Deutsche Bank Results Presentation Deck

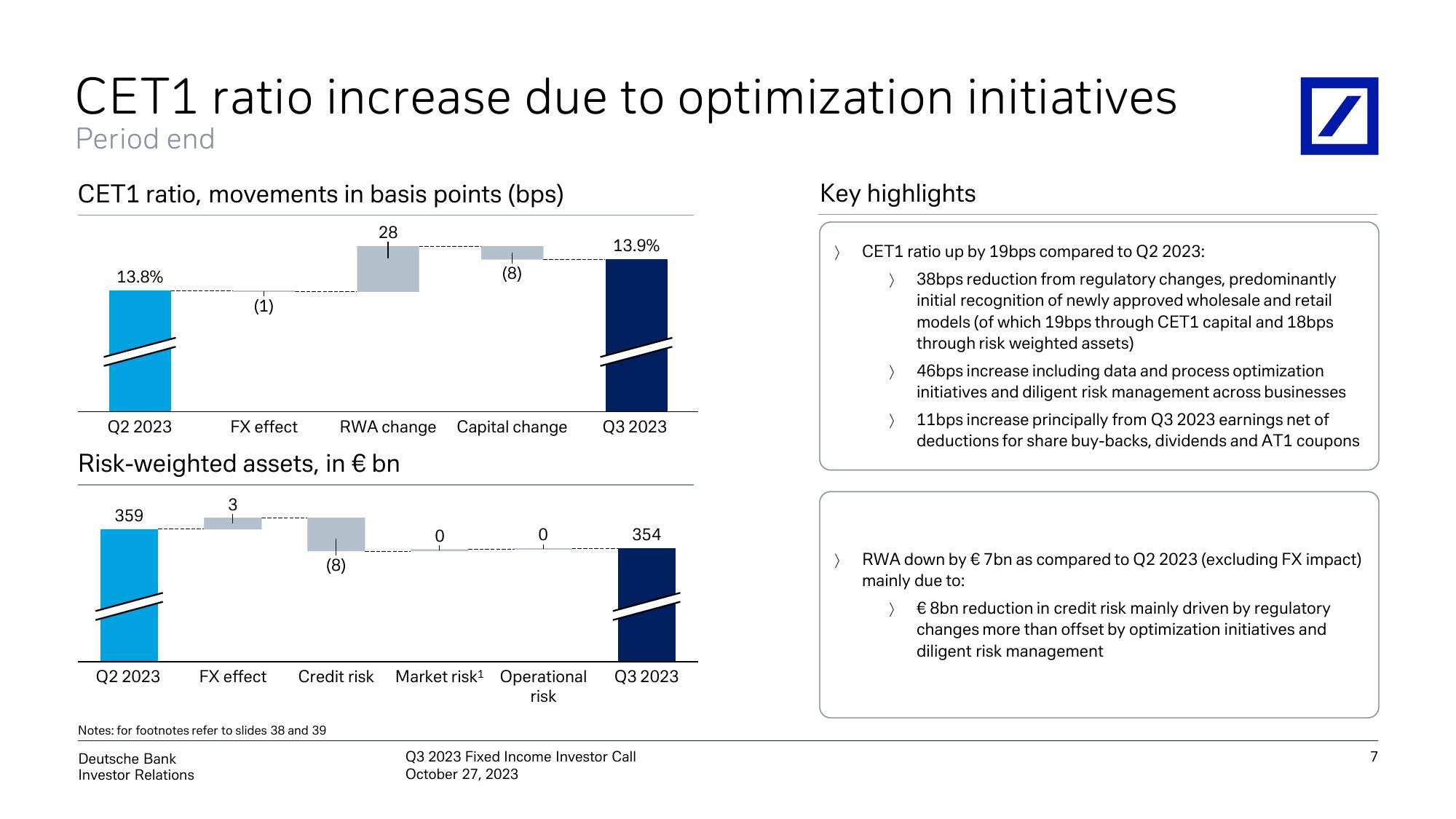

CET1 ratio increase due to optimization initiatives

Period end

CET1 ratio, movements in basis points (bps)

28

13.8%

359

Q2 2023

FX effect

Risk-weighted assets, in € bn

Q2 2023

(1)

3

Deutsche Bank

Investor Relations

Notes: for footnotes refer to slides 38 and 39

RWA change Capital change

FX effect Credit risk

(8)

0

0

Market risk¹ Operational

risk

13.9%

Q3 2023

354

Q3 2023

Q3 2023 Fixed Income Investor Call

October 27, 2023

Key highlights

CET1 ratio up by 19bps compared to Q2 2023:

>

/

38bps reduction from regulatory changes, predominantly

initial recognition of newly approved wholesale and retail

models (of which 19bps through CET1 capital and 18bps

through risk weighted assets)

46bps increase including data and process optimization

initiatives and diligent risk management across businesses

11bps increase principally from Q3 2023 earnings net of

deductions for share buy-backs, dividends and AT1 coupons

> RWA down by € 7bn as compared to Q2 2023 (excluding FX impact)

mainly due to:

>

€ 8bn reduction in credit risk mainly driven by regulatory

changes more than offset by optimization initiatives and

diligent risk management

7View entire presentation