Inovalon Results Presentation Deck

Updated 2017 Adjusted EBITDA Margin

Expansion

inovalon

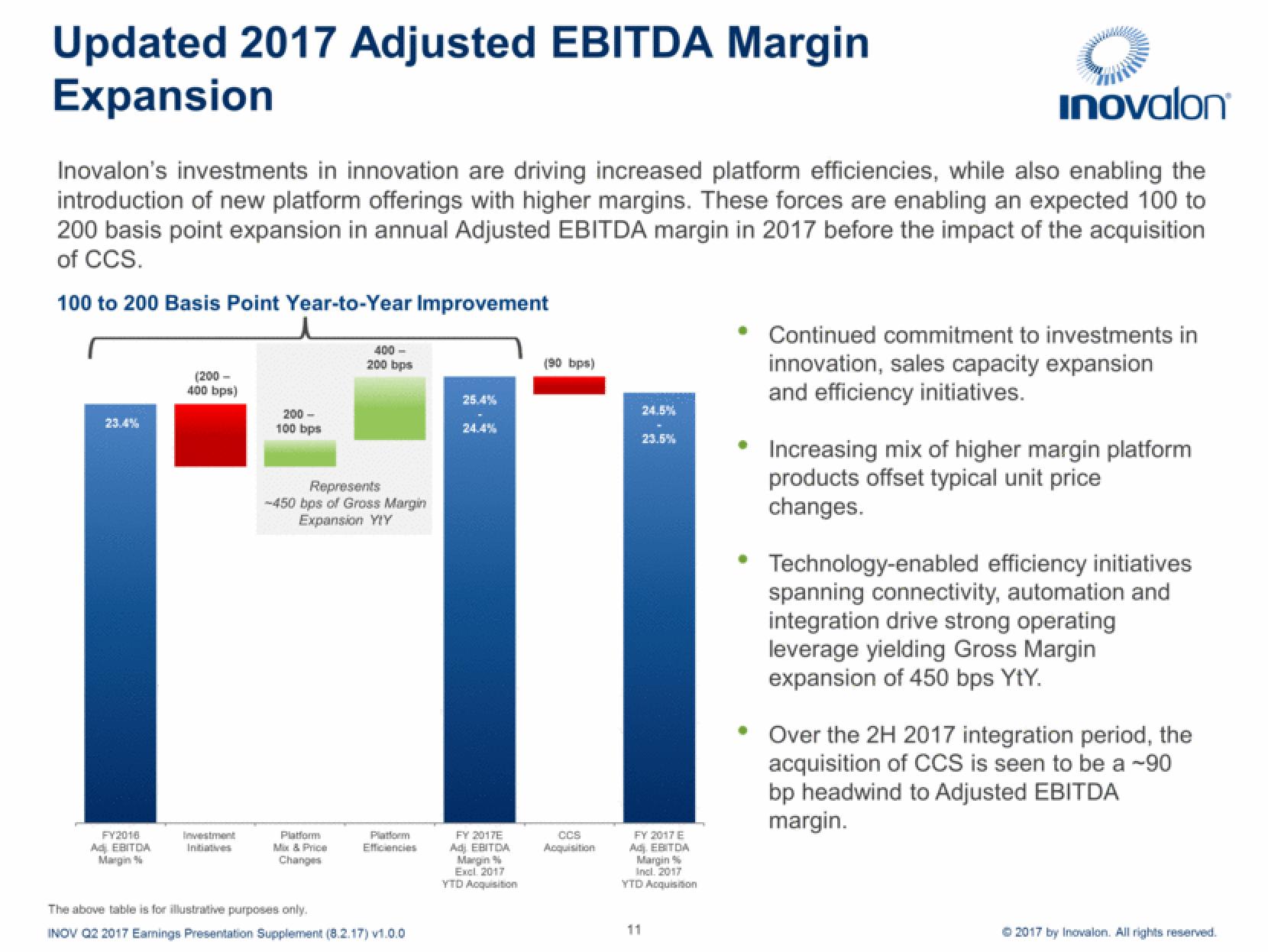

Inovalon's investments in innovation are driving increased platform efficiencies, while also enabling the

introduction of new platform offerings with higher margins. These forces are enabling an expected 100 to

200 basis point expansion in annual Adjusted EBITDA margin in 2017 before the impact of the acquisition

of CCS.

100 to 200 Basis Point Year-to-Year Improvement

23.4%

FY2016

Ad EBITDA

Margin %

(200-

400 bps)

Investment

Initiatives

200-

100 bps

400-

200 bps

Represents

-450 bps of Gross Margin

Expansion YIY

Platform

Mix & Price

Changes

Platform

Efficiencies

The above table is for illustrative purposes only.

INOV Q2 2017 Earnings Presentation Supplement (8.2.17) v1.0.0

FY 2017E

AA ERITIDA

Margin%

Excl. 2017

YTD Acquisition

(90 bps)

CCS

Acquisition

24.5%

23.5%

FY 2017 E

Adj. EBITDA

11

Margin%

Incl. 2017

YTD Acquisition

Continued commitment to investments in

innovation, sales capacity expansion

and efficiency initiatives.

Increasing mix of higher margin platform

products offset typical unit price

changes.

Technology-enabled efficiency initiatives

spanning connectivity, automation and

integration drive strong operating

leverage yielding Gross Margin

expansion of 450 bps YtY.

Over the 2H 2017 integration period, the

acquisition of CCS is seen to be a -90

bp headwind to Adjusted EBITDA

margin.

© 2017 by Inovalon. All rights reserved.View entire presentation