Trian Partners Activist Presentation Deck

Confidential-Not for Reproduction or Distribution

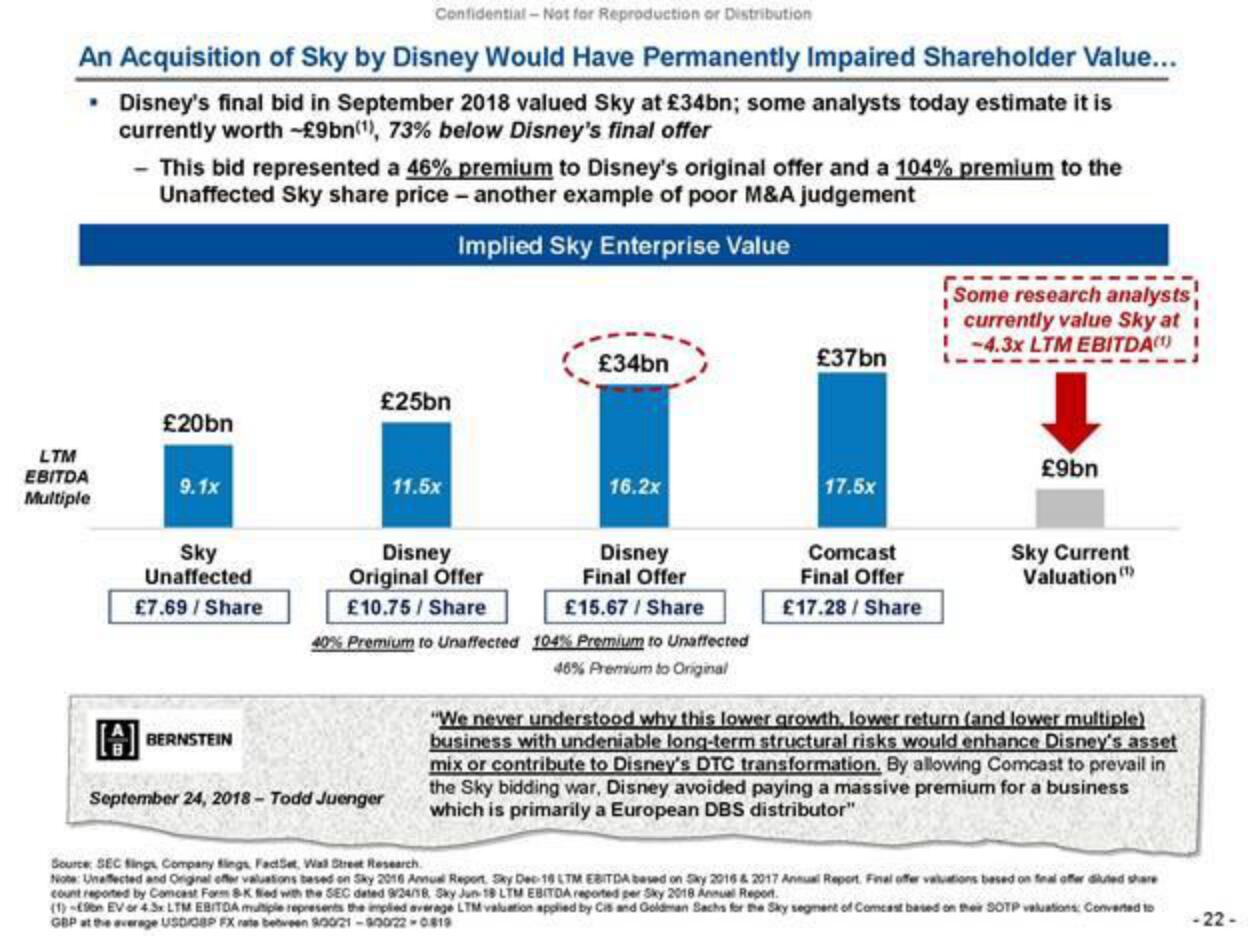

An Acquisition of Sky by Disney Would Have Permanently Impaired Shareholder Value...

• Disney's final bid in September 2018 valued Sky at £34bn; some analysts today estimate it is

currently worth -£9bn(¹), 73% below Disney's final offer

LTM

EBITDA

Multiple

- This bid represented a 46% premium to Disney's original offer and a 104% premium to the

Unaffected Sky share price - another example of poor M&A judgement

Implied Sky Enterprise Value

£20bn

9.1x

Sky

Unaffected

£7.69 / Share

BERNSTEIN

£25bn

11.5x

Disney

Original Offer

September 24, 2018 - Todd Juenger

£34bn

16.2x

Disney

Final Offer

£15.67 / Share

£10.75/Share

40% Premium to Unaffected 104% Premium to Unaffected

46% Premium to Original

£37bn

17.5x

Comcast

Final Offer

£17.28/Share

Some research analysts

i currently value Sky at i

-4.3x LTM EBITDA)

£9bn

Sky Current

Valuation (¹)

"We never understood why this lower growth, lower return (and lower multiple)

business with undeniable long-term structural risks would enhance Disney's asset

mix or contribute to Disney's DTC transformation. By allowing Comcast to prevail in

the Sky bidding war, Disney avoided paying a massive premium for a business

which is primarily a European DBS distributor"

Source SEC fings Company fings, FactSet, Wall Street Research.

Note: Unaffected and Original offer valuations based on Sky 2016 Annual Report Sky Dec-18 LTM EBITDA based on Sky 2016 & 2017 Annual Report. Final offer valuations based on final offer diluted share

count reported by Comcast Form 8-K fied with the SEC dated 9/24/18 Sky Jun-19 LTM EBITDA reported per Sky 2018 Annual Report.

(1) -

EV or 4.3x LTM EBITDA multiple represents the implied average LTM valuation applied by Cis and Goldman Sachs for the Sky segment of Comcast based on their SOTP valuations Converted to

GBP at the average USD/GBP FX rate between 90021-90022-0819

-22-View entire presentation