Bird Investor Presentation Deck

Financial highlights

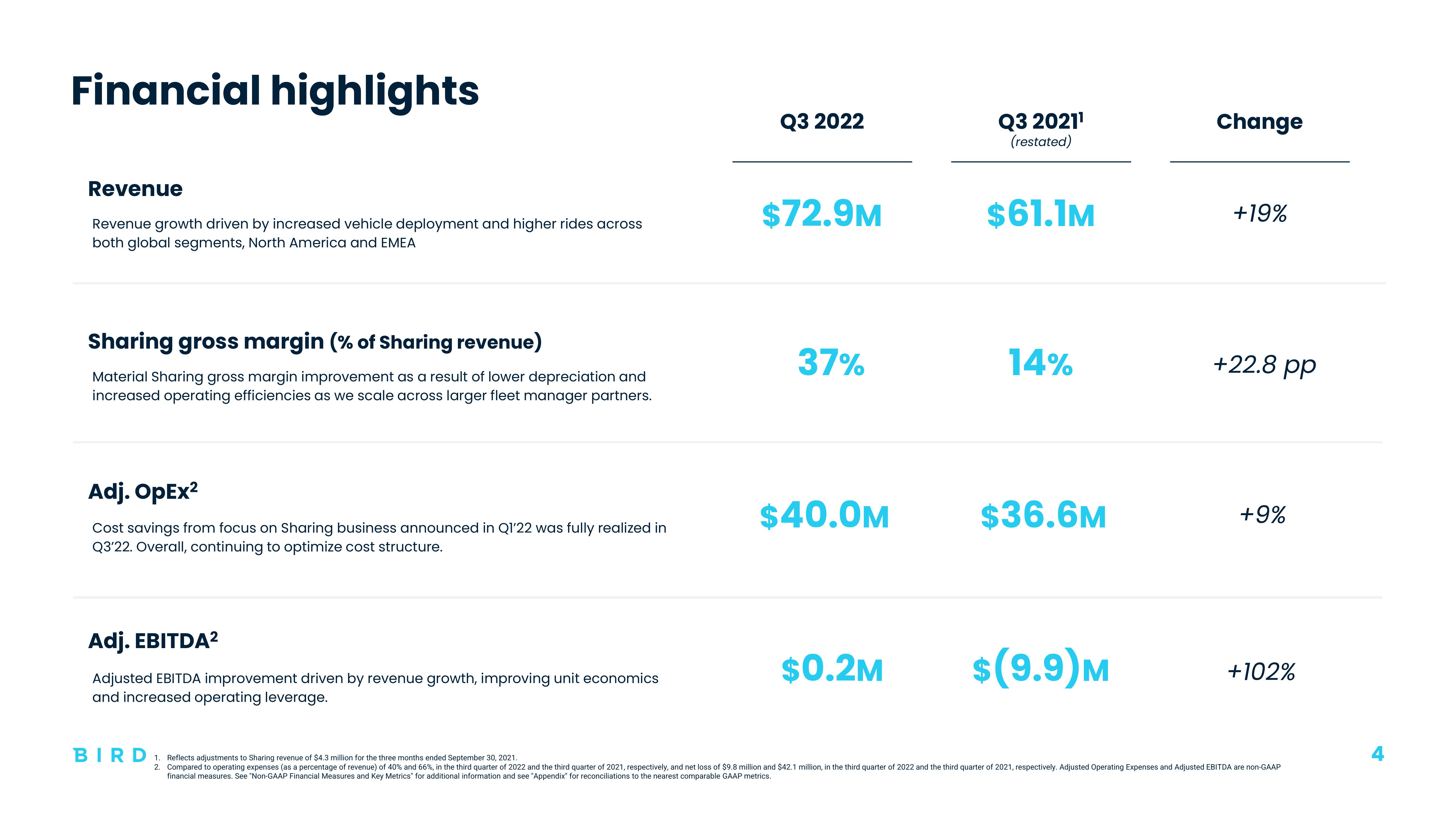

Revenue

Revenue growth driven by increased vehicle deployment and higher rides across

both global segments, North America and EMEA

Sharing gross margin (% of Sharing revenue)

Material Sharing gross margin improvement as a result of lower depreciation and

increased operating efficiencies as we scale across larger fleet manager partners.

Adj. OpEx²

Cost savings from focus on Sharing business announced in Q1'22 was fully realized in

Q3'22. Overall, continuing to optimize cost structure.

Adj. EBITDA²

Adjusted EBITDA improvement driven by revenue growth, improving unit economics

and increased operating leverage.

Q3 2022

$72.9M

37%

$40.0M

$0.2M

Q3 2021¹

(restated)

$61.1M

14%

$36.6M

$(9.9)M

Change

+19%

+22.8 pp

+9%

+102%

BIRD 1. Reflects adjustments to Sharing revenue of $4.3 million for the three months ended September 30, 2021.

2. Compared to operating expenses (as a percentage of revenue) of 40% and 66%, in the third quarter of 2022 and the third quarter of 2021, respectively, and net loss of $9.8 million and $42.1 million, in the third quarter of 2022 and the third quarter of 2021, respectively. Adjusted Operating Expenses and Adjusted EBITDA are non-GAAP

financial measures. See "Non-GAAP Financial Measures and Key Metrics" for additional information and see "Appendix" for reconciliations to the nearest comparable GAAP metrics.View entire presentation