PropertyGuru SPAC Presentation Deck

Transaction Overview

37

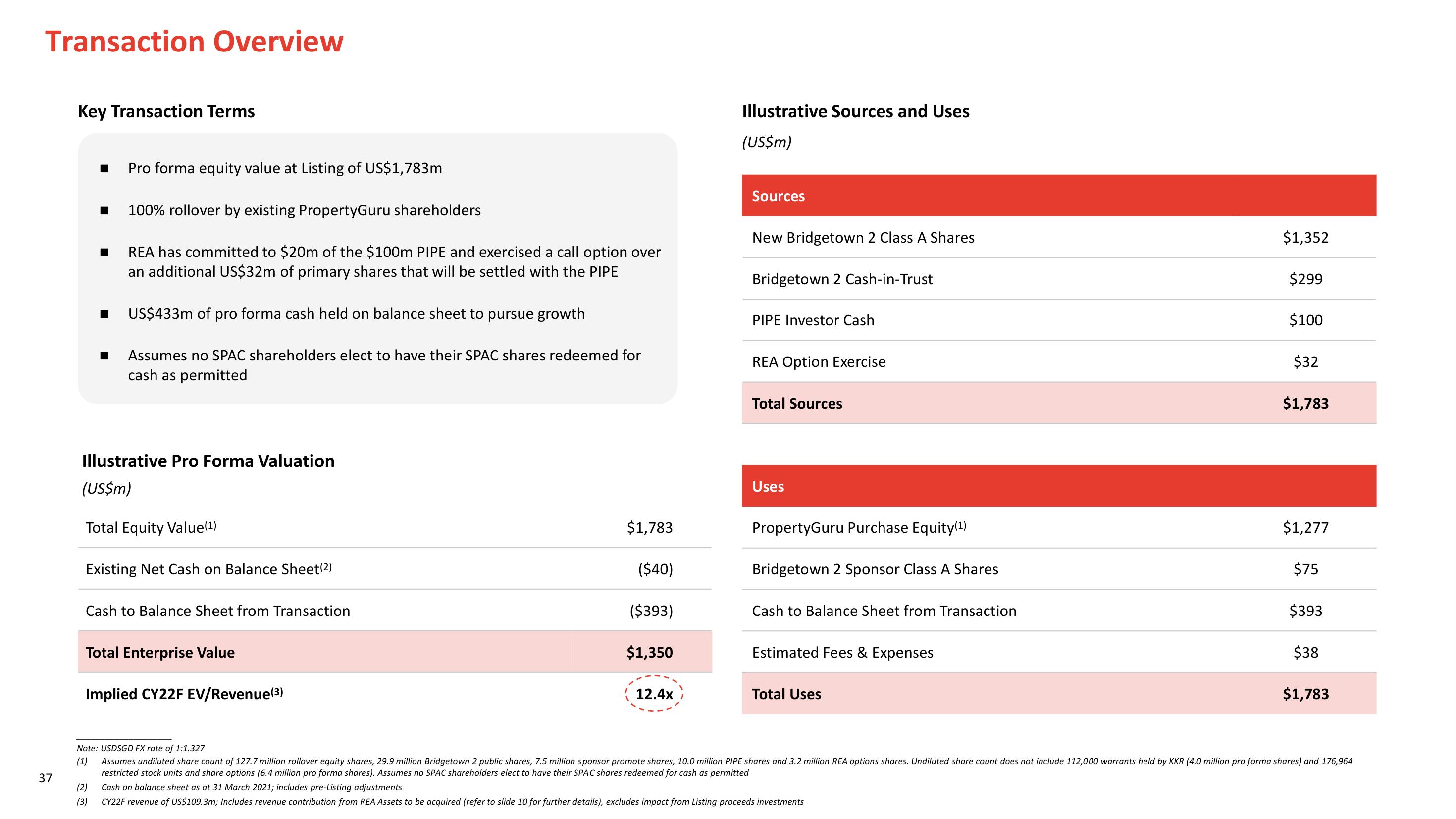

Key Transaction Terms

Pro forma equity value at Listing of US$1,783m

100% rollover by existing PropertyGuru shareholders

REA has committed to $20m of the $100m PIPE and exercised a call option over

an additional US$32m of primary shares that will be settled with the PIPE

US$433m of pro forma cash held on balance sheet to pursue growth

Assumes no SPAC shareholders elect to have their SPAC shares redeemed for

cash as permitted

Illustrative Pro Forma Valuation

(US$m)

Total Equity Value(¹)

Existing Net Cash on Balance Sheet(2)

Cash to Balance Sheet from Transaction

Total Enterprise Value

Implied CY22F EV/Revenue (3)

(2)

(3)

$1,783

($40)

($393)

$1,350

12.4x

Illustrative Sources and Uses

(US$m)

Sources

New Bridgetown 2 Class A Shares

Bridgetown 2 Cash-in-Trust

PIPE Investor Cash

REA Option Exercise

Total Sources

Uses

PropertyGuru Purchase Equity(1)

Bridgetown 2 Sponsor Class A Shares

Cash to Balance Sheet from Transaction

Estimated Fees & Expenses

Total Uses

$1,352

$299

$100

$32

$1,783

$1,277

$75

$393

$38

$1,783

Note: USDSGD FX rate of 1:1.327

(1)

Assumes undiluted share count of 127.7 million rollover equity shares, 29.9 million Bridgetown 2 public shares, 7.5 million sponsor promote shares, 10.0 million PIPE shares and 3.2 million REA options shares. Undiluted share count does not include 112,000 warrants held by KKR (4.0 million pro forma shares) and 176,964

restricted stock units and share options (6.4 million pro forma shares). Assumes no SPAC shareholders elect to have their SPAC shares redeemed for cash as permitted

Cash on balance sheet as at 31 March 2021; includes pre-Listing adjustments

CY22F revenue of US$109.3m; Includes revenue contribution from REA Assets to be acquired (refer to slide 10 for further details), excludes impact from Listing proceeds investmentsView entire presentation