Pershing Square Activist Presentation Deck

III. Pershing's Proposal to McDonald's:

McOpCo IPO

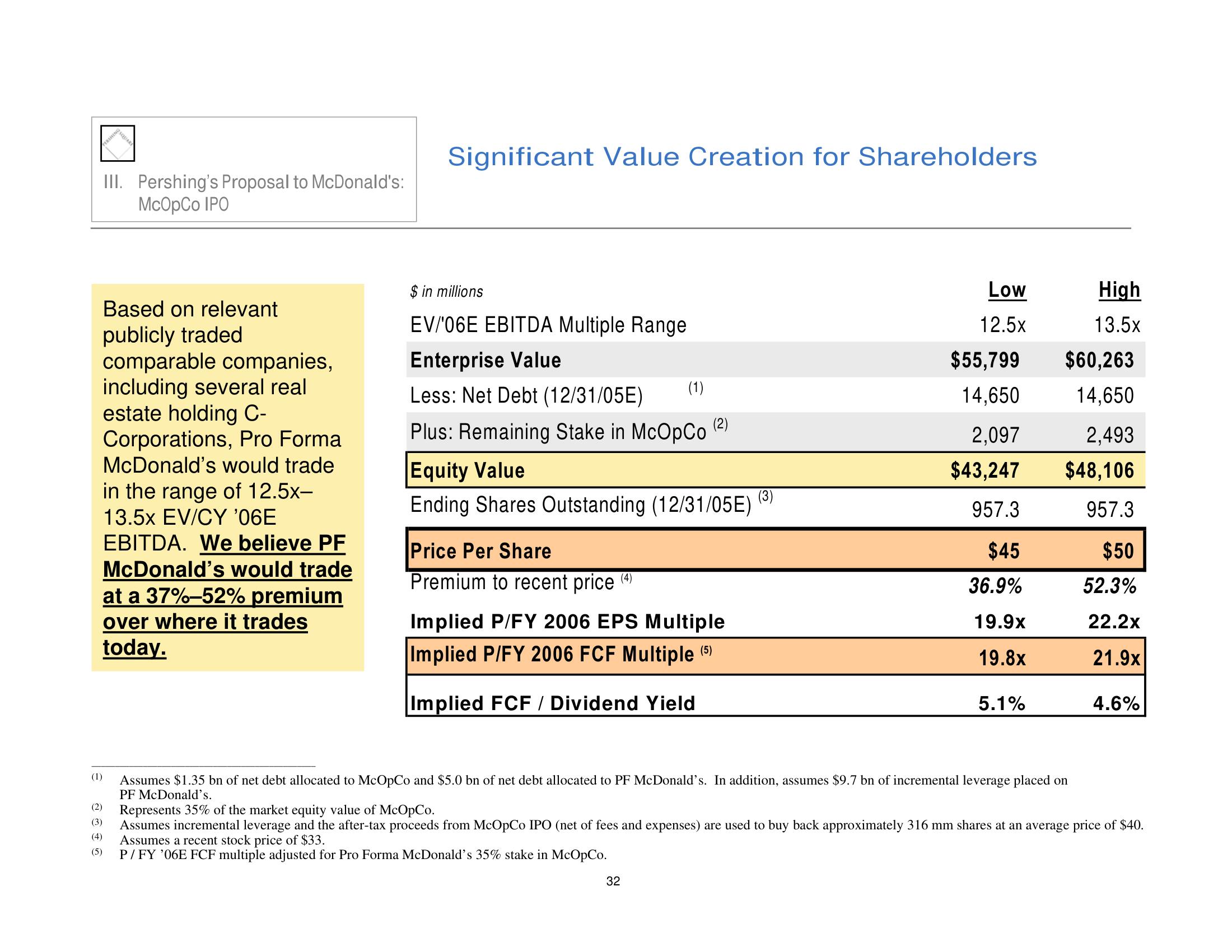

Based on relevant

publicly traded

comparable companies,

including several real

estate holding C-

Corporations, Pro Forma

McDonald's would trade

in the range of 12.5x-

13.5x EV/CY '06E

EBITDA. We believe PF

McDonald's would trade

at a 37%-52% premium

over where it trades

today.

(1)

Significant Value Creation for Shareholders

$ in millions

EV/06E EBITDA Multiple Range

Enterprise Value

Less: Net Debt (12/31/05E) (1)

Plus: Remaining Stake in McOpCo

Equity Value

Ending Shares Outstanding (12/31/05E)

Price Per Share

Premium to recent price

(2)

Implied P/FY 2006 EPS Multiple

Implied P/FY 2006 FCF Multiple (5)

Implied FCF / Dividend Yield

(3)

32

Low

12.5x

$55,799

14,650

2,097

$43,247

957.3

$45

36.9%

19.9x

19.8x

5.1%

High

13.5x

$60,263

14,650

Assumes $1.35 bn of net debt allocated to McOpCo and $5.0 bn of net debt allocated to PF McDonald's. In addition, assumes $9.7 bn of incremental leverage placed on

PF McDonald's.

2,493

$48,106

957.3

$50

52.3%

22.2x

21.9x

4.6%

(2) Represents 35% of the market equity value of McOpCo.

(3)

(4)

Assumes incremental leverage and the after-tax proceeds from McOpCo IPO (net of fees and expenses) are used to buy back approximately 316 mm shares at an average price of $40.

Assumes a recent stock price of $33.

(5)

P/FY '06E FCF multiple adjusted for Pro Forma McDonald's 35% stake in McOpCo.View entire presentation