Marti SPAC Presentation Deck

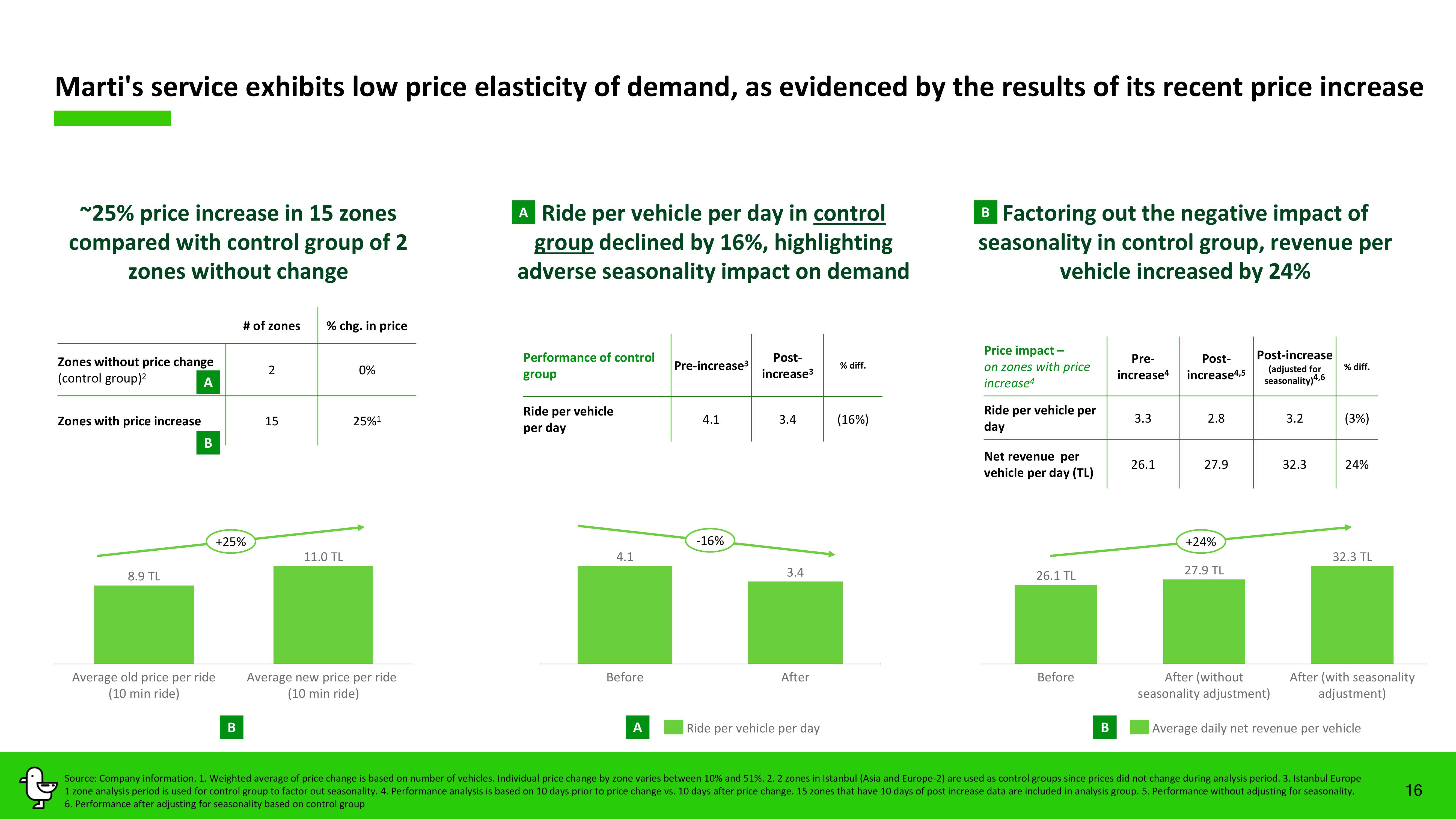

Marti's service exhibits low price elasticity of demand, as evidenced by the results of its recent price increase

~25% price increase in 15 zones

compared with control group of 2

zones without change

Zones without price change

(control group)²

A

Zones with price increase

8.9 TL

B

+25%

Average old price per ride

(10 min ride)

# of zones % chg. in price

B

2

15

11.0 TL

0%

25%¹

Average new price per ride

(10 min ride)

A Ride per vehicle per day in control

group declined by 16%, highlighting

adverse seasonality impact on demand

Performance of control

group

Ride per vehicle

per day

4.1

Before

A

Pre-increase³

4.1

-16%

Post-

increase³

3.4

3.4

After

Ride per vehicle per day

% diff.

(16%)

B Factoring out the negative impact of

seasonality in control group, revenue per

vehicle increased by 24%

Price impact-

on zones with price

increase4

Ride per vehicle per

day

Net revenue per

vehicle per day (TL)

26.1 TL

Before

B

Pre-

Post-

increase4 increase4,5

3.3

26.1

2.8

27.9

+24%

27.9 TL

Post-increase

(adjusted for

seasonality) 4,6

3.2

32.3

% diff.

(3%)

24%

32.3 TL

After (without

seasonality adjustment)

Average daily net revenue per vehicle

After (with seasonality

adjustment)

Source: Company information. 1. Weighted average of price change is based on number of vehicles. Individual price change by zone varies between 10% and 51%. 2. 2 zones in Istanbul (Asia and Europe-2) are used as control groups since prices did not change during analysis period. 3. Istanbul Europe

1 zone analysis period is used for control group to factor out seasonality. 4. Performance analysis is based on 10 days prior to price change vs. 10 days after price change. 15 zones that have 10 days of post increase data are included in analysis group. 5. Performance without adjusting for seasonality.

6. Performance after adjusting for seasonality based on control group

16View entire presentation