AngloAmerican Results Presentation Deck

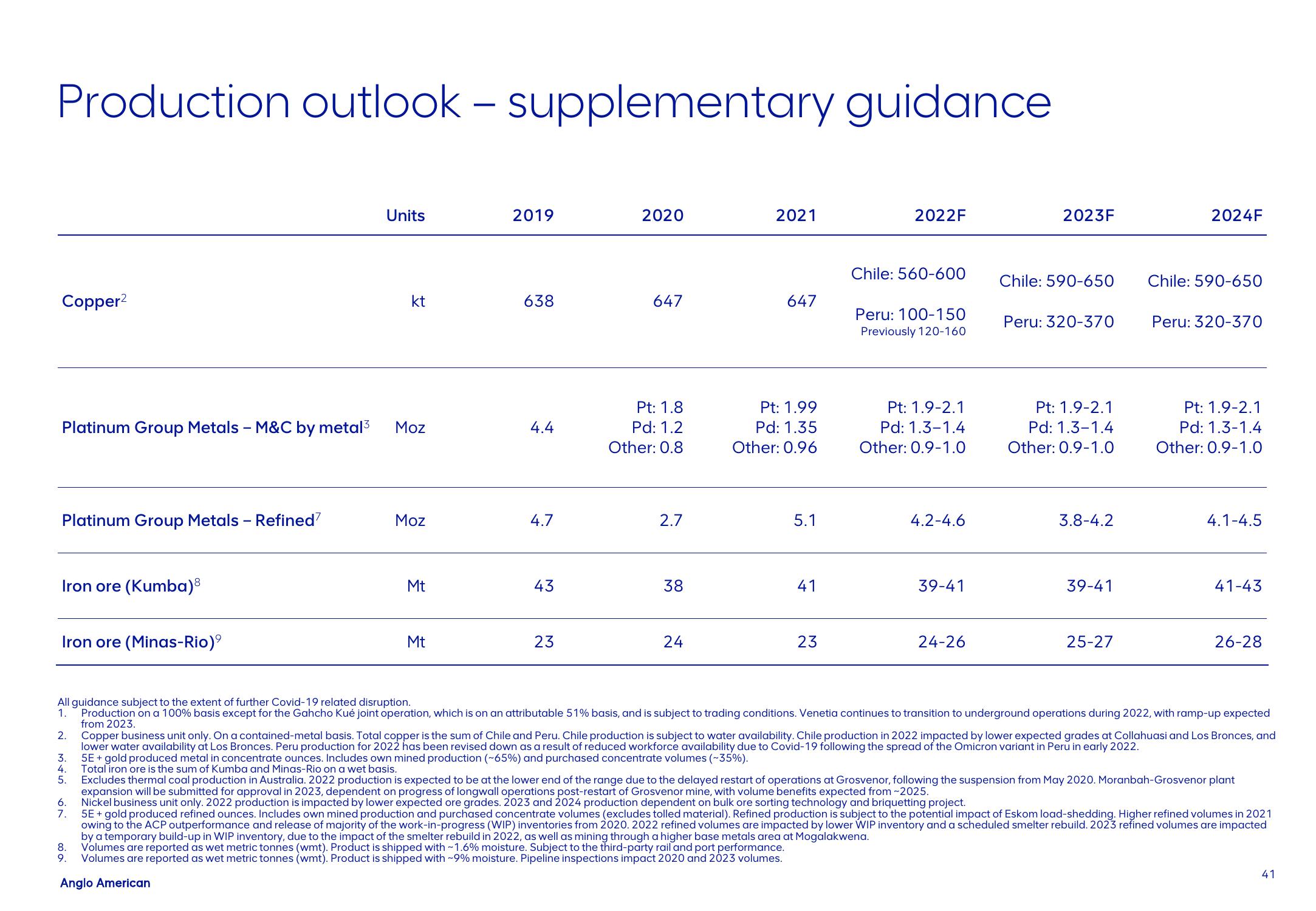

Production outlook - supplementary guidance

Copper²

Platinum Group Metals - Refined?

Platinum Group Metals - M&C by metal³ Moz

Iron ore (Kumba)8

Iron ore (Minas-Rio)⁹

2.

3.

4.

5.

Units

6.

7.

kt

8.

9.

Moz

Mt

Mt

2019

638

4.4

4.7

43

23

2020

647

Pt: 1.8

Pd: 1.2

Other: 0.8

2.7

38

24

2021

647

Pt: 1.99

Pd: 1.35

Other: 0.96

5.1

41

23

2022F

Chile: 560-600

Peru: 100-150

Previously 120-160

Pt: 1.9-2.1

Pd: 1.3-1.4

Other: 0.9-1.0

4.2-4.6

39-41

24-26

Chile:

2023F

Peru: 320-370

Pt: 1.9-2.1

Pd: 1.3-1.4

Other: 0.9-1.0

3.8-4.2

39-41

25-27

2024F

Chile: 590-650

Peru: 320-370

Pt: 1.9-2.1

Pd: 1.3-1.4

Other: 0.9-1.0

1.

All guidance subject to the extent of further Covid-19 related disruption.

Production on a 100% basis except for the Gahcho Kué joint operation, which is on an attributable 51% basis, and is subject to trading conditions. Venetia continues to transition to underground operations during 2022, with ramp-up expected

from 2023.

Copper business unit only. On a contained-metal basis. Total copper is the sum of Chile and Peru. Chile production is subject to water availability. Chile production in 2022 impacted by lower expected grades at Collahuasi and Los Bronces, and

lower water availability at Los Bronces. Peru production for 2022 has been revised down as a result of reduced workforce availability due to Covid-19 following the spread of the Omicron variant in Peru in early 2022.

5E + gold produced metal in concentrate ounces. Includes own mined production (~65%) and purchased concentrate volumes (~35%).

Total iron ore is the sum of Kumba and Minas-Rio on a wet basis.

Excludes thermal coal production in Australia. 2022 production is expected to be at the lower end of the ran due to the delayed restart of operations at Grosvenor, following the suspension from May 2020. Moranbah-Grosvenor plant

expansion will be submitted for approval in 2023, dependent on progress of longwall operations post-restart of Grosvenor mine, with volume benefits expected from ~2025.

Nickel business unit only. 2022 production is impacted by lower expected ore grades. 2023 and 2024 production dependent on bulk ore sorting technology and briquetting project.

5E + gold produced refined ounces. Includes own mined production and purchased concentrate volumes (excludes tolled material). Refined production is subject to the potential impact of Eskom load-shedding. Higher refined volumes in 2021

owing to the ACP outperformance and release of majority of the work-in-progress (WIP) inventories from 2020. 2022 refined volumes are impacted by lower WIP inventory and a scheduled smelter rebuild. 2023 refined volumes are impacted

by a temporary build-up in WIP inventory, due to the impact of the smelter rebuild in 2022, as well as mining through a higher base metals area at Mogalakwena.

Volumes are reported as wet metric tonnes (wmt). Product is shipped with ~1.6% moisture. Subject to the third-party rail and port performance.

Volumes are reported as wet metric tonnes (wmt). Product is shipped with ~9% moisture. Pipeline inspections impact 2020 and 2023 volumes.

Anglo American

4.1-4.5

41-43

26-28

41View entire presentation