Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

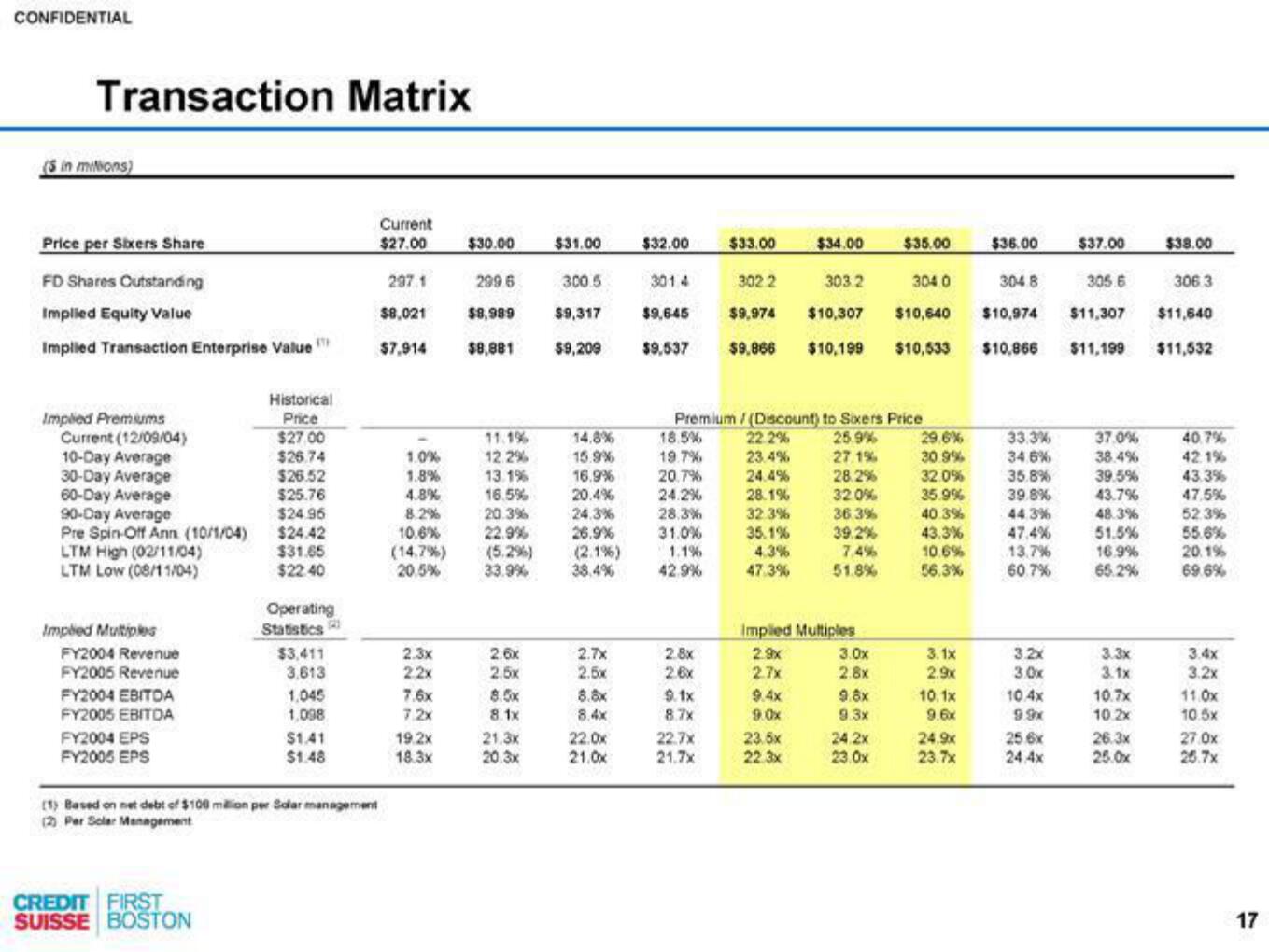

Transaction Matrix

(5 in mitions)

Price per Sixers Share

FD Shares Cutstanding

Implied Equity Value

Implied Transaction Enterprise Value

Implied Premiums

Current (12/09/04)

10-Day Average

30-Day Average

60-Day Average

90-Day Average

Pre Spin-Off Ann (10/1/04)

LTM High (02/11/04)

LTM Low (08/11/04)

Implied Multiples

FY2004 Revenue

FY2005 Revenue

FY2004 EBITDA

FY2005 EBITDA

FY2004 EPS

FY2005 EPS

ETH

CREDIT FIRST

SUISSE BOSTON

Historical

Price

$27.00

$26.74

$26.52

$25.76

$24.95

$24.42

$31.65

$22.40

Operating

Statistics

$3,411

3,613

1.045

1,098

$1.41

$1.48

(1) Based on net debt of $100 million per Solar management

(2) Per Solar Management

Current

$27.00

297.1

$8,021

$7,914

1.0%

1.8%

4.8%

8.2%

10.6%

(14.7%)

20.5%

2.3x

22x

7.6x

7.2x

19.2x

18.3x

$30.00

299 6

$8,989

$8,881

11.1%

12.2%

13.1%

16.5%

20.3%

22.9%

(5.2%)

33.9%

2.6x

2.5x

8.5x

8.1x

21.3x

20.3x

$31.00

300.5

$9,317

$9,209

14.8%

15.9%

16.9%

20.4%

24.3%

26.9%

(2.1%)

38.4%

2.7x

2.5x

8.8x

8.4x

22.0x

21.0x

$32.00

3014

$9,645

$9,537

18.5%

19.7%

20.7%

24.2%

28.3%

31.0%

1.1%

42.9%

2.8x

2.6x

9.1x

8.7x

$33.00

Premium /(Discount) to Sixers Price

22.2%

25.9%

23.4%

27.1%

24.4%

28.2%

28.1%

32.0%

32.3%

36.3%

35.1%

39.2%

4.3%

7.4%

47.3%

51.8%

22.7x

21.7x

302 2

$9,974

$9,866 $10,199

$34.00

9.4x

9.0x

Implied Multiples

2.9x

2.7x

236

22.3x

303.2

304.0

$10,307 $10,640

$10,533

3.0x

2.8x

$35.00

9.8x

9.3x

24.2x

23.0x

29.6%

30.9%

32.0%

35.9%

40.3%

43.3%

10.6%

56.3%

3.1x

2.9x

10.1x

9.6x

24.9x

23.7x

$36.00

33.3%

34.6%

304 8

305.6

306.3

$10,974

$11,307 $11,640

$10,866 $11,199 $11,532

35.8%

39.8%

44.3%

47.4%

13.7%

60.7%

3.2x

3.0x

10.4x

9.9x

$37.00

25.6x

24.4x

37.0%

38.4%

39.5%

43.7%

48.3%

51.5%

16.9%

65.2%

3.3x

3.1x

10.7x

10.2x

$38.00

26.3x

25.0x

40.7%

42.1%

43.3%

47,5%

52.3%

55.6%

20.1%

69.6%

3.4x

3.2x

11.0x

1058

27.0x

25.7x

17View entire presentation