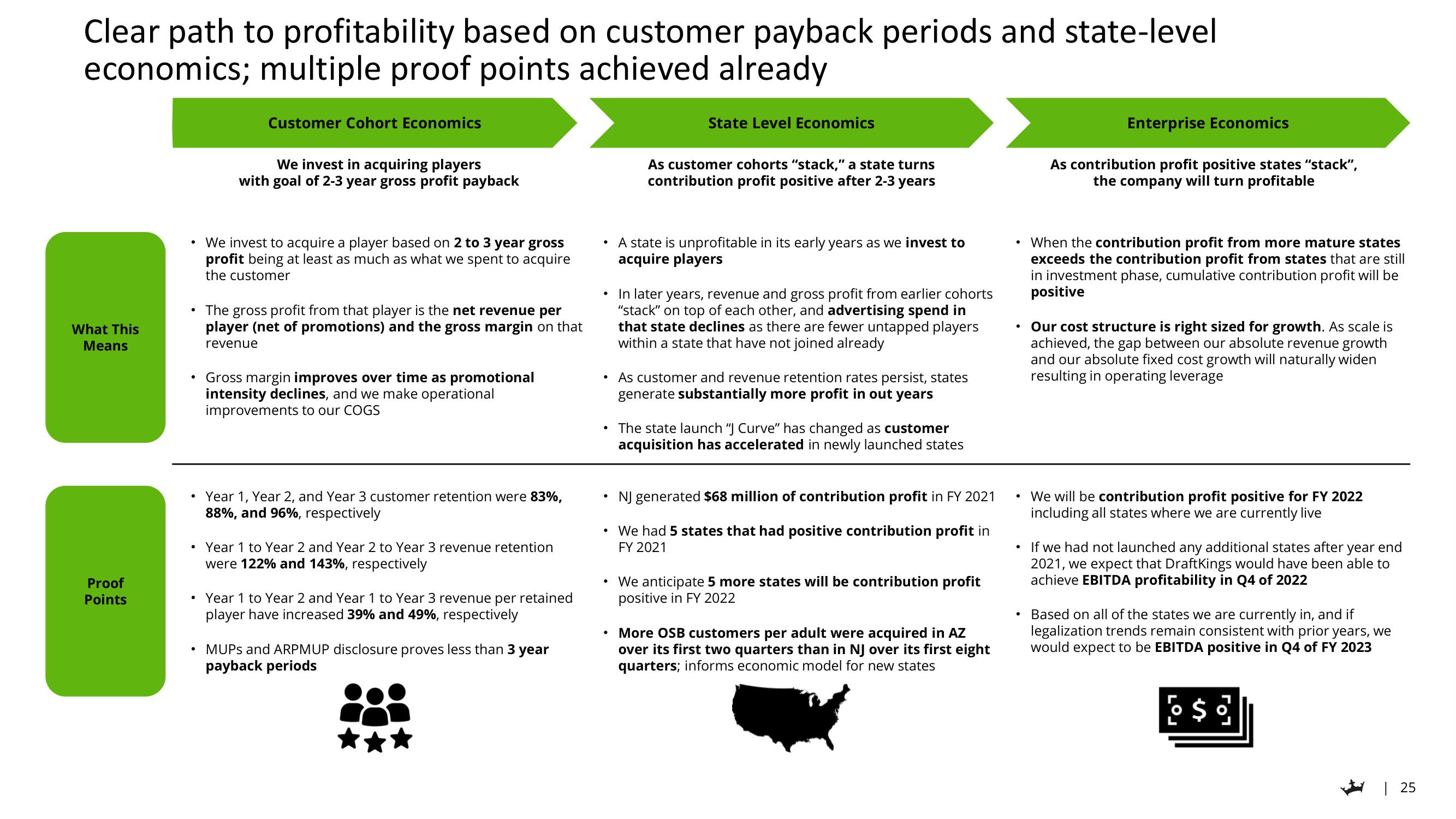

Clear path to profitability based on customer payback periods and state-level

economics; multiple proof points achieved already

What This

Means

Proof

Points

●

●

Customer Cohort Economics

We invest in acquiring players

with goal of 2-3 year gross profit payback

• The gross profit from that player is the net revenue per

player (net of promotions) and the gross margin on that

revenue

●

We invest to acquire a player based on 2 to 3 year gross

profit being at least as much as what we spent to acquire

the customer

Gross margin improves over time as promotional

intensity declines, and we make operational

improvements to our COGS

Year 1, Year 2, and Year 3 customer retention were 83%,

88%, and 96%, respectively

• Year 1 to Year 2 and Year 2 to Year 3 revenue retention

were 122% and 143%, respectively

Year 1 to Year 2 and Year 1 to Year 3 revenue per retained

player have increased 39% and 49%, respectively

• MUPS and ARPMUP disclosure proves less than 3 year

payback periods

●

• A state is unprofitable in its early years as we invest to

acquire players

●

●

●

●

●

State Level Economics

●

As customer cohorts "stack," a state turns

contribution profit positive after 2-3 years

In later years, revenue and gross profit from earlier cohorts

"stack" on top of each other, and advertising spend in

that state declines as there are fewer untapped players

within a state that have not joined already

As customer and revenue retention rates persist, states

generate substantially more profit in out years

The state launch "J Curve" has changed as customer

acquisition has accelerated in newly launched states

NJ generated $68 million of contribution profit in FY 2021

We had 5 states that had positive contribution profit in

FY 2021

We anticipate 5 more states will be contribution profit

positive in FY 2022

More OSB customers per adult were acquired in AZ

over its first two quarters than in NJ over its first eight

quarters; informs economic model for new states

Enterprise Economics

As contribution profit positive states "stack",

the company will turn profitable

• When the contribution profit from more mature states

exceeds the contribution profit from states that are still

in investment phase, cumulative contribution profit will be

positive

• Our cost structure is right sized for growth. As scale is

achieved, the gap between our absolute revenue growth

and our absolute fixed cost growth will naturally widen

resulting in operating leverage

• We will be contribution profit positive for FY 2022

including all states where we are currently live

If we had not launched any additional states after year end

2021, we expect that DraftKings would have been able to

achieve EBITDA profitability in Q4 of 2022

• Based on all of the states we are currently in, and if

legalization trends remain consistent with prior years, we

would expect to be EBITDA positive in Q4 of FY 2023

| 25View entire presentation