Accelerating Value Creation for Shareholders

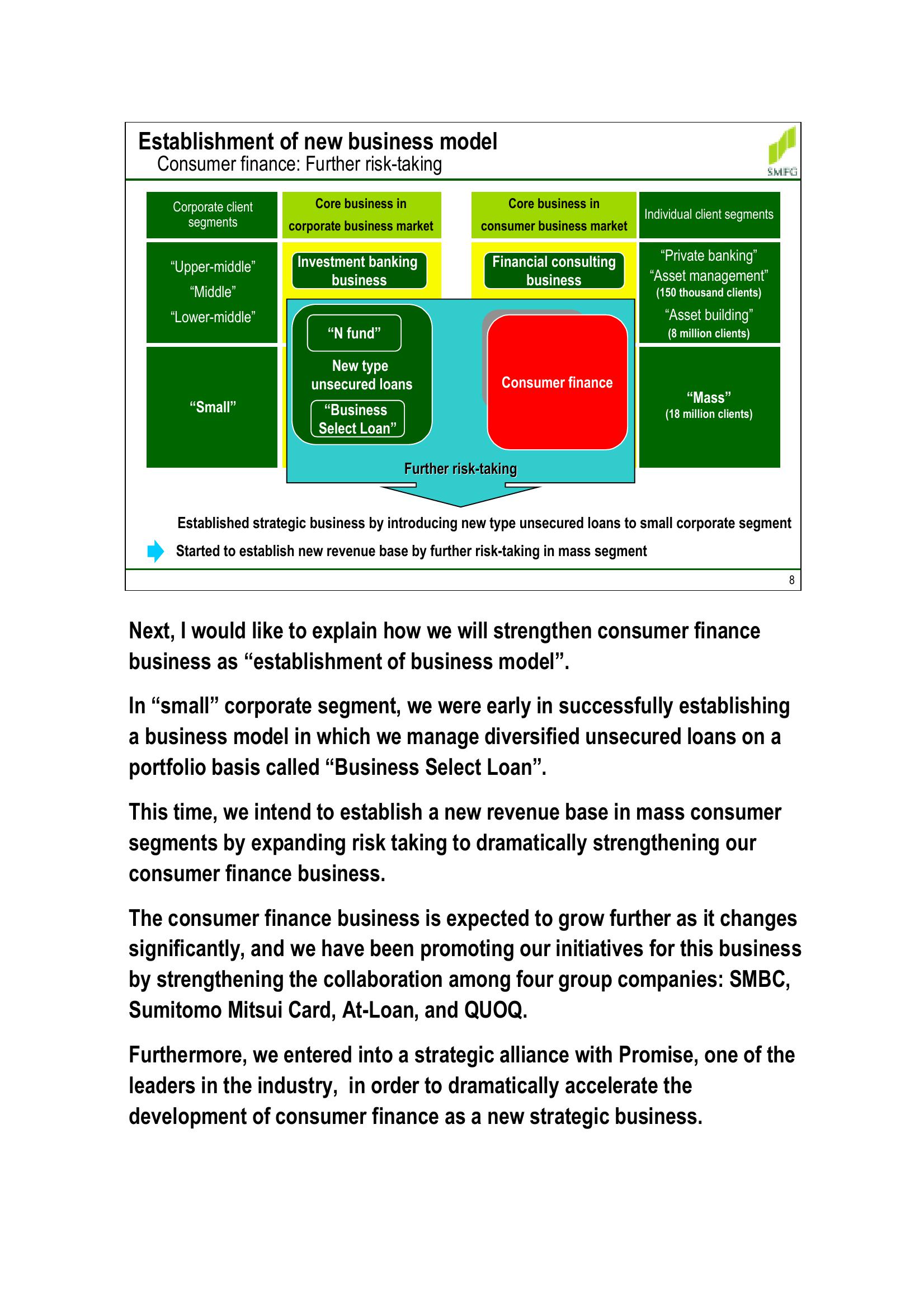

Establishment of new business model

Consumer finance: Further risk-taking

Corporate client

segments

"Upper-middle"

"Middle"

"Lower-middle"

Core business in

corporate business market

Investment banking

business

SMFG

Core business in

consumer business market

Financial consulting

business

Individual client segments

"Private banking"

"Asset management"

(150 thousand clients)

"Asset building"

(8 million clients)

"N fund"

New type

unsecured loans

Consumer finance

"Small"

"Business

Select Loan"

"Mass"

(18 million clients)

Further risk-taking

Established strategic business by introducing new type unsecured loans to small corporate segment

Started to establish new revenue base by further risk-taking in mass segment

8

Next, I would like to explain how we will strengthen consumer finance

business as "establishment of business model".

In "small" corporate segment, we were early in successfully establishing

a business model in which we manage diversified unsecured loans on a

portfolio basis called "Business Select Loan".

This time, we intend to establish a new revenue base in mass consumer

segments by expanding risk taking to dramatically strengthening our

consumer finance business.

The consumer finance business is expected to grow further as it changes

significantly, and we have been promoting our initiatives for this business

by strengthening the collaboration among four group companies: SMBC,

Sumitomo Mitsui Card, At-Loan, and QUOQ.

Furthermore, we entered into a strategic alliance with Promise, one of the

leaders in the industry, in order to dramatically accelerate the

development of consumer finance as a new strategic business.View entire presentation