AngloAmerican Results Presentation Deck

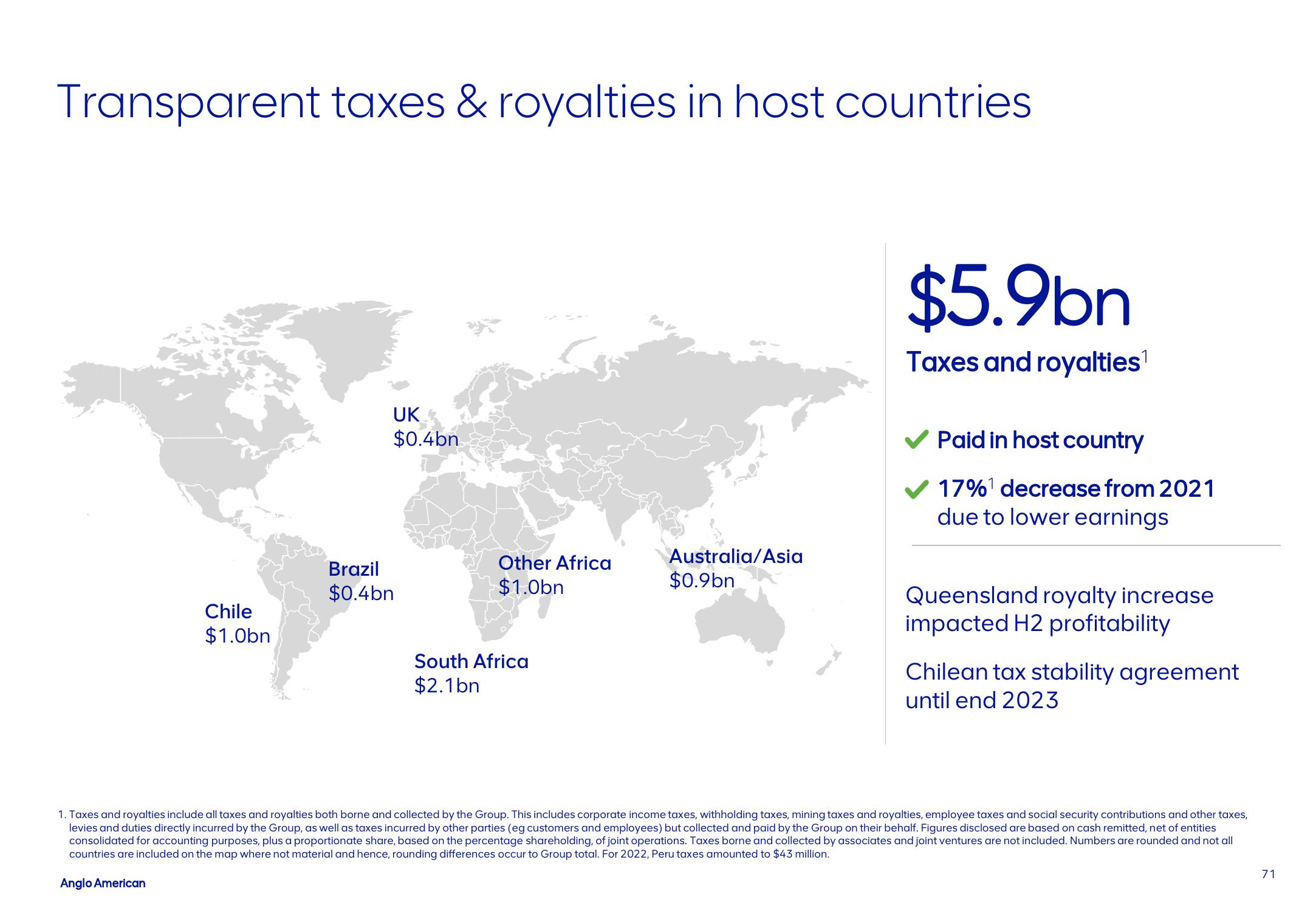

Transparent taxes & royalties in host countries

Chile

$1.0bn

UK

$0.4bn

Brazil

$0.4bn

Other Africa

$1.0bn

South Africa

$2.1bn

Australia/Asia

$0.9bn

$5.9bn

Taxes and royalties¹

Paid in host country

17%¹ decrease from 2021

due to lower earnings

Queensland royalty increase

impacted H2 profitability

Chilean tax stability agreement

until end 2023

1. Taxes and royalties include all taxes and royalties both borne and collected by the Group. This includes corporate income taxes, withholding taxes, mining taxes and royalties, employee taxes and social security contributions and other taxes,

levies and duties directly incurred by the Group, as well as taxes incurred by other parties (eg customers and employees) but collected and paid by the Group on their behalf. Figures disclosed are based on cash remitted, net of entities

consolidated for accounting purposes, plus a proportionate share, based on the percentage shareholding, of joint operations. Taxes borne and collected by associates and joint ventures are not included. Numbers are rounded and not all

countries are included on the map where not material and hence, rounding differences occur to Group total. For 2022, Peru taxes amounted to $43 million.

Anglo American

71View entire presentation