Fort Capital Investment Banking Pitch Book

Capital & Operating Expense and Equity Financing Summary

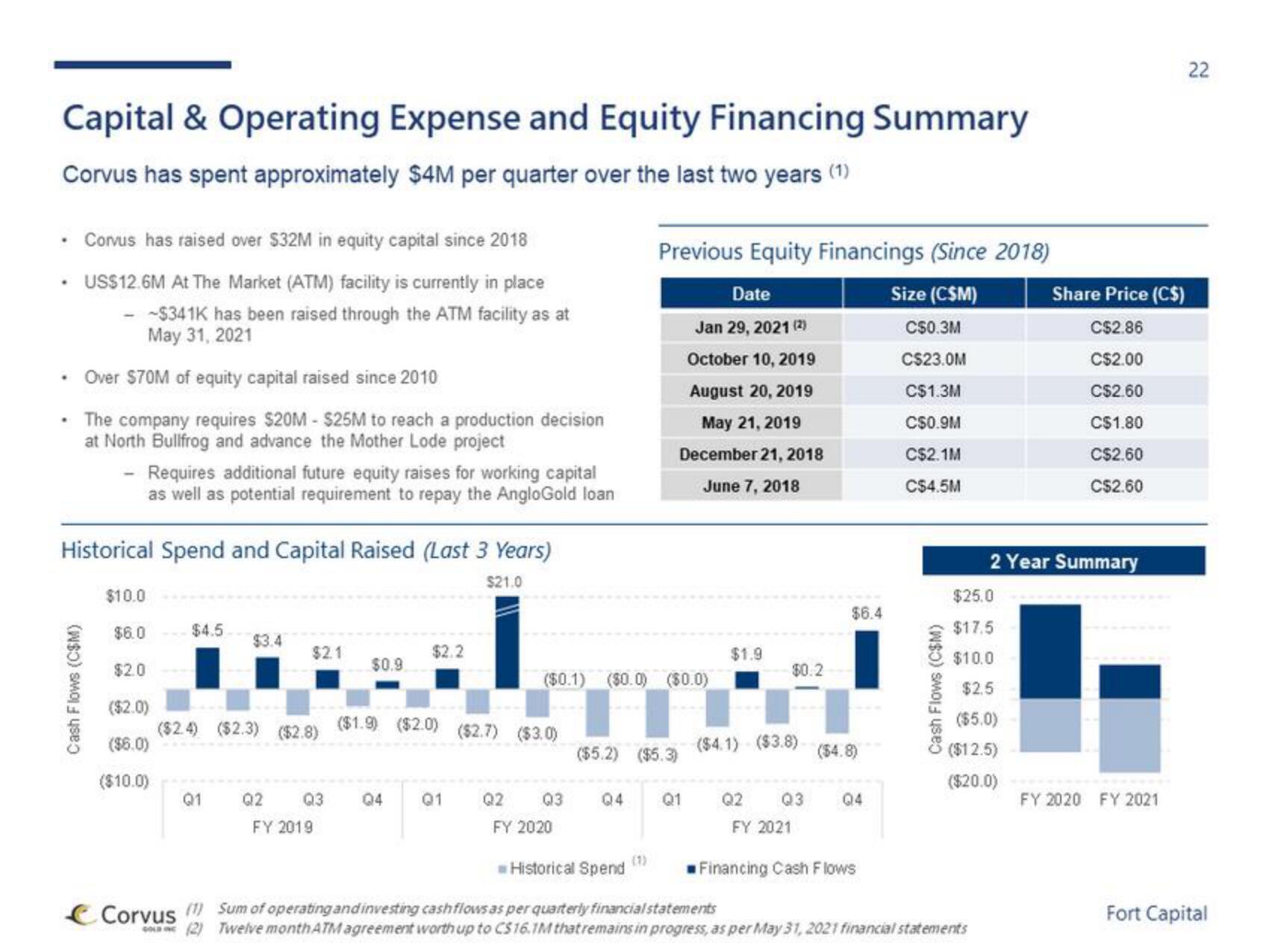

Corvus has spent approximately $4M per quarter over the last two years (1)

.

.

.

Corvus has raised over $32M in equity capital since 2018

US$12.6M At The Market (ATM) facility is currently in place

--$341K has been raised through the ATM facility as at

May 31, 2021

Over $70M of equity capital raised since 2010

The company requires $20M - $25M to reach a production decision

at North Bullfrog and advance the Mother Lode project

- Requires additional future equity raises for working capital

as well as potential requirement to repay the AngloGold loan

Historical Spend and Capital Raised (Last 3 Years)

$21.0

$10.0

$6.0

$2.0

($2.0)

($6.0)

($10.0)

$4.5

Q1

$3.4

Corvus (

(2)

$2.1

$0.9

$2.2

($2.4) ($2.3) ($2.8) ($1.9) ($2.0) ($2.7) ($3.0)

Q2 Q3 Q4 Q1

FY 2019

Previous Equity Financings (Since 2018)

Size (CSM)

($0.1) ($0.0) ($0.0)

Date

Jan 29, 2021 (2)

October 10, 2019

August 20, 2019

May 21, 2019

December 21, 2018

June 7, 2018

($5.2) ($5.3)

(1)

$1.9

Q1

$0.2

($4.1) ($3.8)

$6.4

($4.8)

Q2 Q3

FY 2021

Financing Cash Flows

Q2 Q3 Q4

FY 2020

Historical Spend

Sum of operating and investing cashflows as per quarterly financial statements

Twelve month ATM agreement worth up to CS 16.1M that remains in progress, as per May 31, 2021 financial statements

C$0.3M

C$23.0M

C$1.3M

C$0.9M

C$2.1M

C$4.5M

Q4

Cash Flows (CSM)

$25.0

$17.5

$10.0

$2.5

($5.0)

($12.5)

($20.0)

Share Price (C$)

C$2.86

C$2.00

C$2.60

C$1.80

C$2.60

C$2.60

2 Year Summary

FY 2020 FY 2021

22

Fort CapitalView entire presentation