Pathward Financial Results Presentation Deck

Loan Portfolio

Interest Rate

Sensitivity

HIGHLIGHTS

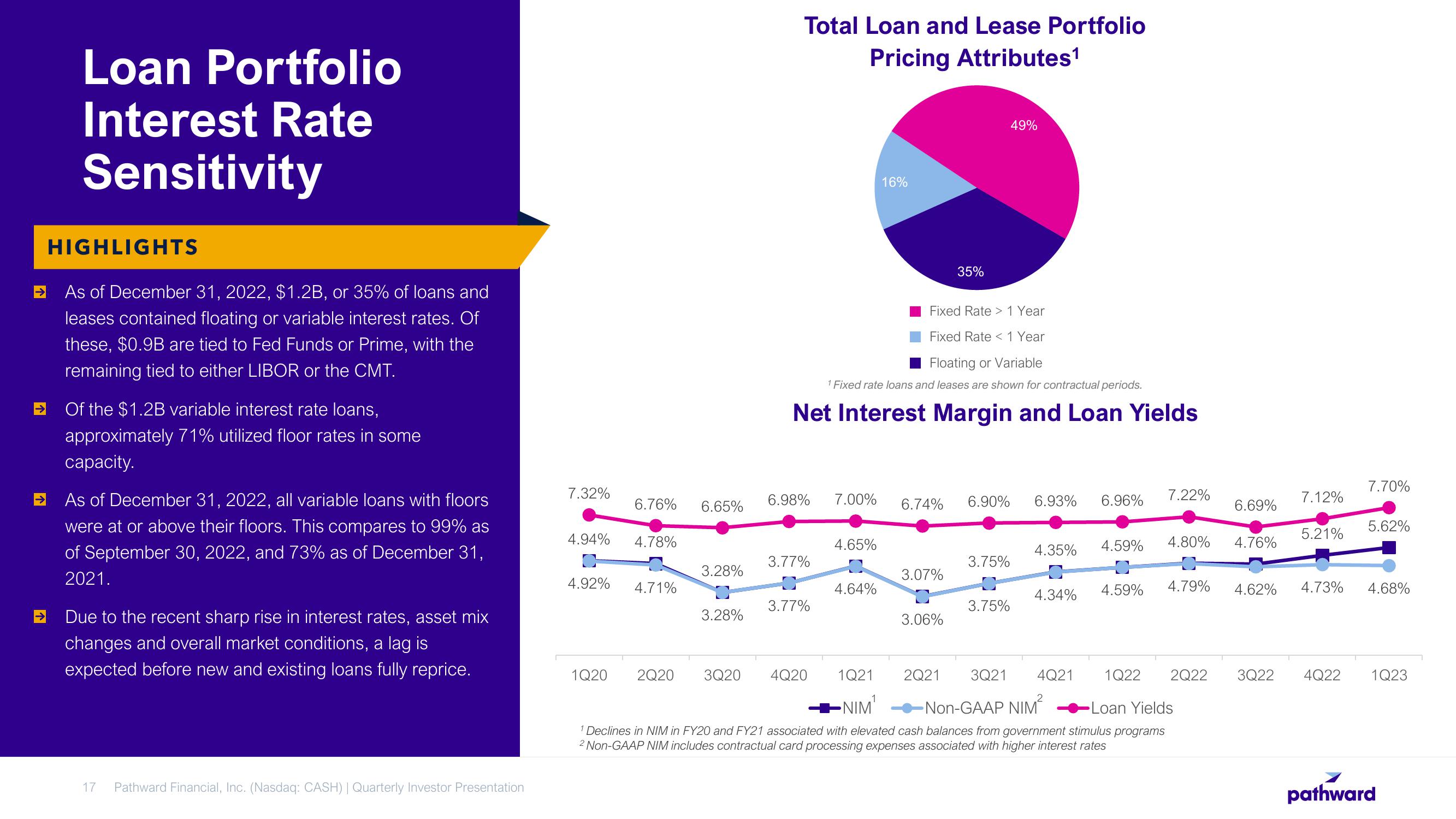

As of December 31, 2022, $1.2B, or 35% of loans and

leases contained floating or variable interest rates. Of

these, $0.9B are tied to Fed Funds or Prime, with the

remaining tied to either LIBOR or the CMT.

Of the $1.2B variable interest rate loans,

approximately 71% utilized floor rates in some

capacity.

As of December 31, 2022, all variable loans with floors

were at or above their floors. This compares to 99% as

of September 30, 2022, and 73% as of December 31,

2021.

Due to the recent sharp rise in interest rates, asset mix

changes and overall market conditions, a lag is

expected before new and existing loans fully reprice.

17

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

7.32%

6.76%

4.94%

C

4.92% 4.71%

4.78%

6.65%

3.28%

3.28%

1Q20 2Q20 3Q20

Total Loan and Lease Portfolio

Pricing Attributes¹

6.98%

3.77%

Fixed Rate > 1 Year

Fixed Rate < 1 Year

Floating or Variable

1 Fixed rate loans and leases are shown for contractual periods.

Net Interest Margin and Loan Yields

3.77%

4Q20

16%

4.65%

4.64%

7.00% 6.74% 6.90% 6.93%

3.07%

35%

3.06%

2Q21

49%

3.75%

3.75%

4.35%

4.34%

3Q21 4Q21

6.96%

4.59%

4.59%

7.22%

4.80%

4.79%

1Q22 2Q22

1Q21

-NIM¹

-Non-GAAP NIM²

-Loan Yields

1 Declines in NIM in FY20 and FY21 associated with elevated cash balances from government stimulus programs

2 Non-GAAP NIM includes contractual card processing expenses associated with higher interest rates

6.69%

4.76%

7.12%

5.21%

4.62% 4.73%

7.70%

5.62%

4.68%

3Q22 4Q22 1Q23

pathwardView entire presentation