Spirit Mergers and Acquisitions Presentation Deck

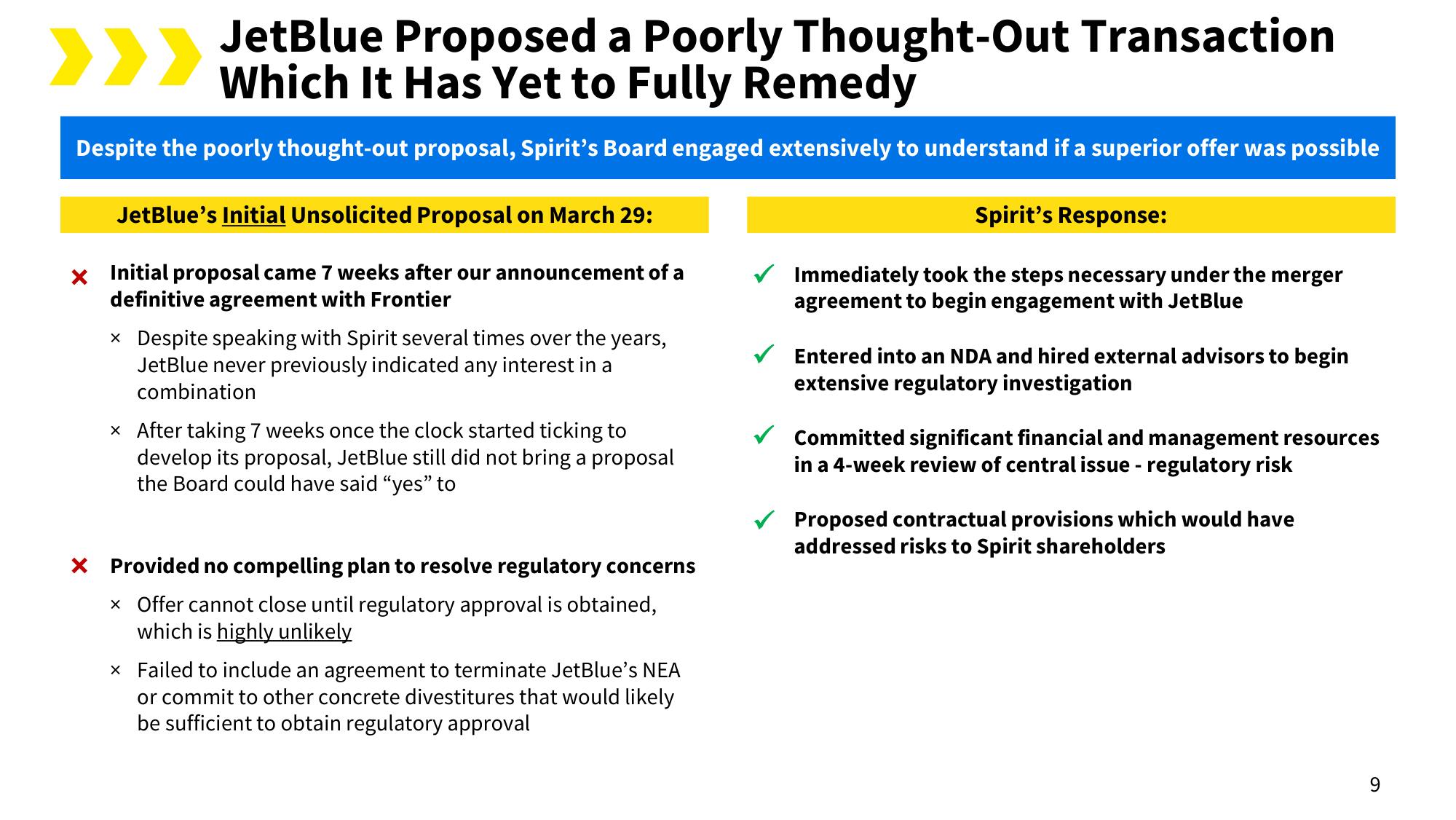

JetBlue Proposed a Poorly Thought-Out Transaction

Which It Has Yet to Fully Remedy

Despite the poorly thought-out proposal, Spirit's Board engaged extensively to understand if a superior offer was possible

>

JetBlue's Initial Unsolicited Proposal on March 29:

x Initial proposal came 7 weeks after our announcement of a

definitive agreement with Frontier

× Despite speaking with Spirit several times over the years,

JetBlue never previously indicated any interest in a

combination

x After taking 7 weeks once the clock started ticking to

develop its proposal, JetBlue still did not bring a proposal

the Board could have said "yes" to

X Provided no compelling plan to resolve regulatory concerns

x Offer cannot close until regulatory approval is obtained,

which is highly unlikely

× Failed to include an agreement to terminate JetBlue's NEA

or commit to other concrete divestitures that would likely

be sufficient to obtain regulatory approval

Spirit's Response:

Immediately took the steps necessary under the merger

agreement to begin engagement with JetBlue

Entered into an NDA and hired external advisors to begin

extensive regulatory investigation

Committed significant financial and management resources

in a 4-week review of central issue - regulatory risk

Proposed contractual provisions which would have

addressed risks to Spirit shareholders

9View entire presentation