Kore SPAC Presentation Deck

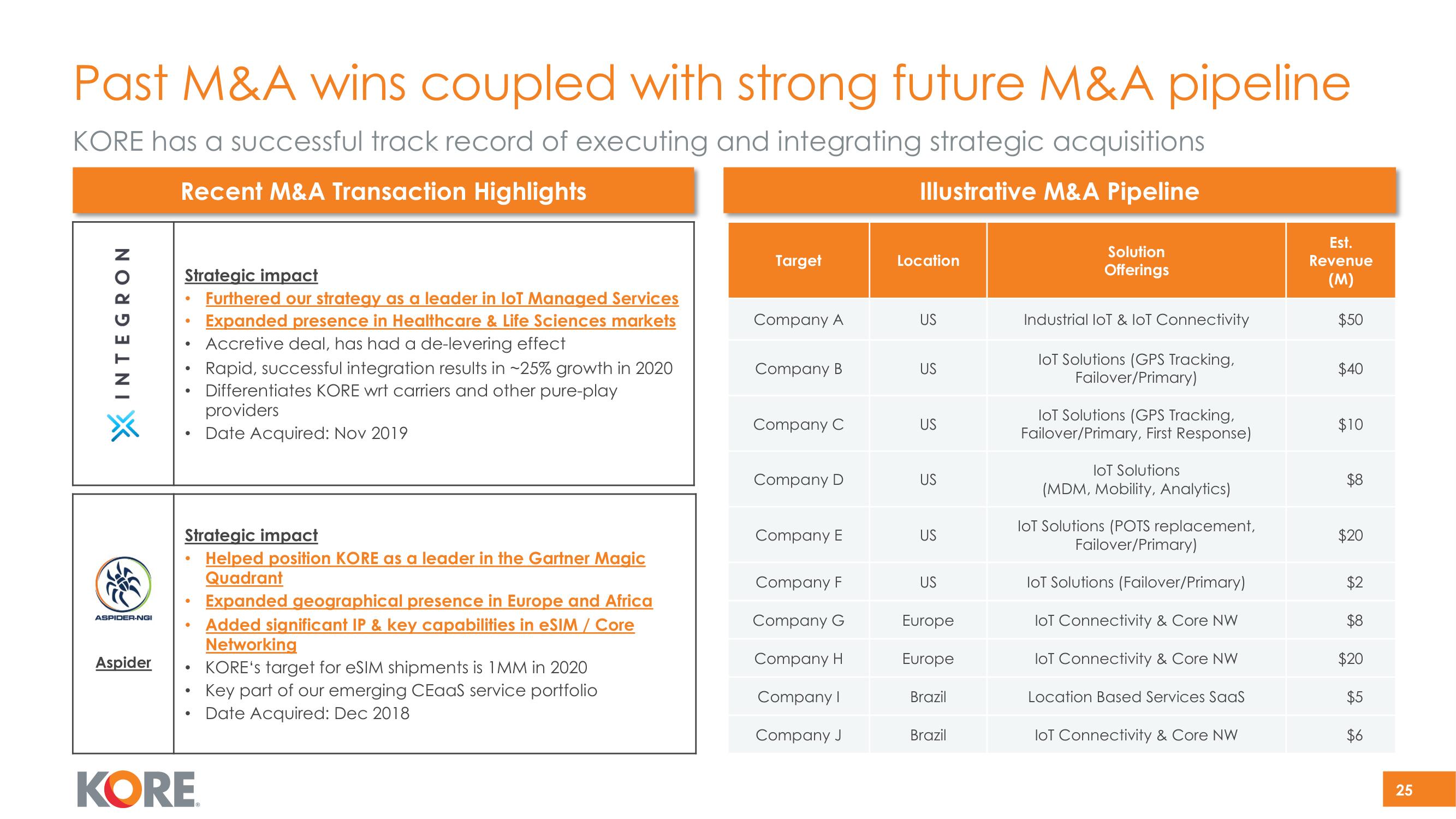

Past M&A wins coupled with strong future M&A pipeline

KORE has a successful track record of executing and integrating strategic acquisitions

Recent M&A Transaction Highlights

Illustrative M&A Pipeline

INTEGRON

G

ASPIDER-NGI

Aspider

Strategic impact

Furthered our strategy as a leader in loT Managed Services

Expanded presence in Healthcare & Life Sciences markets

Accretive deal, has had a de-levering effect

Strategic impact

Helped position KORE as a leader in the Gartner Magic

Quadrant

Expanded geographical presence in Europe and Africa

Added significant IP & key capabilities in eSIM / Core

Networking

●

Rapid, successful integration results in ~25% growth in 2020

Differentiates KORE wrt carriers and other pure-play

providers

Date Acquired: Nov 2019

KORE

KORE's target for eSIM shipments is 1MM in 2020

Key part of our emerging CEaaS service portfolio

Date Acquired: Dec 2018

Target

Company A

Company B

Company C

Company D

Company E

Company F

Company G

Company H

Company I

Company J

Location

US

US

US

US

US

US

Europe

Europe

Brazil

Brazil

Solution

Offerings

Industrial IoT & IoT Connectivity

loT Solutions (GPS Tracking,

Failover/Primary)

loT Solutions (GPS Tracking,

Failover/Primary, First Response)

IoT Solutions

(MDM, Mobility, Analytics)

loT Solutions (POTS replacement,

Failover/Primary)

loT Solutions (Failover/Primary)

IoT Connectivity & Core NW

IoT Connectivity & Core NW

Location Based Services SaaS

loT Connectivity & Core NW

Est.

Revenue

(M)

$50

$40

$10

$8

$20

$2

$8

$20

$5

$6

25View entire presentation