Zegna Results Presentation Deck

3Q 2022 GROUP REVENUES BY CHANNEL

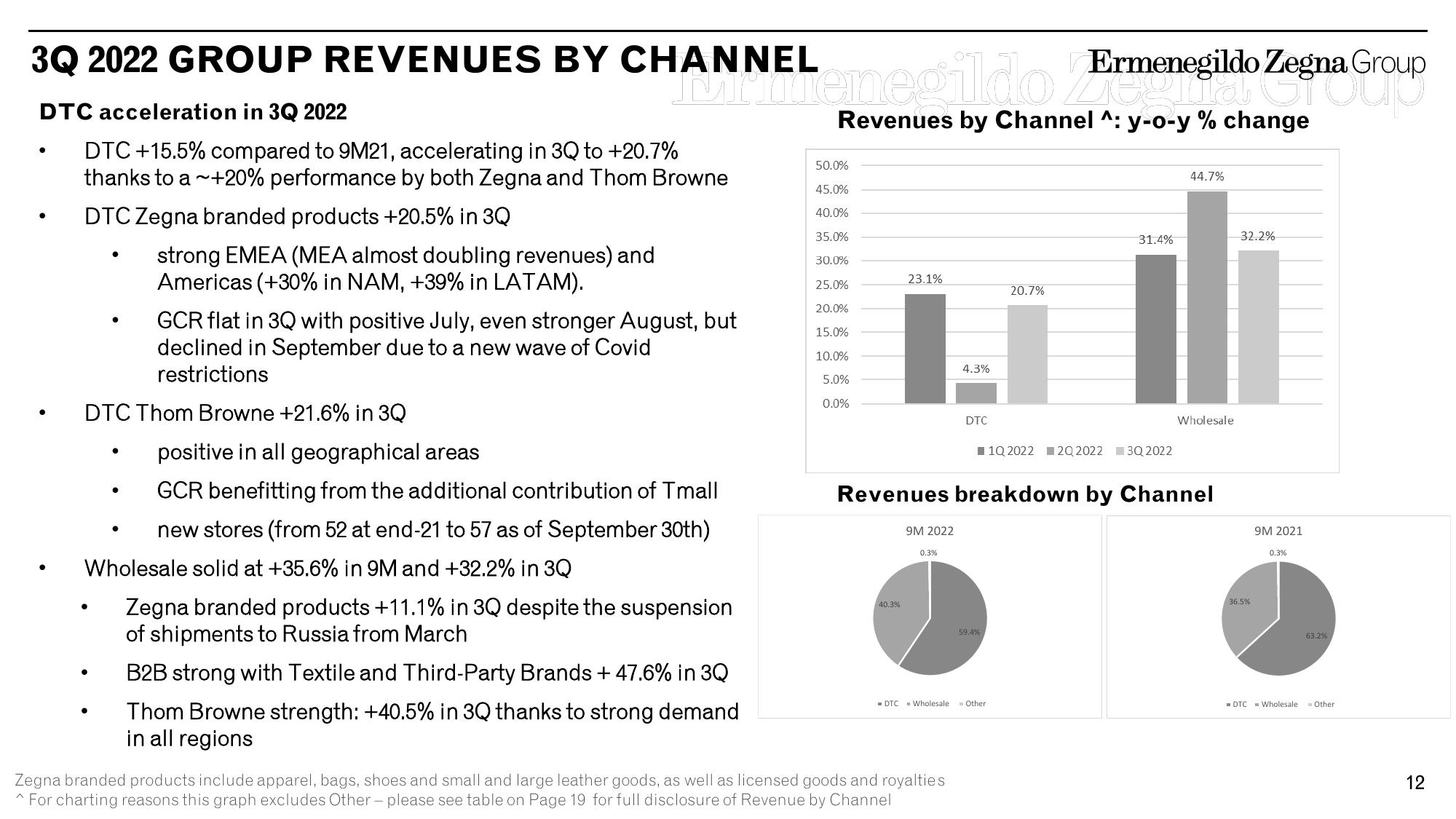

DTC acceleration in 3Q 2022

DTC +15.5% compared to 9M21, accelerating in 3Q to +20.7%

thanks to a ~+20% performance by both Zegna and Thom Browne

DTC Zegna branded products +20.5% in 3Q

●

●

DTC Thom Browne +21.6% in 3Q

●

strong EMEA (MEA almost doubling revenues) and

Americas (+30% in NAM, +39% in LATAM).

●

GCR flat in 3Q with positive July, even stronger August, but

declined in September due to a new wave of Covid

restrictions

Minulenegildo Ermenegildo Zegna Group

egna Group

Revenues by Channel ^: y-o-y % change

Wholesale solid at +35.6% in 9M and +32.2% in 3Q

positive in all geographical areas

GCR benefitting from the additional contribution of Tmall

new stores (from 52 at end-21 to 57 as of September 30th)

Zegna branded products +11.1% in 3Q despite the suspension

of shipments to Russia from March

B2B strong with Textile and Third-Party Brands + 47.6% in 3Q

Thom Browne strength: +40.5% in 3Q thanks to strong demand

in all regions

50.0%

45.0%

40.0%

35.0%

30.0%

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

23.1%

40.3%

9M 2022

0.3%

DTC Wholesale

4.3%

Zegna branded products include apparel, bags, shoes and small and large leather goods, as well as licensed goods and royalties

^ For charting reasons this graph excludes Other - please see table on Page 19 for full disclosure of Revenue by Channel

DTC

Revenues breakdown by Channel

59.4%

20.7%

Other

31.4%

1Q 2022 2Q 2022 3Q 2022

44.7%

Wholesale

32.2%

36.5%

9M 2021

0.3%

DTC Wholesale

63.2%

Other

12View entire presentation