Sonos Results Presentation Deck

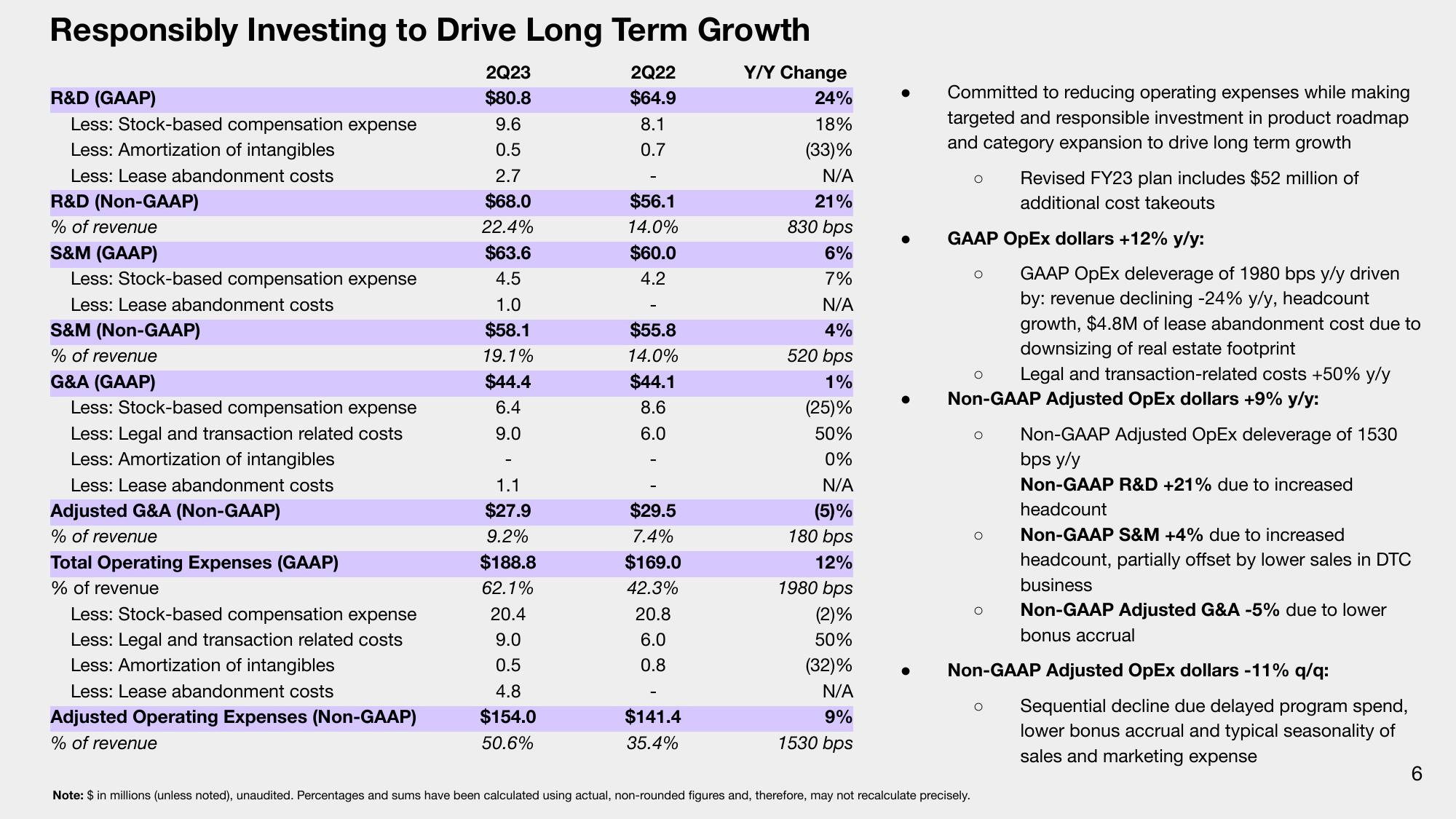

Responsibly Investing to Drive Long Term Growth

2Q22

Y/Y Change

$64.9

8.1

24%

18%

(33)%

N/A

0.7

21%

830 bps

6%

7%

N/A

4%

520 bps

1%

(25)%

50%

0%

N/A

(5)%

180 bps

12%

R&D (GAAP)

Less: Stock-based compensation expense

Less: Amortization of intangibles

Less: Lease abandonment costs

R&D (Non-GAAP)

% of revenue

S&M (GAAP)

Less: Stock-based compensation expense

Less: Lease abandonment costs

S&M (Non-GAAP)

% of revenue

G&A (GAAP)

Less: Stock-based compensation expense

Less: Legal and transaction related costs

Less: Amortization of intangibles

Less: Lease abandonment costs

Adjusted G&A (Non-GAAP)

% of revenue

Total Operating Expenses (GAAP)

% of revenue

Less: Stock-based compensation expense

Less: Legal and transaction related costs

Less: Amortization of intangibles

Less: Lease abandonment costs

Adjusted Operating Expenses (Non-GAAP)

% of revenue

2Q23

$80.8

9.6

0.5

2.7

$68.0

22.4%

$63.6

4.5

1.0

$58.1

19.1%

$44.4

6.4

9.0

1.1

$27.9

9.2%

$188.8

62.1%

20.4

9.0

0.5

4.8

$154.0

50.6%

$56.1

14.0%

$60.0

4.2

$55.8

14.0%

$44.1

8.6

6.0

$29.5

7.4%

$169.0

42.3%

20.8

6.0

0.8

$141.4

35.4%

1980 bps

(2)%

50%

(32)%

N/A

9%

1530 bps

Committed to reducing operating expenses while making

targeted and responsible investment in product roadmap

and category expansion to drive long term growth

O

GAAP OpEx dollars +12% y/y:

O

Note: $ in millions (unless noted), unaudited. Percentages and sums have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.

Legal and transaction-related costs +50% y/y

Non-GAAP Adjusted OpEx dollars +9% y/y:

Revised FY23 plan includes $52 million of

additional cost takeouts

O

Non-GAAP Adjusted OpEx deleverage of 1530

bps y/y

Non-GAAP R&D +21% due to increased

headcount

Non-GAAP S&M +4% due to increased

headcount, partially offset by lower sales in DTC

business

O Non-GAAP Adjusted G&A -5% due to lower

bonus accrual

O

GAAP OpEx deleverage of 1980 bps y/y driven

by: revenue declining -24% y/y, headcount

growth, $4.8M of lease abandonment cost due to

downsizing of real estate footprint

Non-GAAP Adjusted OpEx dollars -11% q/q:

O

Sequential decline due delayed program spend,

lower bonus accrual and typical seasonality of

sales and marketing expense

6View entire presentation