Cannae SPAC Presentation Deck

1 Cannae overview

Cannae Holdings Inc. ("Cannae" or the "Company") is a diversified holding company led by

William P. Foley, Il ("Bill Foley" or "Foley")

Cannae was started as Fidelity National Financial Ventures (FNFV), a tracking stock of

Fidelity National Financial (FNF), and in 2017, FNF spun out FNFV, renamed Cannae

Holdings, Inc.

Cannae leverages Foley's 30+ year track record of operating and investing in world class

businesses and delivering significant shareholder value

Foley has led the creation of ~$146 billion of shareholder value across

multiple public company platforms over his career (1)

Cannae has built an attractive portfolio of investments in leading companies with significant

upside potential

Cannae focuses on investing in profitable and growing technology enabled businesses in

compelling industries

The Company is externally managed by Trasimene Capital Management

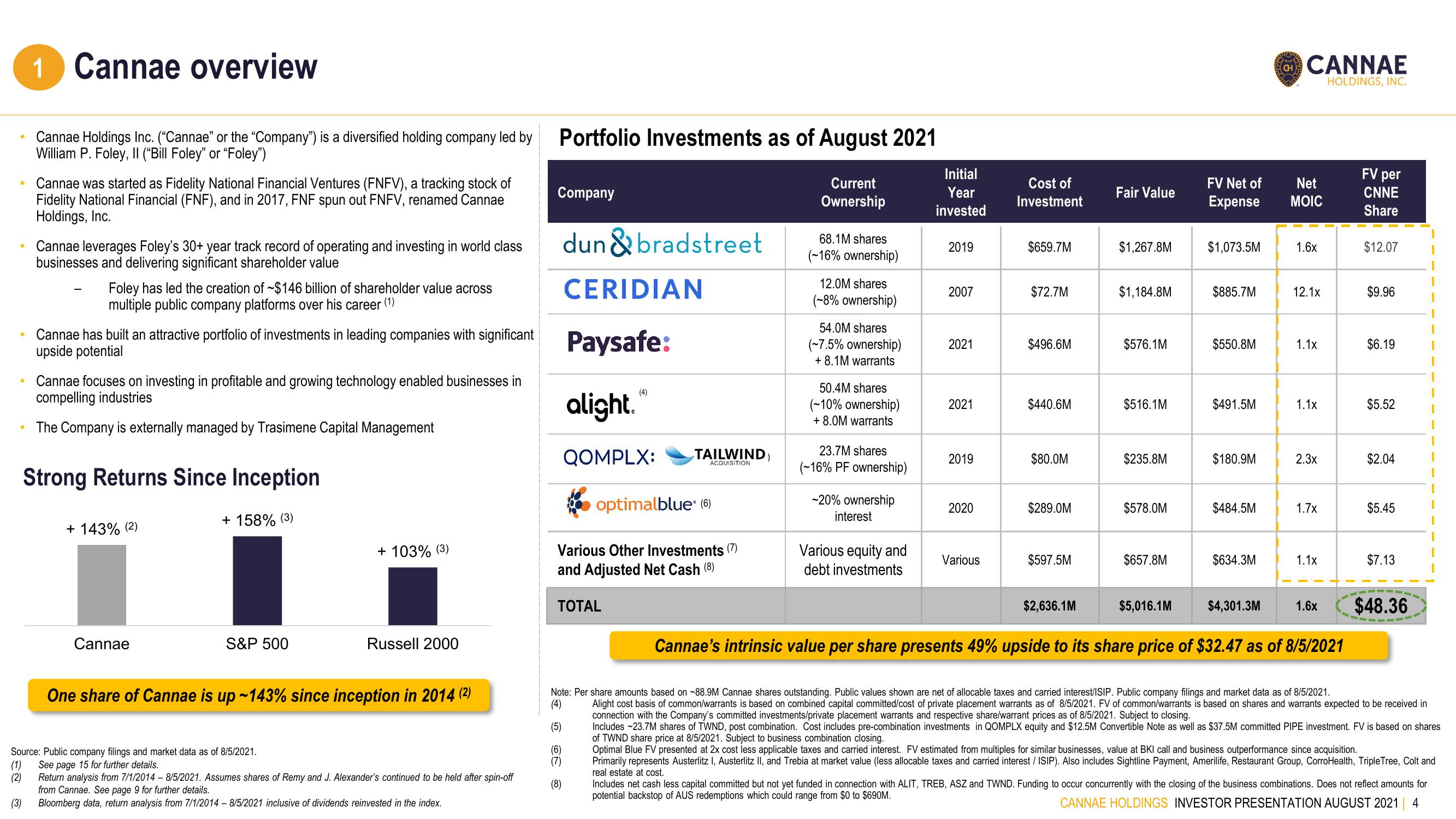

Strong Returns Since Inception

+ 143% (2)

