AngloAmerican Investor Presentation Deck

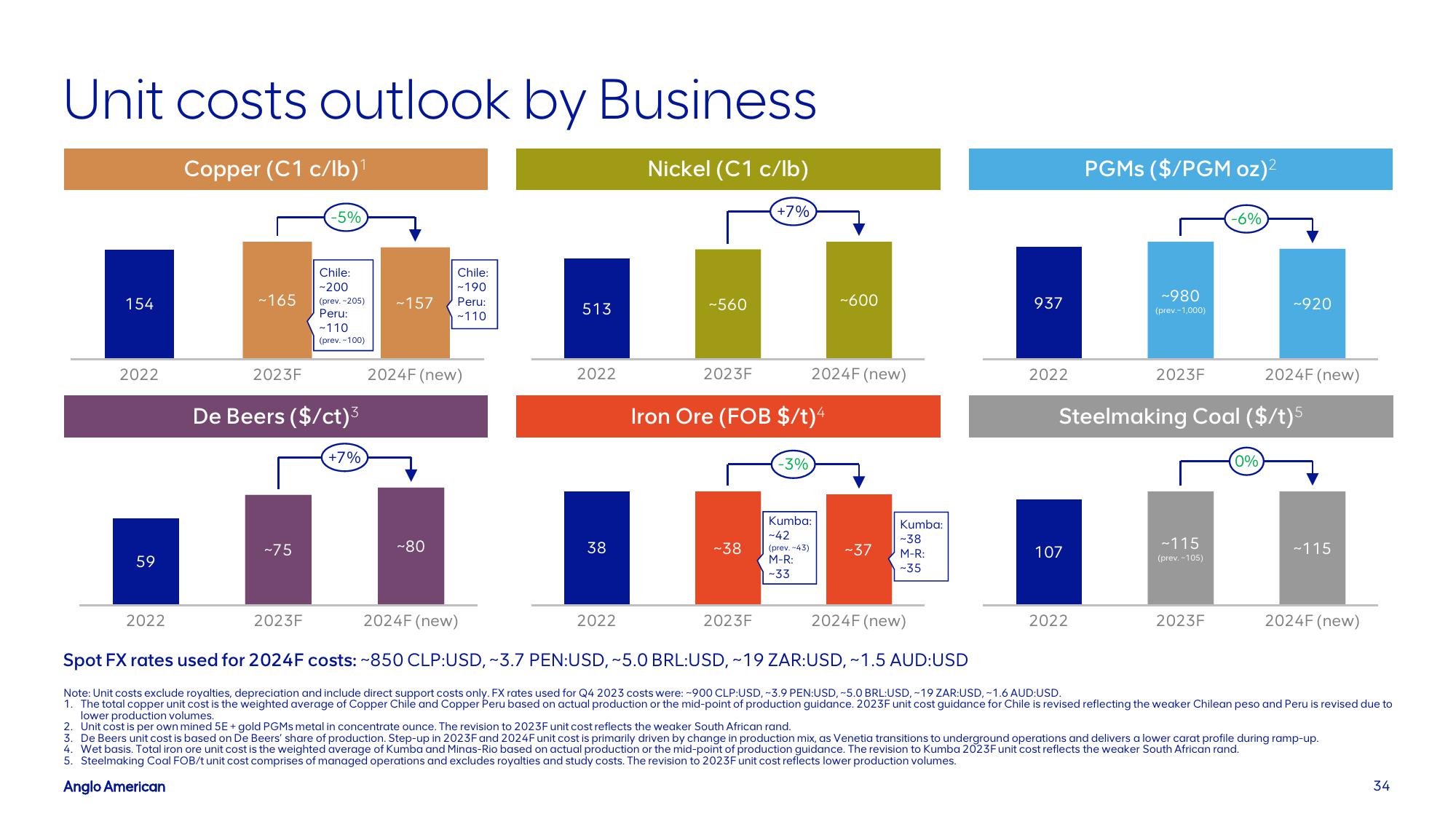

Unit costs outlook by Business

Copper (C1 c/lb)¹

Nickel (C1 c/lb)

154

2022

59

~165

2022

2023F

~75

-5%

Chile:

-200

De Beers ($/ct)³

2023F

(prev.-205) ~157

Peru:

-110

(prev.-100)

+7%

Chile:

-190

Peru:

-110

2024F (new)

~80

513

2022

38

-560

2022

2023F

~38

+7%

Iron Ore (FOB $/t)4

2023F

-3%

2024F (new)

~600

Kumba:

~42

(prev. -43)

M-R:

-33

~37

Kumba:

-38

M-R:

-35

937

2022

107

PGMs ($/PGM oz)²

~980

(prev.-1,000)

2022

2023F

Steelmaking Coal ($/t)5

~115

(prev. -105)

-6%

2024F (new)

2024F (new)

Spot FX rates used for 2024F costs: ~850 CLP:USD, ~3.7 PEN:USD, ~5.0 BRL:USD, ~19 ZAR:USD, ~1.5 AUD:USD

Note: Unit costs exclude royalties, depreciation and include direct support costs only. FX rates used for Q4 2023 costs were: -900 CLP:USD, -3.9 PEN:USD, -5.0 BRL:USD,-19 ZAR:USD,-1.6 AUD:USD.

1. The total copper unit cost is the weighted average of Copper Chile and Copper Peru based on actual production or the mid-point of production guidance. 2023F unit cost guidance for Chile is revised reflecting the weaker Chilean peso and Peru is revised due to

lower production volumes.

2. Unit cost is per own mined 5E + gold PGMs metal in concentrate ounce. The revision to 2023F unit cost reflects the weaker South African rand.

3. De Beers unit cost is based on De Beers' share of production. Step-up in 2023F and 2024F unit cost is primarily driven by change in production mix, as Venetia transitions to underground operations and delivers a lower carat profile during ramp-up.

4. Wet basis. Total iron ore unit cost is the weighted average of Kumba and Minas-Rio based on actual production or the mid-point of production guidance. The revision to Kumba 2023F unit cost reflects the weaker South African rand.

5. Steelmaking Coal FOB/t unit cost comprises of managed operations and excludes royalties and study costs. The revision to 2023F unit cost reflects lower production volumes.

Anglo American

2023F

~920

(0%

2024F (new)

~115

2024F (new)

34View entire presentation