Apollo Global Management Investor Day Presentation Deck

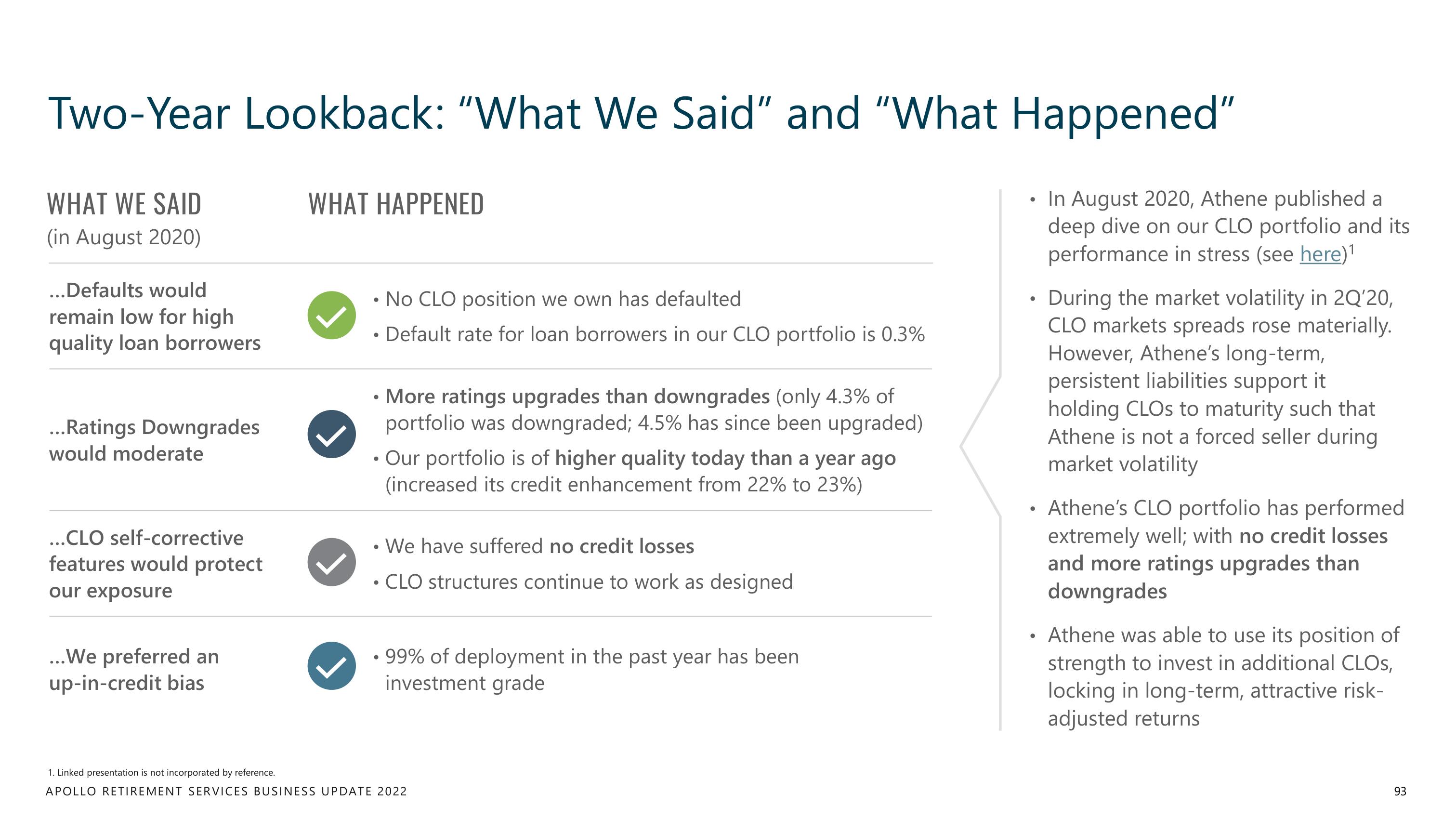

Two-Year Lookback: "What We Said" and "What Happened"

WHAT WE SAID

(in August 2020)

...Defaults would

remain low for high

quality loan borrowers

...Ratings Downgrades

would moderate

...CLO self-corrective

features would protect

our exposure

...We preferred an

up-in-credit bias

WHAT HAPPENED

• No CLO position we own has defaulted.

• Default rate for loan borrowers in our CLO portfolio is 0.3%

More ratings upgrades than downgrades (only 4.3% of

portfolio was downgraded; 4.5% has since been upgraded)

Our portfolio is of higher quality today than a year ago

(increased its credit enhancement from 22% to 23%)

We have suffered no credit losses

CLO structures continue to work as designed

• 99% of deployment in the past year has been.

investment grade

1. Linked presentation is not incorporated by reference.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

●

●

●

●

In August 2020, Athene published a

deep dive on our CLO portfolio and its

performance in stress (see here)¹

During the market volatility in 2Q'20,

CLO markets spreads rose materially.

However, Athene's long-term,

persistent liabilities support it

holding CLOs to maturity such that

Athene is not a forced seller during

market volatility

Athene's CLO portfolio has performed

extremely well; with no credit losses

and more ratings upgrades than

downgrades

Athene was able to use its position of

strength to invest in additional CLOS,

locking in long-term, attractive risk-

adjusted returns

93View entire presentation