MP Materials SPAC Presentation Deck

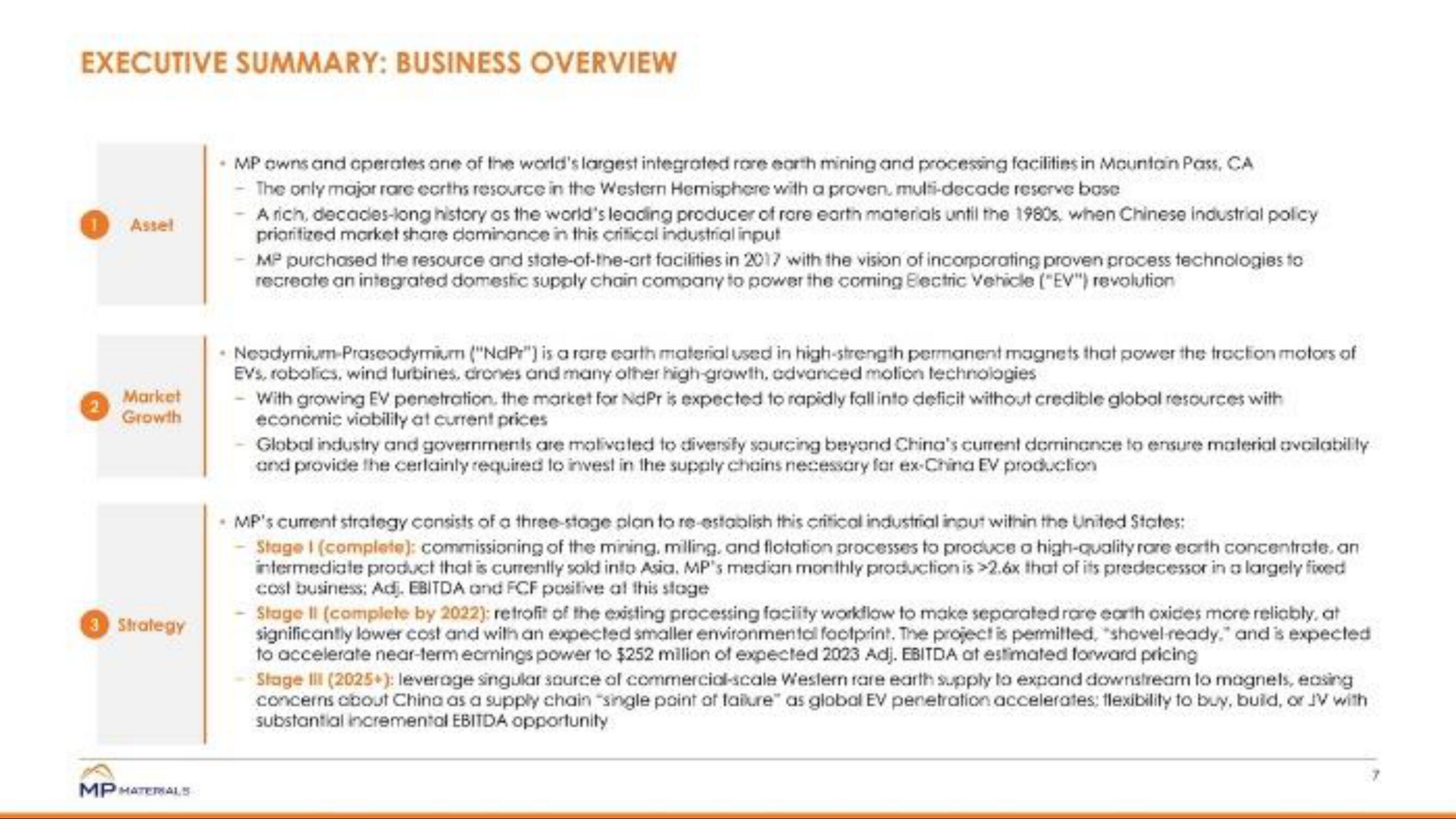

EXECUTIVE SUMMARY: BUSINESS OVERVIEW

1 Assel

Market

Growth

3 Strategy

MPMATERIALS

MP owns and operates one of the world's largest integrated rare earth mining and processing facilities in Mountain Pass, CA

- The only major rare earths resource in the Western Hemisphere with a proven, multi-decade reserve base

A rich, decades-long history as the world's leading producer of rore earth materials until the 1980s, when Chinese industrial policy

prioritized market share dominance in this critical industrial input

MP purchased the resource and state-of-the-art facilities in 2017 with the vision of incorporating proven process technologies to

recreate an integrated domestic supply chain company to power the coming Electric Vehicle ("EV") revolution

-Neodymium-Praseodymium ("NdPr") is a rare earth material used in high-strength permanent magnets that power the traction motors of

EVs, robolics, wind turbines, drones and many other high-growth, advanced motion technologies

- With growing EV penetration, the market for NdPr is expected to rapidly fall into deficit without credible global resources with

economic viability at current prices

Global industry and governments are motivated to diversify sourcing beyand China's current dominance to ensure material availability

and provide the certainly required to invest in the supply chains necessary for ex-China EV production

.MP's current strategy consists of a three-stage plan to re-establish this critical industrial input within the United States:

Stage I (complete): commissioning of the mining, milling, and flotation processes to produce a high-quality rare earth concentrate, an

intermediate product that is currently sold into Asia. MP's median monthly production is >2.6x that of its predecessor in a largely fixed

cost business: Adj. EBITDA and FCF positive at this stage

Stage II (complete by 2022): retrofit of the existing processing facility workflow to make separated rare earth oxides more reliably, at

significantly lower cost and with an expected smaller environmental footprint. The project is permitted, "shovel-ready." and is expected

to accelerate near-term ecmings power to $252 milion of expected 2023 Adj. EBITDA at estimated forward pricing

Stage II (2025+): leverage singular source of commercial-scale Western rare earth supply to expand downstream to magnels, easing

concerns about China as a supply chain "single point of failure" as global EV penetration accelerates: flexibility to buy, build, or JV with

substantial incremental EBITDA opportunityView entire presentation