Kushco Merger

TRANSACTION OVERVIEW

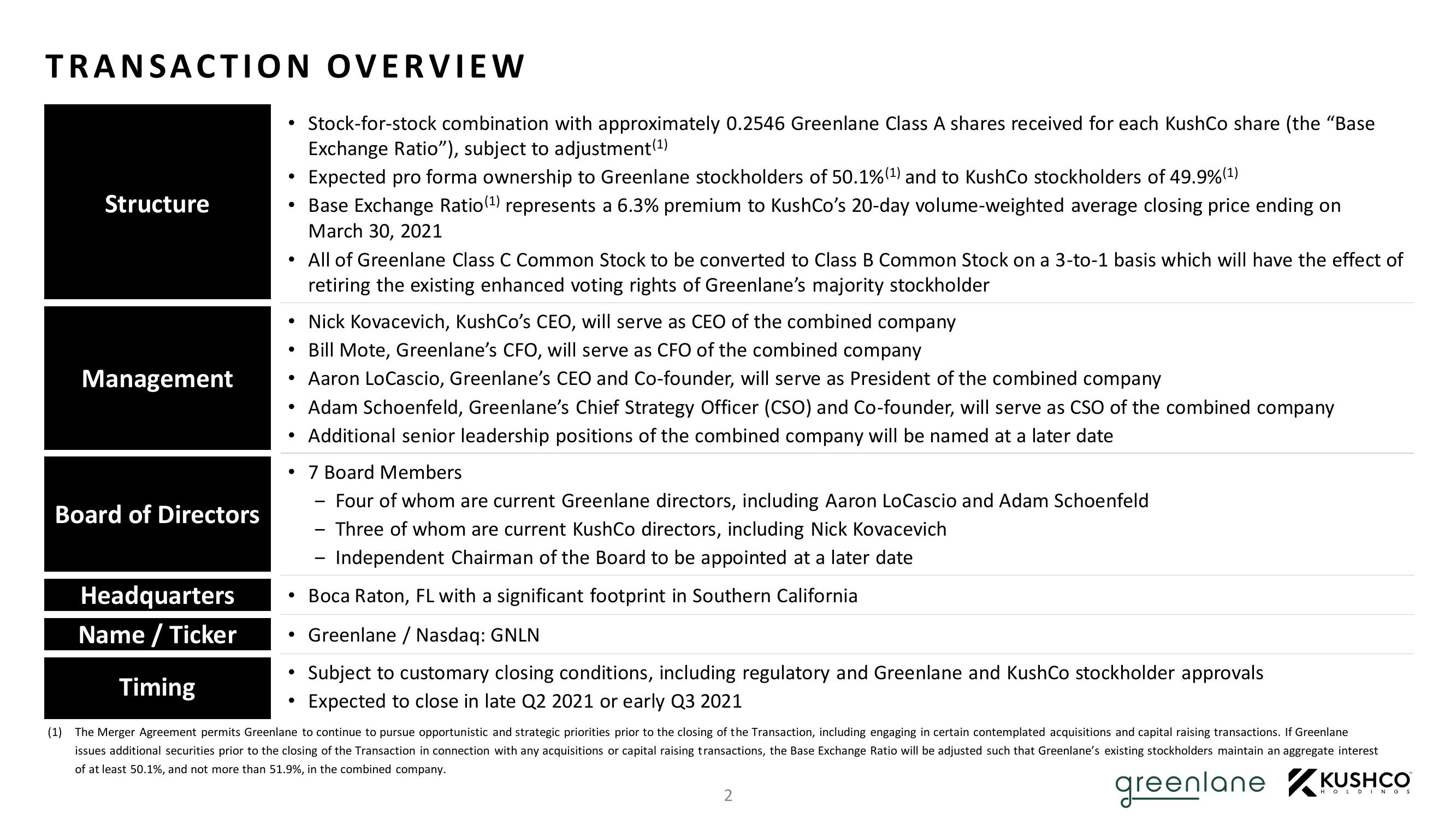

Structure

Management

Board of Directors

Headquarters

Name / Ticker

●

• Base Exchange Ratio (¹) represents a 6.3% premium to KushCo's 20-day volume-weighted average closing price ending on

March 30, 2021

●

• Nick Kovacevich, KushCo's CEO, will serve as CEO of the combined company

Bill Mote, Greenlane's CFO, will serve as CFO of the combined company

• Aaron LoCascio, Greenlane's CEO and Co-founder, will serve as President of the combined company

• Adam Schoenfeld, Greenlane's Chief Strategy Officer (CSO) and Co-founder, will serve as CSO of the combined company

Additional senior leadership positions of the combined company will be named at a later date

●

Stock-for-stock combination with approximately 0.2546 Greenlane Class A shares received for each KushCo share (the "Base

Exchange Ratio"), subject to adjustment(¹)

Expected pro forma ownership to Greenlane stockholders of 50.1% (¹) and to KushCo stockholders of 49.9%(¹)

• 7 Board Members

Four of whom are current Greenlane directors, including Aaron LoCascio and Adam Schoenfeld

Three of whom are current KushCo directors, including Nick Kovacevich

Independent Chairman of the Board to be appointed at a later date

Boca Raton, FL with a significant footprint in Southern California

Greenlane / Nasdaq: GNLN

Subject to customary closing conditions, including regulatory and Greenlane and KushCo stockholder approvals

Expected to close in late Q2 2021 or early Q3 2021

●

●

All of Greenlane Class C Common Stock to be converted to Class B Common Stock on a 3-to-1 basis which will have the effect of

retiring the existing enhanced voting rights of Greenlane's majority stockholder

●

Timing

(1) The Merger Agreement permits Greenlane to continue to pursue opportunistic and strategic priorities prior to the closing of the Transaction, including engaging in certain contemplated acquisitions and capital raising transactions. If Greenlane

issues additional securities prior to the closing of the Transaction in connection with any acquisitions or capital raising transactions, the Base Exchange Ratio will be adjusted such that Greenlane's existing stockholders maintain an aggregate interest

of at least 50.1%, and not more than 51.9%, in the combined company.

greenlane

2

KUSHCO

HOLDING SView entire presentation