Cannae

+ 158% (3)

S&P 500

+ 103% (3)

Russell 2000

One share of Cannae is up ~143% since inception in 2014 (²)

Source: Public company filings and market data as of 8/5/2021.

(1) See page 15 for further details.

(2)

Return analysis from 7/1/2014 - 8/5/2021. Assumes shares of Remy and J. Alexander's continued to be held after spin-off

from Cannae. See page 9 for further details.

(3)

Bloomberg data, return analysis from 7/1/2014 - 8/5/2021 inclusive of dividends reinvested in the index.

Portfolio Investments as of August 2021

Current

Ownership

Company

dun & bradstreet

CERIDIAN

Paysafe:

alight."

QOMPLX:

TAILWIND

ACQUISITION

optimalblue (6)

Various Other Investments (7)

and Adjusted Net Cash (8)

TOTAL

68.1M shares

(~16% ownership)

12.0M shares

(-8% ownership)

54.0M shares

(~7.5% ownership)

+ 8.1M warrants

50.4M shares

(-10% ownership)

+ 8.0M warrants

23.7M shares

(~16% PF ownership)

-20% ownership

interest

Various equity and

debt investments

Initial

Year

invested

2019

2007

2021

2021

2019

2020

Various

Cost of

Investment

$659.7M

$72.7M

$496.6M

$440.6M

$80.0M

$289.0M

$597.5M

$2,636.1M

Fair Value

$1,267.8M

$1,184.8M

$576.1M

$516.1M

$235.8M

$578.0M

$657.8M

$5,016.1M

FV Net of

Expense

$1,073.5M

$885.7M

$550.8M

$491.5M

$180.9M

$484.5M

$634.3M

$4,301.3M

CH

CANNAE

HOLDINGS, INC.

Net

MOIC

1.6x

12.1x

1.1x

1.1x

2.3x

1.7x

1.1x

1.6x

Cannae's intrinsic value per share presents 49% upside to its share price of $32.47 as of 8/5/2021

FV per

CNNE

Share

$12.07

$9.96

$6.19

$5.52

$2.04

$5.45

$7.13

$48.36

Note: Per share amounts based on ~88.9M Cannae shares outstanding. Public values shown are net of allocable taxes and carried interest/ISIP. Public company filings and market data as of 8/5/2021.

(4) Alight cost basis of common/warrants is based on combined capital committed/cost of private placement warrants as of 8/5/2021. FV of common/warrants is based on shares and warrants expected to be received in

connection with the Company's committed investments/private placement warrants and respective share/warrant prices as of 8/5/2021. Subject to closing.

(5)

Includes -23.7M shares of TWND, post combination. Cost includes pre-combination investments in QOMPLX equity and $12.5M Convertible Note as well as $37.5M committed PIPE investment. FV is based on shares

of TWND share price at 8/5/2021. Subject to business combination closing.

(6)

Optimal Blue FV presented at 2x cost less applicable taxes and carried interest. FV estimated from multiples for similar businesses, value at BKI call and business outperformance since acquisition.

(7)

Primarily represents Austerlitz I, Austerlitz II, and Trebia at market value (less allocable taxes and carried interest / ISIP). Also includes Sightline Payment, Amerilife, Restaurant Group, CorroHealth, Triple Tree, Colt and

real estate at cost.

(8)

Includes net cash less capital committed but not yet funded in connection with ALIT, TREB, ASZ and TWND. Funding to occur concurrently with the closing of the business combinations. Does not reflect amounts for

potential backstop of AUS redemptions which could range from $0 to $690M.

CANNAE HOLDINGS INVESTOR PRESENTATION AUGUST 2021 4View entire presentation