Terran Orbital SPAC Presentation Deck

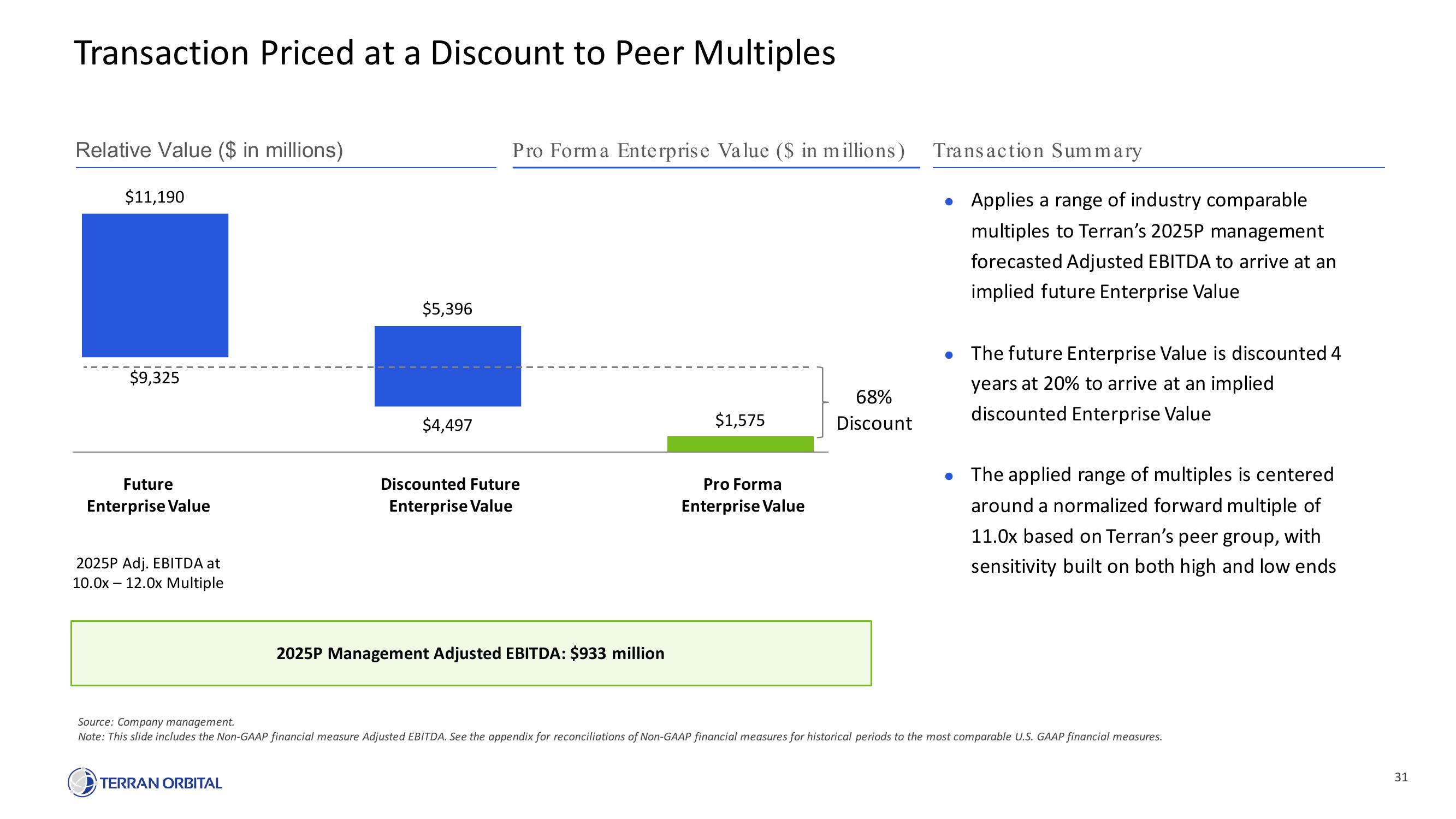

Transaction Priced at a Discount to Peer Multiples

Relative Value ($ in millions)

$11,190

$9,325

Future

Enterprise Value

2025P Adj. EBITDA at

10.0x - 12.0x Multiple

$5,396

TERRAN ORBITAL

$4,497

Pro Forma Enterprise Value ($ in millions)

Discounted Future

Enterprise Value

2025P Management Adjusted EBITDA: $933 million

$1,575

Pro Forma

Enterprise Value

68%

Discount

Transaction Summary

• Applies a range of industry comparable

multiples to Terran's 2025P management

forecasted Adjusted EBITDA to arrive at an

implied future Enterprise Value

●

The future Enterprise Value is discounted 4

years at 20% to arrive at an implied

discounted Enterprise Value

The applied range of multiples is centered

around a normalized forward multiple of

11.0x based on Terran's peer group, with

sensitivity built on both high and low ends

Source: Company management.

Note: This slide includes the Non-GAAP financial measure Adjusted EBITDA. See the appendix for reconciliations of Non-GAAP financial measures for historical periods to the most comparable U.S. GAAP financial measures.

31View entire presentation