Elms SPAC Presentation Deck

Transaction Summary

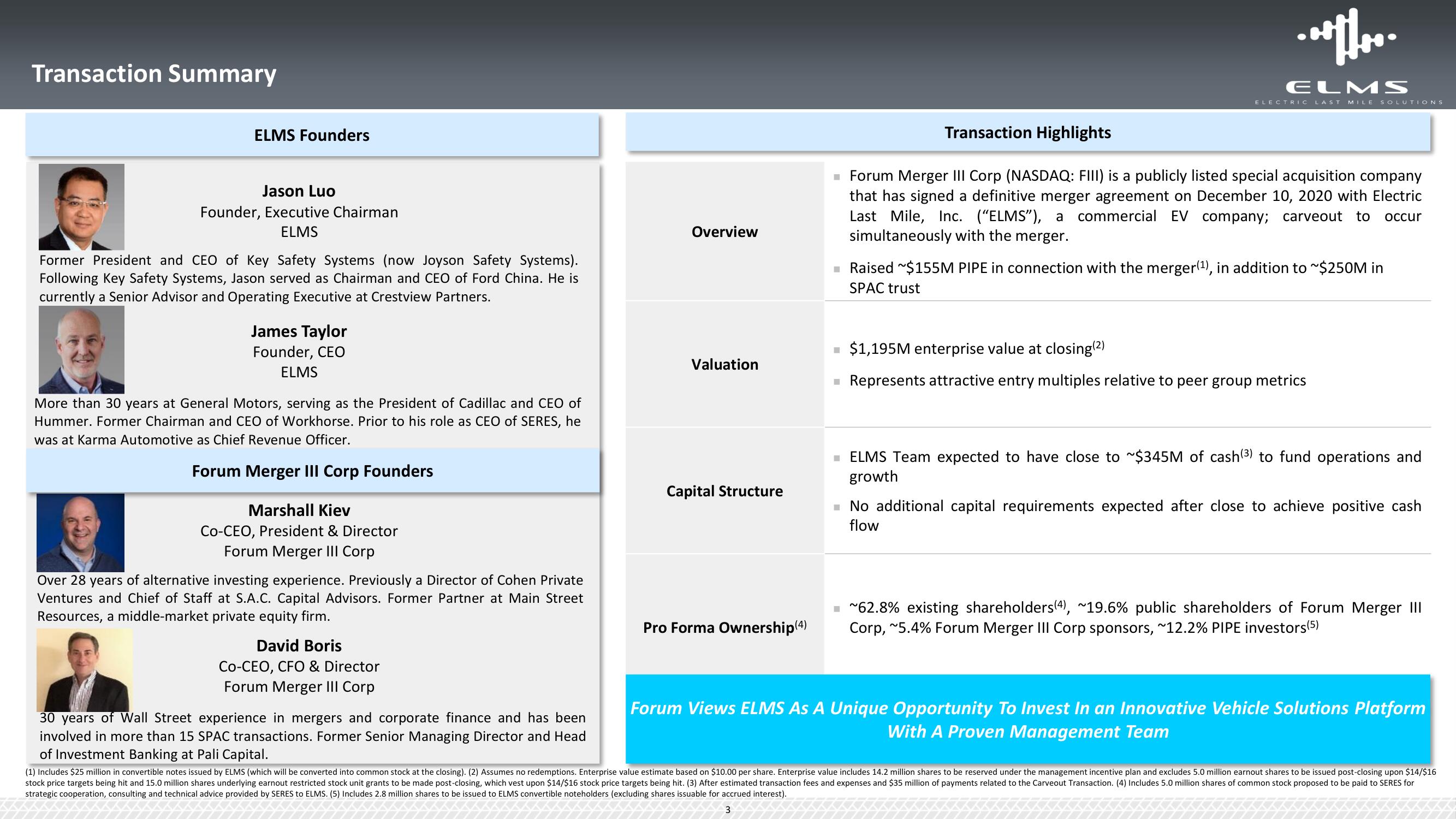

ELMS Founders

Jason Luo

Founder, Executive Chairman

ELMS

Former President and CEO of Key Safety Systems (now Joyson Safety Systems).

Following Key Safety Systems, Jason served as Chairman and CEO of Ford China. He is

currently a Senior Advisor and Operating Executive at Crestview Partners.

James Taylor

Founder, CEO

ELMS

More than 30 years at General Motors, serving as the President of Cadillac and CEO of

Hummer. Former Chairman and CEO of Workhorse. Prior to his role as CEO of SERES, he

was at Karma Automotive as Chief Revenue Officer.

Forum Merger III Corp Founders

Marshall Kiev

Co-CEO, President & Director

Forum Merger III Corp

Over 28 years of alternative investing experience. Previously a Director of Cohen Private

Ventures and Chief of Staff at S.A.C. Capital Advisors. Former Partner at Main Street

Resources, a middle-market private equity firm.

David Boris

Co-CEO, CFO & Director

Forum Merger III Corp

30 years of Wall Street experience in mergers and corporate finance and has been

involved in more than 15 SPAC transactions. Former Senior Managing Director and Head

of Investment Banking at Pali Capital.

Overview

Valuation

Capital Structure

Pro Forma Ownership (4)

.....

ELMS

ELECTRIC LAST MILE SOLUTIONS

Transaction Highlights

■ Forum Merger III Corp (NASDAQ: FIII) is a publicly listed special acquisition company

that has signed a definitive merger agreement on December 10, 2020 with Electric

Last Mile, Inc. ("ELMS"), a commercial EV company; carveout to occur

simultaneously with the merger.

Raised $155M PIPE in connection with the merger(¹), in addition to ~$250M in

SPAC trust

■ $1,195M enterprise value at closing(2)

■ Represents attractive entry multiples relative to peer group metrics

■ ELMS Team expected to have close to ~$345M of cash(³) to fund operations and

growth

■ No additional capital requirements expected after close to achieve positive cash

flow

~62.8% existing shareholders(4), ~19.6% public shareholders of Forum Merger III

Corp, ~5.4% Forum Merger III Corp sponsors, ~12.2% PIPE investors(5)

Forum Views ELMS As A Unique Opportunity To Invest In an Innovative Vehicle Solutions Platform

With A Proven Management Team

(1) Includes $25 million in convertible notes issued by ELMS (which will be converted into common stock at the closing). (2) Assumes no redemptions. Enterprise value estimate based on $10.00 per share. Enterprise value includes 14.2 million shares to be reserved under the management incentive plan and excludes 5.0 million earnout shares to be issued post-closing upon $14/$16

stock price targets being hit and 15.0 million shares underlying earnout restricted stock unit grants to be made post-closing, which vest upon $14/$16 stock price targets being hit. (3) After estimated transaction fees and expenses and $35 million of payments related to the Carveout Transaction. (4) Includes 5.0 million shares of common stock proposed to be paid to SERES for

strategic cooperation, consulting and technical advice provided by SERES to ELMS. (5) Includes 2.8 million shares to be issued to ELMS convertible noteholders (excluding shares issuable for accrued interest).

3View entire presentation