NuStar Energy Investor Conference Presentation Deck

NuStar

Reconciliation of Non-GAAP Financial Information

(continued)

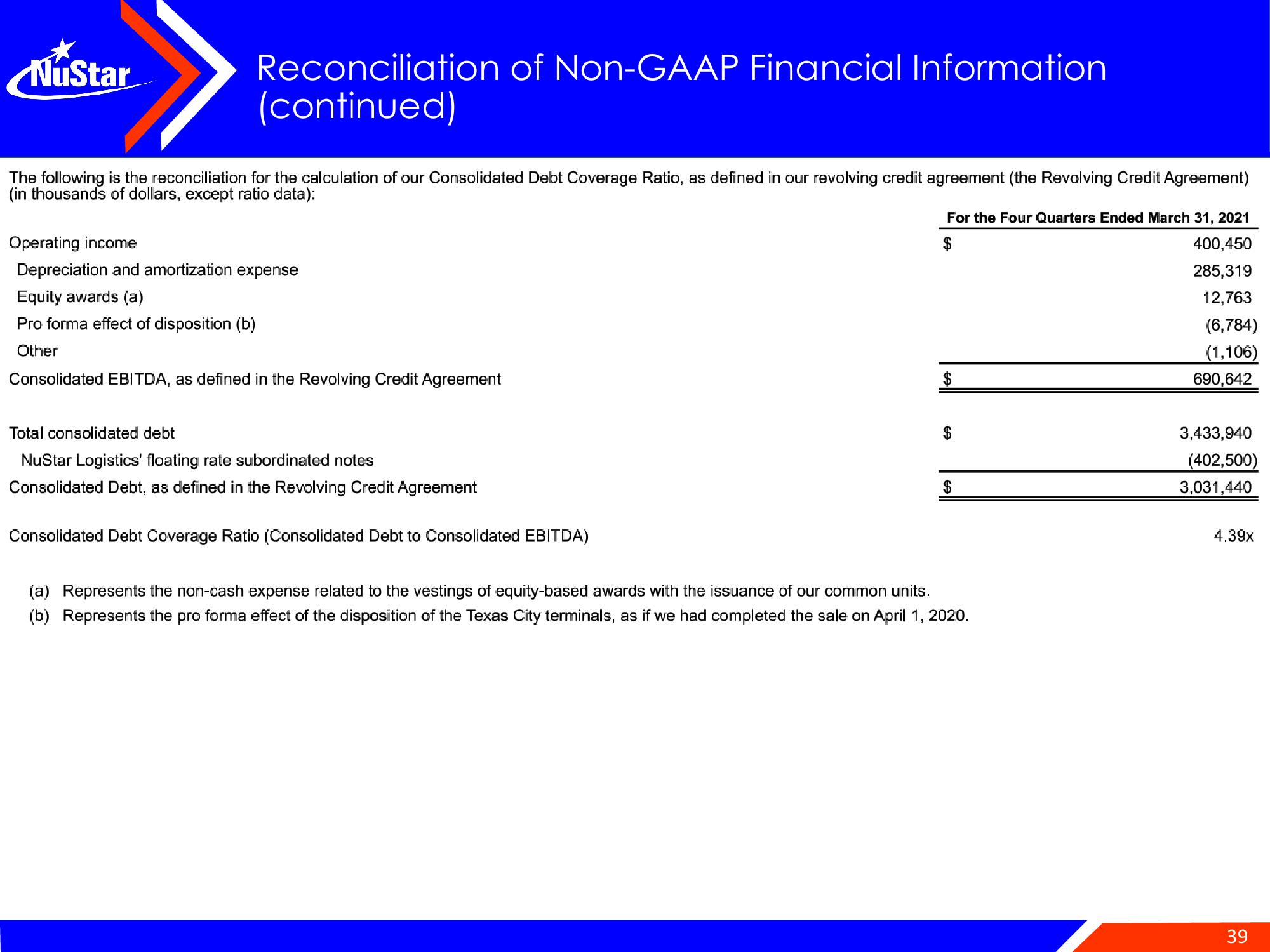

The following is the reconciliation for the calculation of our Consolidated Debt Coverage Ratio, as defined in our revolving credit agreement (the Revolving Credit Agreement)

(in thousands of dollars, except ratio data):

Operating income

Depreciation and amortization expense

Equity awards (a)

Pro forma effect of disposition (b)

Other

Consolidated EBITDA, as defined in the Revolving Credit Agreement

Total consolidated debt

NuStar Logistics' floating rate subordinated notes

Consolidated Debt, as defined in the Revolving Credit Agreement

Consolidated Debt Coverage Ratio (Consolidated Debt to Consolidated EBITDA)

For the Four Quarters Ended March 31, 2021

400,450

285,319

12,763

(6,784)

(1,106)

690,642

$

$

(a) Represents the non-cash expense related to the vestings of equity-based awards with the issuance of our common units.

(b) Represents the pro forma effect of the disposition of the Texas City terminals, as if we had completed the sale on April 1, 2020.

3,433,940

(402,500)

3,031,440

4.39x

39View entire presentation