Ford Results Presentation Deck

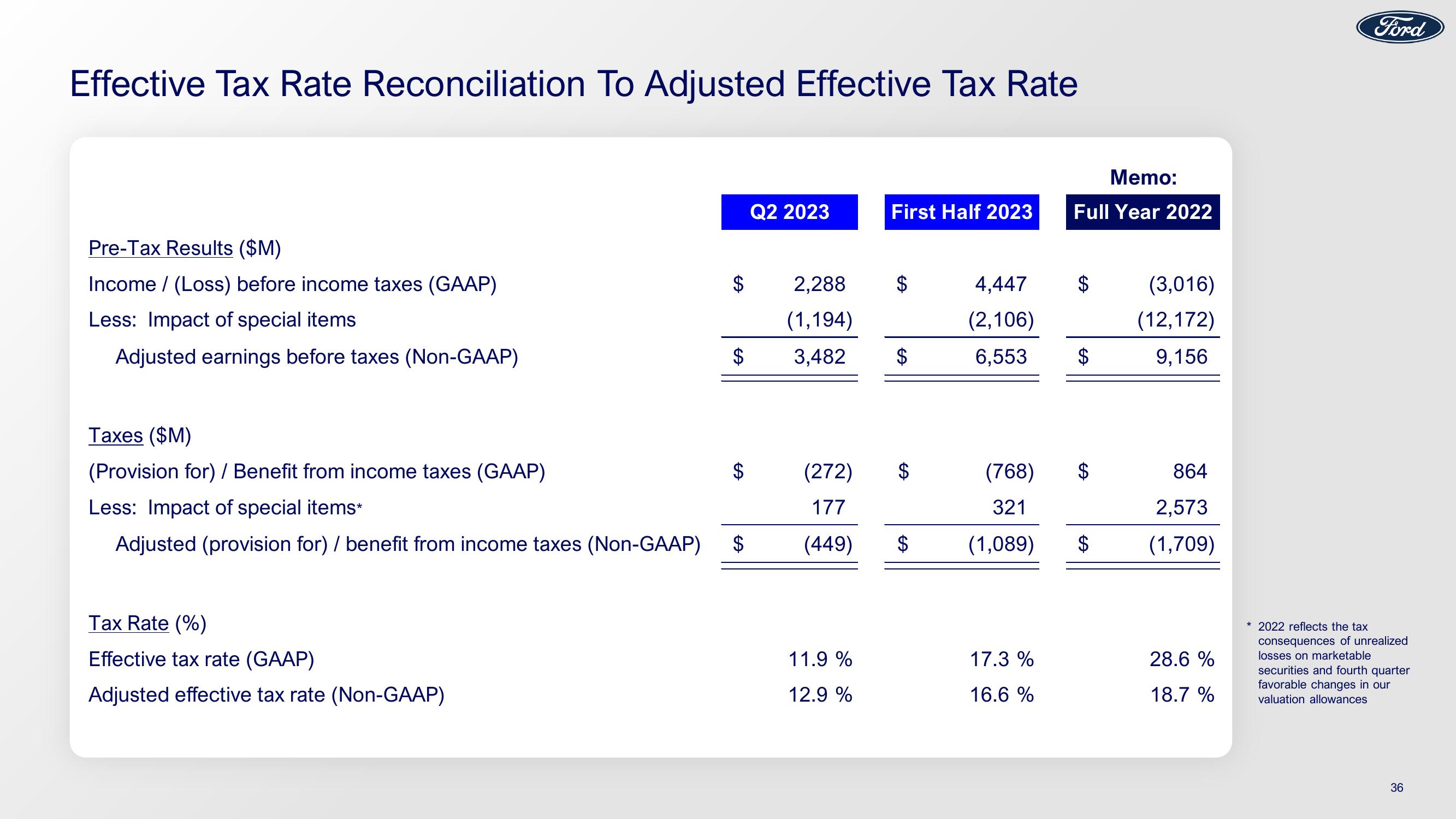

Effective Tax Rate Reconciliation To Adjusted Effective Tax Rate

Pre-Tax Results ($M)

Income / (Loss) before income taxes (GAAP)

Less: Impact of special items

Adjusted earnings before taxes (Non-GAAP)

Taxes ($M)

(Provision for) / Benefit from income taxes (GAAP)

Less: Impact of special items*

Adjusted (provision for) / benefit from income taxes (Non-GAAP)

Tax Rate (%)

Effective tax rate (GAAP)

Adjusted effective tax rate (Non-GAAP)

$

$

A

$

Q2 2023

2,288

(1,194)

3,482

(272)

177

(449)

11.9 %

12.9 %

First Half 2023

$

$

$

$

(768)

321

(1,089)

Memo:

Full Year 2022

4,447

(2,106)

6,553 $

17.3 %

16.6 %

$

$

$

(3,016)

(12,172)

9,156

864

2,573

(1,709)

28.6%

18.7 %

Ford

2022 reflects the tax

consequences of unrealized

losses on marketable

securities and fourth quarter

favorable changes in our

valuation allowances

36View entire presentation