Evercore Investment Banking Pitch Book

Appendix

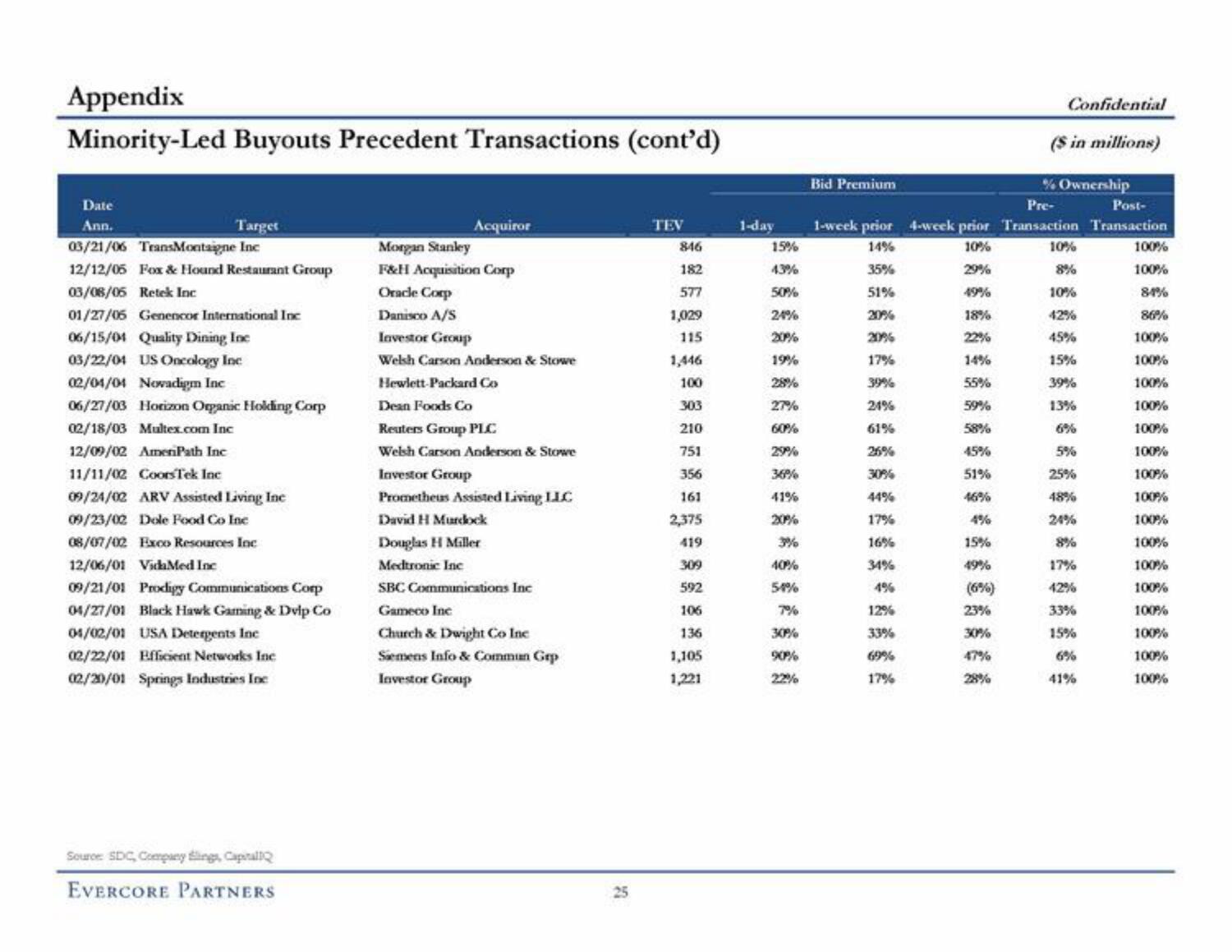

Minority-Led Buyouts Precedent Transactions (cont'd)

Date

Ann.

03/21/06 TransMontaigne Inc

12/12/05 Fox & Hound Restaurant Group

03/08/05 Retek Inc

01/27/06 Genencor International Inc

06/15/01 Quality Dining Inc

03/22/04 US Oncology Inc

Target

02/04/04 Newadigm Inc

06/27/03 Horizon Organic Holding Corp

02/18/03 Multex.com Inc

12/09/02 AmerPath Inc

11/11/02 CoorsTek Inc

09/24/02 ARV Assisted Living Inc

09/23/02 Dole Food Co Inc

08/07/02 Exco Resources Inc

12/06/01 VidaMed Inc

09/21/01 Prodigy Communications Corp

04/27/01 Black Hawk Gaming & Dvip Co

04/02/01 USA Detergents Inc

02/22/01 Efficient Networks Inc

02/20/01 Springs Industries Inc

Source: SDC, Company Slings, CapitallQ

EVERCORE PARTNERS

Acquiror

Morgan Stanley

F&H Acquisition Corp

Oracle Corp

Danisco A/S

Investor Group

Welsh Carson Anderson & Stowe

Hewlett-Packard Co

Dean Foods Co

Reuters Group PLC

Welsh Carson Anderson & Stowe

Investor Group

Prometheus Assisted Living LLC

David H Murdock

Douglas H Miller

Medtronic Inc

SBC Communications Inc

Gameco Inc

Church & Dwight Co Inc

Siemens Info & Commun Grp

Investor Group

25

TEV

846

182

577

1,029

115

1,446

100

303

210

751

356

161

2,375

419

309

592

106

136

1,105

1,221

1-day

15%

43%

50%

24%

20%

19%

28%

27%

60%%

29%

36%

41%

20%

40%%

54%

7%

30%

90%

Bid Premium

Pre-

Post-

1-week prior 4-week prior Transaction Transaction

14%

10%

29%

49%

35%

51%

20%

20%

17%

39%

21%

61%

25%

30%

44%

17%

16%

34%

4%

12%

33%

69%

17%

18%

22%

14%

55%

59%

58%

45%

51%

4%

15%

49%

Confidential

($ in millions)

% Ownership

23%

30%

47%

28%

10%

8%

10%

42%

45%

15%

39%

13%

5%

25%

48%

24%

8%

17%

42%

33%

15%

41%

100%

100%

84%

86%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%View entire presentation