Repay SPAC

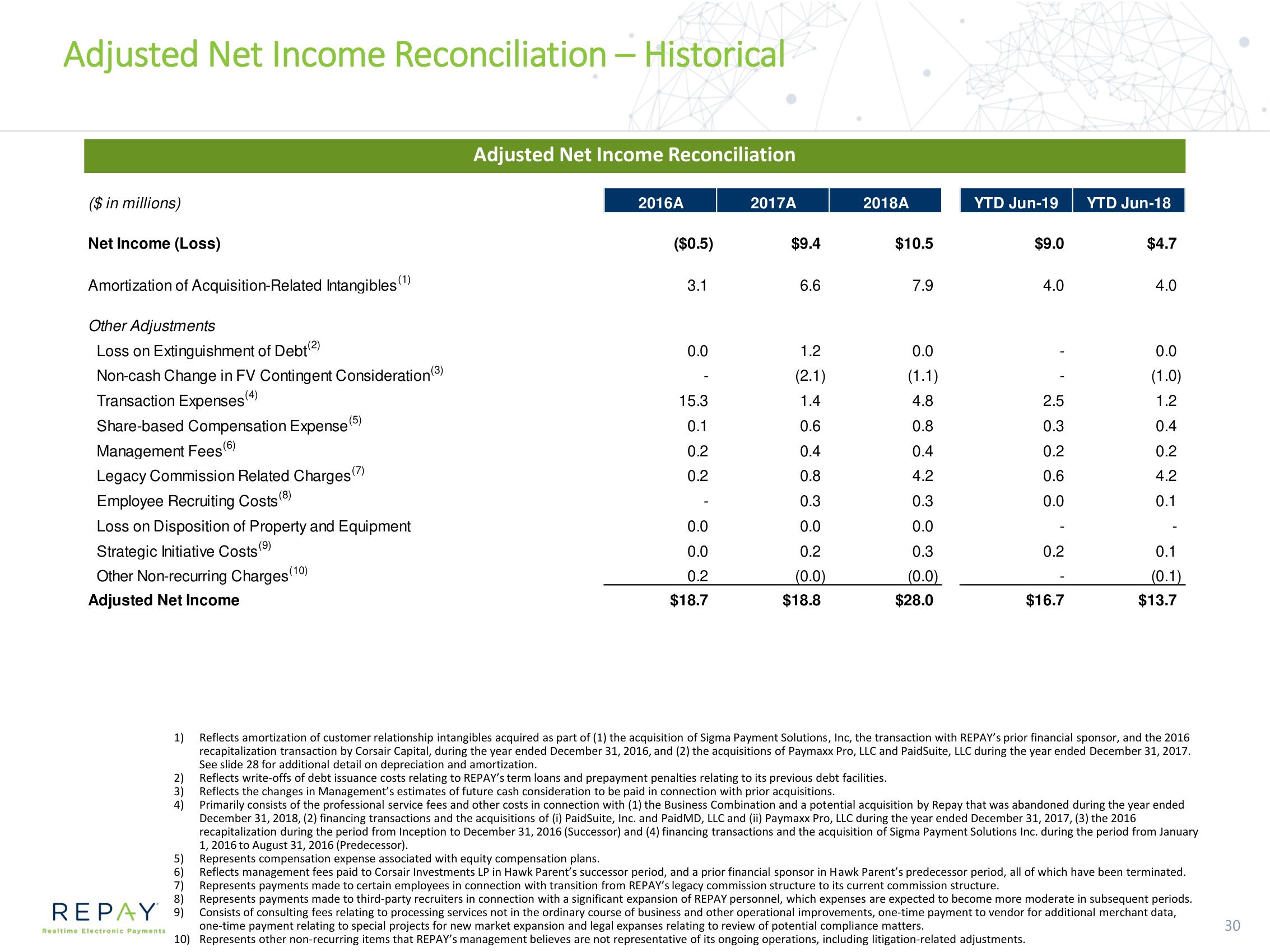

Adjusted Net Income Reconciliation- Historical

($ in millions)

Net Income (Loss)

Amortization of Acquisition-Related Intangibles (1)

Other Adjustments

Loss on Extinguishment of Debt(²)

Non-cash Change in FV Contingent Consideration (³)

Transaction Expenses(4)

Share-based Compensation Expense (5)

Management Fees (6)

Legacy Commission Related Charges (7)

Employee Recruiting Costs (8)

Loss on Disposition of Property and Equipment

Strategic Initiative Costs (⁹)

(10)

Other Non-recurring Charges (10

Adjusted Net Income

2)

3)

4)

Adjusted Net Income Reconciliation

2016A

6)

7)

8)

REPAY 9)

Realtime Electronic Payments

($0.5)

3.1

0.0

15.3

0.1

0.2

0.2

0.0

0.0

0.2

$18.7

2017A

$9.4

6.6

1.2

(2.1)

1.4

0.6

0.4

0.8

0.3

0.0

0.2

(0.0)

$18.8

2018A

$10.5

7.9

0.0

(1.1)

4.8

0.8

0.4

4.2

0.3

0.0

0.3

(0.0)

$28.0

YTD Jun-19

$9.0

4.0

2.5

0.3

0.2

0.6

0.0

0.2

$16.7

YTD Jun-18

$4.7

4.0

0.0

(1.0)

1.2

0.4

0.2

4.2

0.1

0.1

(0.1)

1) Reflects amortization of customer relationship intangibles acquired as part of (1) the acquisition of Sigma Payment Solutions, Inc, the transaction with REPAY's prior financial sponsor, and the 2016

recapitalization transaction by Corsair Capital, during the year ended December 31, 2016, and (2) the acquisitions of Paymaxx Pro, LLC and PaidSuite, LLC during the year ended December 31, 2017.

See slide 28 for additional detail on depreciation and amortization.

Reflects write-offs of debt issuance costs relating to REPAY's term loans and prepayment penalties relating to its previous debt facilities.

Reflects the changes in Management's estimates of future cash consideration to be paid in connection with prior acquisitions.

Primarily consists of the professional service fees and other costs in connection with (1) the Business Combination and a potential acquisition by Repay that was abandoned during the year ended

December 31, 2018, (2) financing transactions and the acquisitions of (i) PaidSuite, Inc. and Paid MD, LLC and (ii) Paymaxx Pro, LLC during the year ended December 31, 2017, (3) the 2016

recapitalization during the period from Inception to December 31, 2016 (Successor) and (4) financing transactions and the acquisition of Sigma Payment Solutions Inc. during the period from January

1, 2016 to August 31, 2016 (Predecessor).

$13.7

5) Represents compensation expense associated with equity compensation plans.

Reflects management fees paid to Corsair Investments LP in Hawk Parent's successor period, and a prior financial sponsor in Hawk Parent's predecessor period, all of which have been terminated.

Represents payments made to certain employees in connection with transition from REPAY's legacy commission structure to its current commission structure.

Represents payments made to third-party recruiters in connection with a significant expansion of REPAY personnel, which expenses are expected to become more moderate in subsequent periods.

Consists of consulting fees relating to processing services not in the ordinary course of business and other operational improvements, one-time payment to vendor for additional merchant data,

one-time payment relating to special projects for new market expansion and legal expanses relating to review of potential compliance matters.

10) Represents other non-recurring items that REPAY's management believes are not representative of its ongoing operations, including litigation-related adjustments.

30View entire presentation