Bausch+Lomb Results Presentation Deck

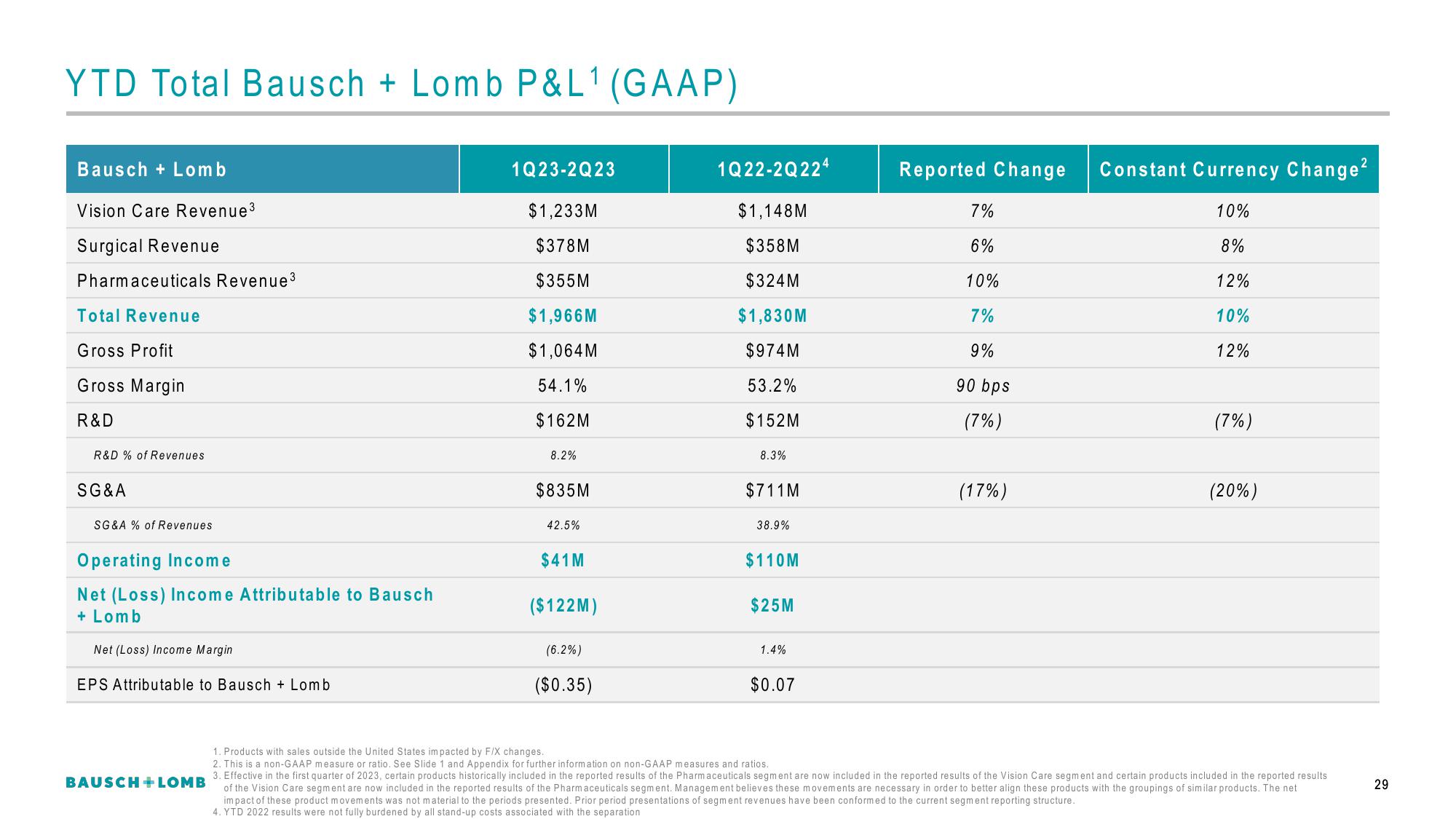

YTD Total Bausch + Lomb P&L¹ (GAAP)

Bausch + Lomb

Vision Care Revenue³

Surgical Revenue

Pharmaceuticals Revenue ³

Total Revenue

Gross Profit

Gross Margin

R&D

R&D % of Revenues

SG&A

SG&A % of Revenues

Operating Income

Net (Loss) Income Attributable to Bausch

+ Lomb

Net (Loss) Income Margin

EPS Attributable to Bausch + Lomb

BAUSCH+ LOMB

1Q23-2Q23

$1,233M

$378M

$355M

$1,966M

$1,064 M

54.1%

$162M

8.2%

$835M

42.5%

$41M

($122M)

(6.2%)

($0.35)

1Q22-2Q224

$1,148M

$358M

$324M

$1,830M

$974M

53.2%

$152M

8.3%

$711M

38.9%

$110M

$25M

1.4%

$0.07

1. Products with sales outside the United States impacted by F/X changes.

2. This is a non-GAAP measure or ratio. See Slide 1 and Appendix for further information on non-GAAP measures and ratios.

Reported Change Constant Currency Change²

10%

8%

12%

10%

12%

7%

6%

10%

7%

9%

90 bps

(7%)

(17%)

(7%)

(20%)

3. Effective in the first quarter of 2023, certain products historically included in the reported results of the Pharmaceuticals segment are now included in the reported results of the Vision Care segment and certain products included in the reported results

of the Vision Care segment are now included in the reported results of the Pharmaceuticals segment. Management believes these movements are necessary in order to better align these products with the groupings of similar products. The net

impact of these product movements was not material to the periods presented. Prior period presentations of segment revenues have been conformed to the current segment reporting structure.

4. YTD 2022 results were not fully burdened by all stand-up costs associated with the separation

29View entire presentation